In government budgeting, understanding the distinction between mandatory and discretionary spending is crucial. This distinction defines the scope and flexibility of government spending, affecting policy decisions and economic outcomes.

Understanding Mandatory Spending

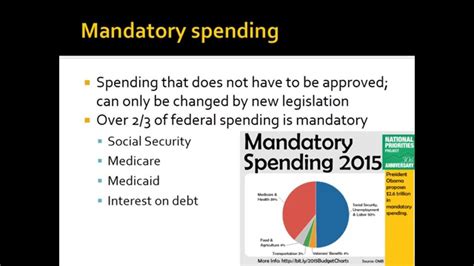

Mandatory spending, also known as entitlement spending, is legally mandated by Congress. It is based on existing laws and regulations, and the government is obligated to make these payments regardless of annual appropriations. Key mandatory spending categories include:

- Social Security: Provides retirement, disability, and survivor benefits.

- Medicare: Covers healthcare expenses for elderly and disabled Americans.

- Medicaid: Provides health insurance for low-income individuals and families.

- Supplemental Nutrition Assistance Program (SNAP): Assists low-income households with food purchases.

Discretionary Spending

Discretionary spending, on the other hand, is not mandated by law but rather determined through the annual budget process. Congress has the flexibility to allocate funds to these programs, which fall under the control of appropriations committees. Major discretionary spending areas include:

- Defense: Funding for the military, including personnel, equipment, and operations.

- Non-defense: Includes spending on education, healthcare, environmental protection, and infrastructure.

- Interest on debt: Payments made on the national debt.

Key Differences

The following table summarizes the key differences between mandatory and discretionary spending:

| Feature | Mandatory Spending | Discretionary Spending |

|---|---|---|

| Nature | Legally-mandated | Determined by annual budget process |

| Flexibility | Less flexible | More flexible |

| Control | Entitlement programs | Appropriations committees |

| Impact on Budget | Fixed | Variable |

| Examples | Social Security, Medicare | Defense, education, healthcare |

Why Mandatory and Discretionary Spending Matters

The distinction between mandatory and discretionary spending has significant implications for government budgeting and policymaking.

Budgetary Constraints: Mandatory spending accounts for a large and growing portion of the federal budget. Its fixed nature constrains the government’s ability to allocate funds to other programs, limiting the flexibility of fiscal policy.

Fiscal Sustainability: The growth of mandatory spending in relation to discretionary spending raises concerns about long-term fiscal sustainability. As entitlement programs expand and populations age, the government faces increased pressure to maintain funding levels.

Policy Priorities: The allocation of discretionary spending reflects the government’s priorities and values. Funding levels for programs such as education, healthcare, and infrastructure can vary significantly depending on political and budgetary constraints.

Benefits of Understanding the Distinction

Understanding the difference between mandatory and discretionary spending provides several benefits:

- Informed Decision-Making: Citizens can make more informed decisions about government policies and spending priorities.

- Fiscal Responsibility: It enables policymakers to weigh the long-term implications of spending decisions on both mandatory and discretionary programs.

- Economic Stability: By balancing the rigidity of mandatory spending with the flexibility of discretionary spending, the government can better adjust to economic conditions.

Common Mistakes to Avoid

When discussing mandatory and discretionary spending, it is important to avoid the following common mistakes:

- Conflation: Do not assume that all government spending is either mandatory or discretionary. There are other categories of spending, such as trust funds and tax credits.

- Oversimplification: Avoid oversimplifying the issue. The distinction between mandatory and discretionary spending is complex and subject to congressional action and interpretation.

- Political Bias: Refrain from using loaded or partisan language when discussing this topic. Focus on objective facts and avoid making value judgments.

Frequently Asked Questions (FAQs)

1. What percentage of the federal budget is mandatory spending?

According to the Congressional Budget Office, mandatory spending accounted for approximately 62% of total federal spending in 2022.

2. What is the projected growth rate of mandatory spending?

The Congressional Budget Office projects that mandatory spending will grow at an average annual rate of about 5.3% over the next decade.

3. Can Congress eliminate mandatory spending programs?

Yes, Congress has the legal authority to eliminate or modify mandatory spending programs. However, such actions would require significant political support and consensus building.

4. What is the impact of mandatory spending on the national debt?

Mandatory spending programs contribute to the national debt because they are not fully funded by current revenue. The government must borrow or print money to cover the shortfall.

5. How does the annual budget process affect discretionary spending?

The annual budget process allows Congress to determine funding levels for discretionary spending programs. These levels can fluctuate depending on budget constraints and political priorities.

6. What are the risks associated with increasing discretionary spending?

Excessive discretionary spending can lead to budget deficits, inflation, and potentially reduced funds for mandatory spending programs.

7. How can the government improve the efficiency of discretionary spending?

The government can improve efficiency by conducting program evaluations, implementing performance-based budgeting, and using technology to streamline processes.

8. What role does the Office of Management and Budget (OMB) play in managing mandatory and discretionary spending?

OMB provides oversight and coordination for the federal government’s budget process. It develops budget estimates, monitors spending, and provides recommendations to Congress and the Executive Branch.