If you’re wondering why your Expected Family Contribution (EFC) is so high, you’re not alone. Many students and families are surprised by the high cost of college, and the EFC is often a major factor.

The EFC is a number that the government calculates to determine how much you can afford to pay for college. It’s based on your family’s income, assets, and other factors. The EFC is used to determine your eligibility for financial aid, such as grants, loans, and work-study programs.

There are a number of reasons why your EFC might be high.

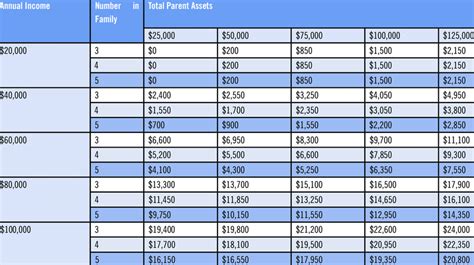

- Your family’s income is high. The higher your family’s income, the higher your EFC will be. This is because the government assumes that families with higher incomes can afford to pay more for college.

- Your family has a lot of assets. Assets include your family’s savings, investments, and real estate. The more assets your family has, the higher your EFC will be. This is because the government assumes that families with more assets can afford to pay more for college.

- Your family has a lot of untaxed income. Untaxed income includes income from sources such as Social Security, veterans’ benefits, and child support. The more untaxed income your family has, the higher your EFC will be. This is because the government assumes that families with more untaxed income can afford to pay more for college.

- Your family has a lot of expenses. Expenses include such things as housing costs, food, and transportation. The more expenses your family has, the lower your EFC will be. This is because the government assumes that families with more expenses have less money available to pay for college.

If you think your EFC is too high, you can appeal it. The appeal process can be complex, so it’s important to get help from a financial aid counselor.

Here are some tips for reducing your EFC:

- Increase your family’s expenses. This can be done by increasing your family’s housing costs, food costs, or transportation costs.

- Reduce your family’s untaxed income. This can be done by reducing your family’s income from Social Security, veterans’ benefits, or child support.

- Increase your family’s assets. This can be done by saving more money, investing more money, or buying more real estate.

If you’re still having trouble with your EFC, you can contact the financial aid office at your school. They can help you understand your EFC and determine if you qualify for any financial aid programs.

There are a number of common mistakes that can lead to a high EFC. Here are some of the most common mistakes to avoid:

- Not reporting all of your family’s income. This includes income from all sources, including wages, salaries, tips, self-employment income, and investment income.

- Not reporting all of your family’s assets. This includes all of your family’s savings, investments, and real estate.

- Not reporting all of your family’s expenses. This includes all of your family’s housing costs, food costs, and transportation costs.

- Not understanding how the EFC is calculated. The EFC is a complex calculation, and it’s important to understand how it works. This will help you make informed decisions about your financial aid options.

-

What is the EFC?

The EFC is a number that the government calculates to determine how much you can afford to pay for college. It’s based on your family’s income, assets, and other factors. The EFC is used to determine your eligibility for financial aid, such as grants, loans, and work-study programs. -

Why is my EFC so high?

There are a number of reasons why your EFC might be high. Some of the most common reasons include:- Your family’s income is high.

- Your family has a lot of assets.

- Your family has a lot of untaxed income.

- Your family has a lot of expenses.

-

Can I appeal my EFC?

Yes, you can appeal your EFC if you think it’s too high. The appeal process can be complex, so it’s important to get help from a financial aid counselor. -

How can I reduce my EFC?

There are a number of ways to reduce your EFC. Some of the most common ways include:- Increasing your family’s expenses.

- Reducing your family’s untaxed income.

- Increasing your family’s assets.

-

What if I still have trouble with my EFC?

If you’re still having trouble with your EFC, you can contact the financial aid office at your school. They can help you understand your EFC and determine if you qualify for any financial aid programs.

The EFC is an important factor in determining your eligibility for financial aid. If you’re wondering why your EFC is so high, it’s important to understand the factors that go into its calculation. By avoiding common mistakes and taking steps to reduce your EFC, you can increase your chances of getting the financial aid you need to pay for college.

| Asset | Value |

|---|---|

| Savings | $50,000 |

| Investments | $100,000 |

| Real estate | $200,000 |

| Total assets | $350,000 |

| Expense | Amount |

|---|---|

| Housing costs | $2,000 per month |

| Food costs | $500 per month |

| Transportation costs | $300 per month |

| Other expenses | $200 per month |

| Total expenses | $3,000 per month |

| Income | Amount |

|---|---|

| Wages | $50,000 per year |

| Self-employment income | $10,000 per year |

| Investment income | $5,000 per year |

| Social Security benefits | $3,000 per year |

| Total income | $68,000 per year |

| FAFSA Worksheet | Value |

|---|---|

| Family size | 4 |

| Number of college students in family | 1 |

| Adjusted gross income | $68,000 |

| Total assets | $350,000 |

| Expected family contribution | $20,000 |