Opportunity Cost: A Foundational Economic Principle

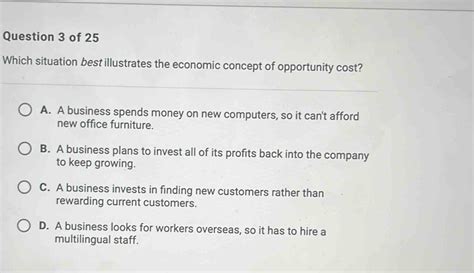

In the realm of economics, the concept of opportunity cost holds great significance. It refers to the value of the next best alternative that is forgone when a choice is made. Essentially, it highlights the trade-offs inherent in any decision-making process, as resources are finite and cannot be simultaneously used for multiple purposes.

Understanding Opportunity Cost through Real-World Situations

Consider the following scenarios that vividly illustrate the economic concept of opportunity cost:

-

A Student’s Dilemma: A high school senior, Sarah, excels in both academics and athletics. She is faced with the choice between accepting a prestigious college scholarship for her academic achievements or pursuing a coveted sports scholarship that could lead to a professional career. Sarah’s opportunity cost is the potential income and success she would give up by choosing the athletic scholarship over the academic scholarship.

-

An Entrepreneur’s Conundrum: Mark is a budding entrepreneur with a passion for both coffee and electronics. He has the opportunity to open either a coffee shop or an electronics store. If he chooses to open the coffee shop, his opportunity cost is the potential profit he could have earned from the electronics store. Conversely, if he opens the electronics store, he sacrifices the enjoyment and potential profit from the coffee shop.

-

A Country’s Fiscal Quandary: The government of a developing nation faces the choice between allocating funds for education or infrastructure development. If the government chooses to invest in education, its opportunity cost is the potential economic growth that could have been achieved by investing in infrastructure. Alternatively, if it invests in infrastructure, it sacrifices the long-term benefits of an educated population.

-

A Consumer’s Compromise: Emily is a young professional with a limited budget. She is torn between purchasing a new car and investing in a retirement fund. If Emily chooses to buy the car, her opportunity cost is the future financial security she would have gained from investing in the retirement fund. Conversely, if she invests in the retirement fund, she sacrifices the immediate gratification of owning a new car.

Practical Tips for Evaluating Opportunity Cost

- Identify the Alternatives: Clearly define the choices available to you and the potential outcomes associated with each one.

- Quantify the Costs and Benefits: Estimate the monetary value or other quantifiable benefits associated with each alternative.

- Compare the Alternatives: Weigh the benefits and drawbacks of each option to determine which one offers the greatest value or utility.

- Consider the Long-Term Impact: Evaluate not only the immediate consequences of each choice but also its potential long-term effects.

- Seek Input from Others: Consult with trusted friends, family members, or experts to gain additional perspectives and insights.

Opportunity Cost in Everyday Decision-Making

The concept of opportunity cost extends beyond high-stakes scenarios and permeates our daily lives. Here are some common examples:

- Choosing to watch a movie instead of studying for an exam.

- Opting for a relaxing vacation over a weekend of overtime work.

- Spending money on a new gadget instead of saving for a down payment on a house.

- Accepting a job offer with higher pay but longer hours over a job offer with more flexible working arrangements.

Empowering Decision-Making through Opportunity Cost Analysis

By understanding and applying the concept of opportunity cost, we can make informed choices that align with our values, goals, and priorities. It empowers us to optimize our resource allocation, minimize regrets, and maximize our potential.

| Choice | Alternative | Opportunity Cost |

|---|---|---|

| Attend college | Pursue a sports career | Potential income and success in sports |

| Open a coffee shop | Open an electronics store | Potential profit from the electronics store |

| Invest in education | Invest in infrastructure | Potential economic growth from infrastructure |

| Buy a new car | Invest in a retirement fund | Future financial security |

| Decision | Opportunity Cost |

|---|---|

| Watching a movie | Potential higher exam grade |

| Taking a vacation | Potential additional income from overtime |

| Buying a gadget | Potential down payment on a house |

| Accepting a higher-paying job | More flexible working arrangements |

Opportunity Cost: A Critical Choice in Decision-Making

The Concept of Opportunity Cost: Making Choices with Confidence

- Consider all available options and their potential outcomes.

- Quantify the costs and benefits of each alternative.

- Weigh the short- and long-term consequences of each choice.

- Consult with others to gain diverse perspectives.

- Use opportunity cost analysis to optimize resource allocation.

- Business Strategy: Evaluate the potential benefits and drawbacks of different marketing campaigns, product launches, or investment opportunities.

- Personal Finance: Determine the best use of savings, investments, and spending decisions.

- Government Decision-Making: Analyze the trade-offs involved in allocating funds for various public programs or infrastructure projects.

- Environmental Policy: Assess the opportunity costs of different approaches to pollution control, resource conservation, and climate change mitigation.