Introduction

Pursuing higher education at Winthrop University can be a significant financial investment. However, the university is committed to providing its students with access to a range of financial aid options to help them achieve their academic goals. This comprehensive guide will explore the various types of financial aid available, eligibility criteria, application processes, and strategies for maximizing financial assistance.

Types of Financial Aid

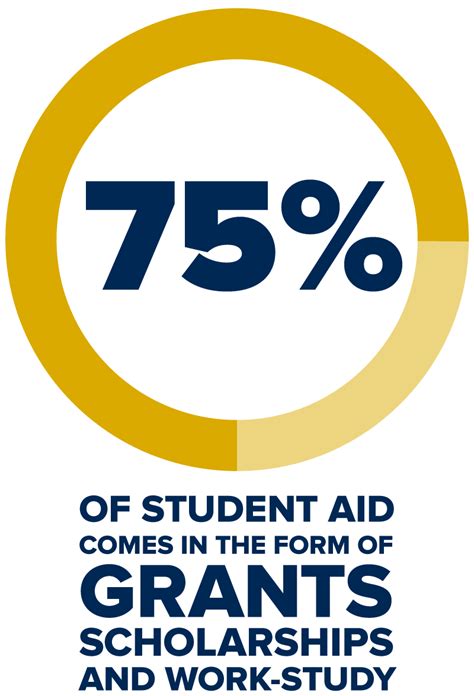

Winthrop University offers a diverse portfolio of financial aid programs to meet the needs of its students. These include:

Scholarships

Scholarships are free money awarded to students based on academic merit, financial need, or other criteria. They do not need to be repaid.

Grants

Grants are also free money awarded to students based on financial need. Unlike scholarships, grants do not require students to maintain a specific GPA.

Loans

Loans are money borrowed from the government or private lenders that must be repaid with interest. Federal student loans typically offer lower interest rates and more flexible repayment options than private loans.

Work-Study

Work-Study allows students to earn money to help pay for their education by working on campus or in community service positions.

Eligibility Criteria

Eligibility for financial aid is determined by a variety of factors, including:

- Financial need, as determined by the Free Application for Federal Student Aid (FAFSA)

- Academic merit, such as GPA and standardized test scores

- Enrollment status (full-time, part-time, graduate)

- Citizenship or residency status

- Satisfactory academic progress

Application Process

To apply for financial aid at Winthrop University, students must complete the following steps:

- Submit the FAFSA by the priority deadline of March 1st.

- Create a Winthrop University student account.

- Complete the online financial aid application through the student account.

- Submit any required documentation, such as tax returns or transcripts.

Effective Strategies for Maximizing Financial Assistance

There are several strategies that students can employ to maximize their financial aid awards:

- Apply early: Submitting the FAFSA and financial aid application as soon as possible gives you the best chance of receiving the most aid.

- Consider all types of aid: Explore a combination of scholarships, grants, loans, and work-study to meet your financial needs.

- Maintain good grades: Many scholarships and grants require students to maintain a specific GPA.

- Get involved in extracurricular activities: Many students discover scholarship opportunities through their involvement in student organizations, athletics, or community service.

- Ask for help: The Winthrop University Financial Aid Office is available to answer questions and assist students with their financial aid applications.

Benefits of Financial Aid

Financial aid plays a crucial role in helping students access and complete higher education. It provides:

- Access to higher education: Financial aid makes it possible for students from all socioeconomic backgrounds to pursue their educational goals.

- Reduced financial burden: Grants and scholarships reduce the amount of student debt students must take on.

- Improved academic outcomes: Students who receive financial aid are more likely to graduate on time and with higher GPAs.

- Increased earning potential: A college degree leads to higher earning potential over a lifetime.

FAQs

1. What is the average amount of financial aid awarded to Winthrop University students?

The average amount of financial aid awarded to Winthrop University students for the 2022-2023 academic year was $14,000.

2. How do I know if I am eligible for financial aid?

To determine your eligibility for financial aid, complete the FAFSA. The FAFSA will calculate your Expected Family Contribution (EFC) and determine your eligibility for need-based aid.

3. What is the deadline to apply for financial aid?

The priority deadline to apply for financial aid at Winthrop University is March 1st. However, students can submit applications after this date.

4. What should I do if I have questions about my financial aid application?

If you have questions about your financial aid application, contact the Winthrop University Financial Aid Office at (803) 323-2141 or [email protected].

5. What are some tips for maintaining financial aid eligibility?

To maintain your financial aid eligibility, ensure you:

- Make satisfactory academic progress by maintaining a specific GPA and course load.

- Submit any required documentation promptly.

- Report any changes in income or family situation.

6. What is the difference between a scholarship and a grant?

Scholarships are typically awarded based on merit, such as academic achievement or talent, while grants are awarded based on financial need.

7. Can I receive both a scholarship and a grant?

Yes, students can receive both scholarships and grants. The amount of aid you receive will depend on your financial need and the availability of funds.

8. What is the difference between a federal student loan and a private student loan?

Federal student loans are typically offered at lower interest rates and have more flexible repayment options than private student loans. Private student loans are offered by banks or other financial institutions.

Conclusion

Winthrop University provides a wide range of financial aid options to help students afford their education. By exploring the various types of aid, understanding the eligibility criteria, and employing effective strategies, students can maximize their financial assistance and achieve their academic goals.