Tax farming is a system in which the government contracts with private individuals or companies to collect taxes. The contractors, known as tax farmers, are typically given a monopoly on tax collection in a particular area. In return, they pay the government a lump sum up front and are allowed to keep any additional revenue they collect beyond that amount.

Tax farming has been used throughout history in many different parts of the world. It was particularly common in Europe during the Middle Ages and early modern period. In China, tax farming was used as early as the Han dynasty (206 BCE – 220 CE).

There are a number of advantages to tax farming for the government. First, it can provide the government with a steady stream of revenue. Second, it can reduce the costs of tax collection. Third, it can help to prevent tax evasion.

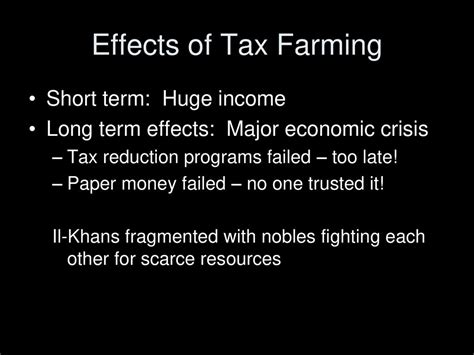

However, there are also a number of disadvantages to tax farming. First, it can lead to corruption and abuse. Second, it can be unfair to taxpayers, who may be forced to pay higher taxes than they would if the government collected taxes directly. Third, it can stifle economic growth by discouraging investment and trade.

In the AP World History curriculum, tax farming is typically discussed in the context of the early modern period. During this time, tax farming was used extensively in Europe, Asia, and the Americas. In some cases, tax farming led to widespread corruption and abuse. In other cases, it helped to provide the government with a steady stream of revenue and reduce the costs of tax collection.

Under a tax farming system, the government would auction off the right to collect taxes in a particular area to the highest bidder. The tax farmer would then be responsible for collecting all of the taxes due in that area. In return, the tax farmer would keep a percentage of the taxes collected, typically around 10-20%.

The tax farmer would typically hire a team of tax collectors to help them collect taxes. These collectors would go door-to-door, collecting taxes from individual taxpayers. The tax farmer would also be responsible for enforcing tax laws and regulations.

Tax farming could be a very lucrative business. In some cases, tax farmers made huge profits. However, it was also a risky business. If the tax farmer collected too little tax, they would lose money. If they collected too much tax, they could be accused of extortion.

Pros:

- Can provide the government with a steady stream of revenue. Tax farmers are typically required to pay the government a lump sum up front. This can provide the government with a reliable source of income, even in times of economic downturn.

- Can reduce the costs of tax collection. The government does not need to hire and train its own tax collectors. The tax farmer is responsible for collecting taxes and enforcing tax laws.

- Can help to prevent tax evasion. Tax farmers have a vested interest in collecting as much tax as possible. This can help to deter taxpayers from evading taxes.

Cons:

- Can lead to corruption and abuse. Tax farmers may be tempted to bribe government officials in order to obtain favorable treatment. They may also use their power to extort money from taxpayers.

- Can be unfair to taxpayers. Tax farmers may be more likely to target poor and vulnerable taxpayers. They may also charge higher taxes than the government would if it collected taxes directly.

- Can stifle economic growth. Tax farming can discourage investment and trade. Businesses may be reluctant to invest in areas where tax farmers are known to be corrupt or abusive.

Tax farming was used extensively in Europe, Asia, and the Americas during the early modern period. In some cases, tax farming led to widespread corruption and abuse. In other cases, it helped to provide the government with a steady stream of revenue and reduce the costs of tax collection.

In the AP World History curriculum, tax farming is typically discussed in the context of the following topics:

- The rise of the modern state. Tax farming was one of the ways that early modern states raised revenue to fund their growing bureaucracies and armies.

- The development of capitalism. Tax farming played a role in the development of capitalism by providing a source of capital for investment.

- The impact of colonialism. Tax farming was one of the ways that European colonial powers exploited their colonies.

Tax farming is a complex and controversial issue. There are both advantages and disadvantages to tax farming. It is important to weigh these factors carefully when considering whether or not to use tax farming in a particular situation.

Here are some tips and tricks for dealing with tax farming in AP World History:

- Understand the basic concepts of tax farming. How does tax farming work? What are the advantages and disadvantages of tax farming?

- Be able to identify examples of tax farming in history. When and where was tax farming used? What were the consequences of tax farming in these cases?

- Be able to evaluate the arguments for and against tax farming. What are the main arguments for and against tax farming? How do these arguments apply to specific historical cases?

What is the difference between tax farming and direct taxation?

Under direct taxation, the government collects taxes directly from taxpayers. Under tax farming, the government contracts with private individuals or companies to collect taxes.

Why was tax farming used in the past?

Tax farming was used in the past for a variety of reasons, including:

- To provide the government with a steady stream of revenue

- To reduce the costs of tax collection

- To prevent tax evasion

What are the disadvantages of tax farming?

Tax farming can lead to corruption, abuse, and unfairness. It can also stifle economic growth.

Is tax farming still used today?

Tax farming is still used in some countries today, although it is less common than it was in the past.

| Advantage | Disadvantage |

|---|---|

| Steady stream of revenue | Corruption and abuse |

| Reduced costs of tax collection | Unfair to taxpayers |

| Prevention of tax evasion | Stifles economic growth |

| Country | Period | Consequences |

|---|---|---|

| China | Han dynasty (206 BCE – 220 CE) | Provided the government with a steady stream of revenue |

| Europe | Middle Ages and early modern period | Led to widespread corruption and abuse |

| Americas | Colonial period | Exploited by European colonial powers |

| Argument for Tax Farming | Argument Against Tax Farming |

|---|---|

| Provides the government with a steady stream of revenue | Can lead to corruption and abuse |

| Reduces the costs of tax collection | Unfair to taxpayers |

| Prevents tax evasion | Stifles economic growth |

| Question | Answer |

|---|---|

| What is tax farming? | Tax farming is a system in which the government contracts with private individuals or companies to collect taxes. |

| Why was tax farming used in the past? | Tax farming was used in the past to provide the government with a steady stream of revenue, reduce the costs of tax collection, and prevent tax evasion. |

| What are the disadvantages of tax farming? | Tax farming can lead to corruption, abuse, and unfairness. It can also stifle economic growth. |

| Is tax farming still used today? | Tax farming is still used in some countries today, although it is less common than it was in the past. |