The Free Application for Federal Student Aid (FAFSA) is the form that students use to apply for federal financial aid. One of the pieces of information you’ll need to provide on the FAFSA is your tax information. But what year of taxes does FAFSA need?

The FAFSA Uses Prior-Prior Year Tax Information

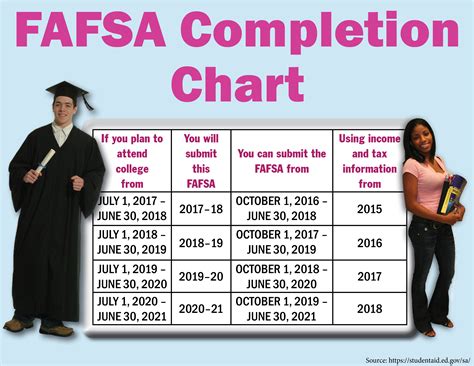

The FAFSA uses prior-prior year tax information. This means that the FAFSA for the 2023-2024 school year will use your 2021 tax information. The IRS defines prior-prior year as “the calendar year that ends two years before the first day of the award year.”

For example, if you’re applying for the 2023-2024 FAFSA, you’ll need to provide your 2021 tax information. This is because the 2023-2024 award year begins on July 1, 2023, and the calendar year that ends two years before that date is 2021.

Why Does the FAFSA Use Prior-Prior Year Tax Information?

The FAFSA uses prior-prior year tax information because it takes time to process tax returns. By the time the FAFSA is available, the IRS has not yet processed all of the tax returns for the current year. Using prior-prior year tax information ensures that all students have an equal opportunity to apply for financial aid, regardless of when they file their taxes.

What If I Haven’t Filed My Taxes Yet?

If you haven’t filed your taxes yet, you can still estimate your tax information on the FAFSA. You can use your W-2s and other tax documents to estimate your income and tax liability.

The FAFSA will ask you to provide an estimated adjusted gross income (AGI). Your AGI is your total income minus certain deductions and adjustments. You can find your AGI on line 11 of your federal tax return.

If you’re not sure how to estimate your AGI, you can use the FAFSA’s online tax estimator. The tax estimator will ask you a series of questions about your income and expenses, and it will then provide you with an estimated AGI.

What If My Tax Information Changes?

If your tax information changes after you’ve submitted the FAFSA, you need to update your information with the financial aid office at your school. The financial aid office will then recalculate your financial aid award.

It’s important to note that if your tax information changes significantly, you may need to repay some of your financial aid. This is because the amount of financial aid you receive is based on your expected family contribution (EFC). Your EFC is calculated using your tax information, and if your tax information changes, your EFC may also change.

If you make a mistake on your FAFSA, you need to contact the financial aid office at your school. The financial aid office will then correct the mistake and recalculate your financial aid award.

It’s important to note that if you make a mistake on your FAFSA, it may delay the processing of your financial aid application. This could mean that you don’t receive your financial aid award in time to pay for your tuition and other expenses.

There are a few things you can do to avoid mistakes on your FAFSA:

- Use the FAFSA worksheet. The FAFSA worksheet can help you gather the information you need to complete the FAFSA.

- File your taxes early. If you file your taxes early, you’ll have more time to review your tax return and make sure that all of the information is correct.

- Review your FAFSA carefully before submitting it. Make sure that all of the information on your FAFSA is correct, including your tax information.