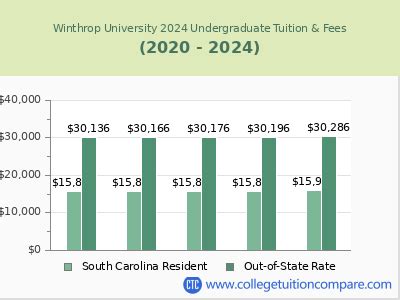

Projected Tuition and Fees for 2024-2025

| Category | In-State | Out-of-State |

|---|---|---|

| Tuition | $8,728 | $21,880 |

| Mandatory Fees | $1,990 | $1,990 |

| Estimated Total | $10,718 | $23,870 |

These figures are based on current tuition rates and fee structures and are subject to change. For the most up-to-date and accurate information, visit the Winthrop University website.

Factors Affecting Tuition Costs

Several factors can influence university tuition costs, including:

- State Funding: Public universities like Winthrop rely on state funding for a portion of their operating costs. Changes in state budget priorities can impact tuition rates.

- Operating Expenses: The cost of maintaining and improving educational facilities, hiring faculty, and providing student services can contribute to tuition increases.

- Enrollment Trends: Fluctuations in student enrollment can affect the university’s financial planning and may lead to tuition adjustments.

Financial Aid Options

Winthrop University offers various financial aid programs to help students and families manage tuition expenses:

- Scholarships: Academic merit and other criteria scholarships are awarded to eligible students.

- Grants: Federal and state grants provide financial assistance based on need and other qualifying factors.

- Loans: Students can borrow funds through federal or private student loans to cover tuition and other expenses.

- Work-Study Programs: Part-time employment opportunities allow students to earn money towards their educational costs.

Tips for Managing Tuition Expenses

- Explore Scholarships and Grants: Diligently search for and apply for scholarships and grants that align with your academic achievements, financial need, and other eligibility criteria.

- Consider In-State Tuition: If possible, consider attending an in-state university, which typically offers lower tuition rates for residents.

- Negotiate with the University: In some cases, students can negotiate with the university’s financial aid office to adjust their financial aid package.

- Explore Payment Plans: Many universities offer payment plans that allow students to spread out the cost of tuition and fees over several months.

Common Mistakes to Avoid

- Not Exploring Financial Aid Options: Skipping the financial aid application process can result in missing out on significant cost savings.

- Overestimating Financial Need: Applying for financial aid without accurately assessing your family’s financial situation can lead to ineligibility for aid.

- Ignoring Payment Deadlines: Missing tuition payment deadlines can result in late fees and potential withdrawal from classes.

- Borrowing More Than You Can Afford: Taking on excessive student loans can burden students with high debt after graduation.

Frequently Asked Questions

1. What is the average cost of attendance for Winthrop University in 2024-2025?

For in-state students, the estimated total cost is $10,718, while for out-of-state students, it is $23,870. This includes tuition, fees, room and board, and other expenses.

2. What percentage of students receive financial aid at Winthrop University?

Over 90% of Winthrop University students receive some form of financial aid, including scholarships, grants, and loans.

3. Are there any scholarships specifically for first-year students?

Yes, Winthrop University offers several scholarships specifically for incoming first-year students. These include the Presidential Scholarship, the Honors College Scholarship, and the Winthrop Legacy Scholarship.

4. Can I negotiate my tuition with the university?

In certain circumstances, students may be able to negotiate with the financial aid office to adjust their financial aid package. This typically involves providing documentation of extenuating financial circumstances.

5. What is the deadline for applying for financial aid?

The priority financial aid application deadline for Winthrop University is March 1st. However, students are encouraged to apply as early as possible to maximize their chances of receiving aid.

6. What are the payment options for tuition and fees?

Winthrop University offers several payment options, including a lump-sum payment, a semester payment plan, and a monthly payment plan. Students can also choose to authorize automatic payments from their bank account.

7. What happens if I miss a tuition payment deadline?

Missing a tuition payment deadline can result in a late fee and potential withdrawal from classes. Students are encouraged to contact the bursar’s office immediately if they are unable to make a payment on time.

8. How do I apply for financial aid?

Students can apply for financial aid by completing the Free Application for Federal Student Aid (FAFSA) at www.fafsa.gov. Winthrop University’s FAFSA code is 003439.