Understanding Mandatory Spending

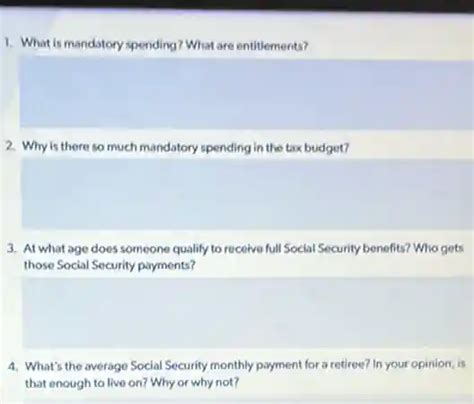

Mandatory spending is a type of government expenditure that is required by law. It makes up a significant portion of the federal budget and includes programs such as Social Security, Medicare, and Medicaid.

These programs are typically established to provide benefits to specific groups of people, such as the elderly, the poor, or the disabled. The funding for these programs is automatic, meaning that it does not require annual approval by Congress.

Key Characteristics of Mandatory Spending

- Legally required

- Automatic funding

- Entitles specific groups of people

- Includes programs like Social Security, Medicare, and Medicaid

What are Entitlements?

Entitlements are a subset of mandatory spending that provides benefits to individuals who meet certain eligibility criteria. These criteria may include age, income level, or disability status.

The most well-known entitlements are Social Security, Medicare, and Medicaid. However, there are also many other entitlement programs, such as food stamps, unemployment insurance, and veterans’ benefits.

Key Characteristics of Entitlements

- Mandatory spending programs

- Provide benefits to eligible individuals

- Eligibility based on specific criteria

- Examples include Social Security, Medicare, and Medicaid

Mandatory Spending vs. Discretionary Spending

In contrast to mandatory spending, discretionary spending is the portion of the federal budget that is subject to annual approval by Congress. This includes funding for programs such as defense, education, and infrastructure.

Congress has more control over discretionary spending than mandatory spending. It can increase or decrease funding levels for these programs based on its priorities.

Significance of Mandatory Spending

Mandatory spending is a major driver of the federal deficit and national debt. In 2022, mandatory spending accounted for approximately 64% of the federal budget, while discretionary spending made up the remaining 36%.

As the population ages and the cost of healthcare rises, mandatory spending is expected to continue to grow. This will put pressure on the federal budget and could lead to higher taxes or cuts to other programs.

Table 1: Examples of Mandatory Spending Programs

| Program | Description |

|---|---|

| Social Security | Provides retirement, disability, and survivor benefits |

| Medicare | Provides health insurance for the elderly and disabled |

| Medicaid | Provides health insurance for low-income individuals and families |

| Food stamps | Provides food assistance to low-income individuals and families |

| Unemployment insurance | Provides temporary income support to unemployed workers |

Table 2: Key Differences between Mandatory and Discretionary Spending

| Feature | Mandatory Spending | Discretionary Spending |

|---|---|---|

| Legal requirement | Required by law | Not required by law |

| Funding | Automatic | Requires annual approval by Congress |

| Eligibility | Based on specific criteria | Not based on eligibility |

| Examples | Social Security, Medicare, Medicaid | Defense, education, infrastructure |

Strategies for Managing Mandatory Spending

Managing mandatory spending is a complex challenge. Some of the strategies that have been proposed include:

- Raising the age of eligibility for certain programs

- Increasing the cost-sharing requirements for beneficiaries

- Gradually reducing the benefits provided by certain programs

- Reforming the tax code to generate more revenue

Tips and Tricks for Understanding Mandatory Spending

- Focus on the key characteristics of mandatory spending and entitlements.

- Compare and contrast mandatory spending with discretionary spending.

- Analyze the trends in mandatory spending over time.

- Consider the potential impact of different strategies for managing mandatory spending.

Common Mistakes to Avoid

- Confusing mandatory spending with discretionary spending

- Assuming that all entitlements are the same

- Oversimplifying the complex issue of mandatory spending

Conclusion

Mandatory spending and entitlements are essential components of the federal budget. They provide important benefits to millions of Americans, but they also contribute significantly to the federal deficit. It is critical to understand the nature of these programs and the challenges associated with managing their costs.