Introduction

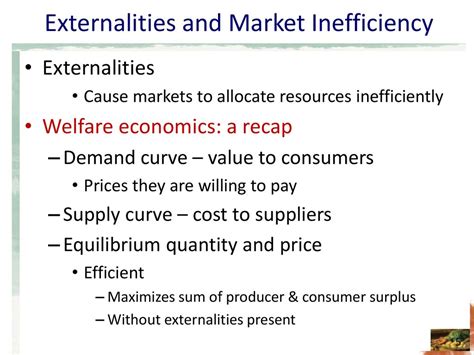

An externality is a cost or benefit that is imposed on a third party as a result of an economic transaction. Externalities can be either positive or negative. A positive externality occurs when a third party benefits from the transaction, while a negative externality occurs when a third party is harmed by the transaction.

When an externality is present, the market equilibrium is inefficient. This is because the market price does not reflect the true social cost or benefit of the good or service. As a result, the market will produce too much or too little of the good or service.

Types of Externalities

There are two main types of externalities:

- Pecuniary externalities occur when the price of a good or service changes as a result of an externality. For example, if a new factory is built in a residential area, the noise and pollution from the factory may cause the prices of homes in the area to fall.

- Technological externalities occur when the production or consumption of a good or service affects the production or consumption of another good or service. For example, if a new road is built, it may reduce the travel time for commuters, which could lead to an increase in the demand for housing in the area.

The Impact of Externalities on Market Equilibrium

Externalities can have a significant impact on market equilibrium. When an externality is present, the market price will not reflect the true social cost or benefit of the good or service. This can lead to the market producing too much or too little of the good or service.

For example, if a negative externality is present, the market price will be too low. This is because the market price does not take into account the external costs that are imposed on third parties. As a result, the market will produce too much of the good or service.

Conversely, if a positive externality is present, the market price will be too high. This is because the market price does not take into account the external benefits that are conferred on third parties. As a result, the market will produce too little of the good or service.

Government Intervention

The government can intervene to correct for the inefficiencies caused by externalities. There are a number of different ways that the government can do this, including:

- Taxes: Taxes can be used to discourage activities that generate negative externalities. For example, the government could impose a tax on pollution.

- Subsidies: Subsidies can be used to encourage activities that generate positive externalities. For example, the government could provide a subsidy for clean energy.

- Regulations: Regulations can be used to limit activities that generate negative externalities. For example, the government could regulate the amount of pollution that factories can emit.

Conclusion

Externalities can have a significant impact on market equilibrium. When an externality is present, the market price does not reflect the true social cost or benefit of the good or service. This can lead to the market producing too much or too little of the good or service. The government can intervene to correct for the inefficiencies caused by externalities.

Additional Resources

- The Economic Costs of Air Pollution

- The Benefits of Clean Energy

- Government Regulations on Pollution