Key Points:

- Decreasing term life insurance provides coverage that gradually decreases over time.

- It is often used to cover debts or expenses that will decline in value.

- The premiums for decreasing term policies typically remain constant throughout the policy’s term.

Overview of Decreasing Term Life Insurance

A decreasing term life insurance policy is a type of life insurance that provides coverage that decreases over time. This type of policy is often used to cover debts or expenses that will decline in value, such as a mortgage or a car loan. The premiums for decreasing term policies typically remain constant throughout the policy’s term, even as the coverage amount decreases.

Benefits of Decreasing Term Life Insurance

There are several benefits to purchasing a decreasing term life insurance policy, including:

- Lower premiums: The premiums for decreasing term policies are typically lower than for level-term policies, which provide a constant coverage amount throughout the policy’s term.

- Flexible coverage: Decreasing term policies can be customized to meet specific needs. For example, you can choose the amount of coverage you need and the term of the policy.

- Peace of mind: Knowing that your debts or expenses will be covered in the event of your death can provide peace of mind for you and your family.

Drawbacks of Decreasing Term Life Insurance

There are also some drawbacks to decreasing term life insurance, including:

- Decreasing coverage: The coverage amount for decreasing term policies decreases over time, which means that it may not provide enough coverage in the later years of your life.

- Limited flexibility: Once you purchase a decreasing term policy, you cannot increase the coverage amount.

- No cash value: Decreasing term policies do not accumulate cash value, which means that you will not receive any money back if you cancel the policy.

Is Decreasing Term Life Insurance Right for Me?

Whether or not decreasing term life insurance is right for you depends on your individual needs and circumstances. If you have debts or expenses that will decline in value over time, then decreasing term life insurance may be a good option for you. However, if you need coverage that will not decrease over time, then you may want to consider a level-term life insurance policy.

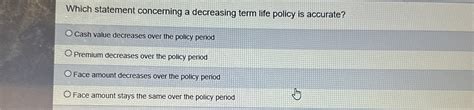

**Statements about Decreasing Term Life Policies**

The following statements about decreasing term life policies are accurate:

- Decreasing term life insurance provides coverage that gradually decreases over time.

- It is often used to cover debts or expenses that will decline in value.

- The premiums for decreasing term policies typically remain constant throughout the policy’s term.

The following statements about decreasing term life policies are not accurate:

- Decreasing term life insurance provides coverage that increases over time.

- It is often used to cover debts or expenses that will increase in value.

- The premiums for decreasing term policies typically increase throughout the policy’s term.

Tips for Choosing a Decreasing Term Life Insurance Policy

If you are considering purchasing a decreasing term life insurance policy, there are a few things you should keep in mind:

- Determine your coverage needs: The first step is to determine how much coverage you need. Consider your debts, expenses, and income.

- Get quotes from multiple insurers: Once you know how much coverage you need, get quotes from multiple insurers to compare rates and coverage options.

- Read the policy carefully: Before you purchase a policy, be sure to read the policy carefully and understand all of the terms and conditions.

Conclusion

Decreasing term life insurance can be a good option for people who need coverage that will decline in value over time. However, it is important to understand the benefits and drawbacks of this type of policy before making a decision.