Introduction

The W-2 box 14 SDI, a seemingly obscure field on your tax form, holds a wealth of information that can impact your financial well-being. Understanding its implications is crucial for optimizing your tax strategy and securing your financial future. This comprehensive guide will delve into the intricacies of W-2 box 14 SDI, empowering you with knowledge to navigate its complexities with ease.

What is W-2 Box 14 SDI?

W-2 box 14 SDI stands for “State Disability Insurance.” It indicates the amount withheld from your paycheck for state disability insurance, a program that provides temporary income replacement if you are unable to work due to a disability. Each state administers its own disability insurance program, and the amount withheld varies depending on your state of residence and income.

Motivation for Withholding SDI

Disability insurance protects you financially in the event of an unforeseen circumstance that prevents you from working. According to the Bureau of Labor Statistics, approximately 4.6 million Americans experience on-the-job injuries or illnesses annually, highlighting the importance of having disability coverage.

Implications of SDI Withholdings

The amount withheld for SDI reduces your take-home pay. However, this reduction is offset by the peace of mind that comes with knowing you have a financial safety net in the event of disability. SDI benefits typically range from $200 to $1,000 per week, depending on your state and income level, providing a much-needed source of support when you are unable to earn wages.

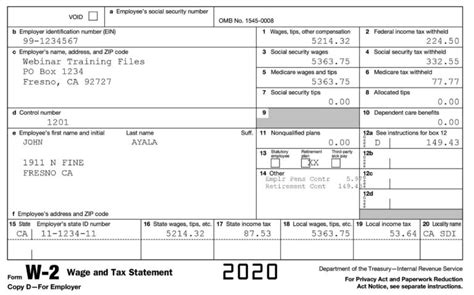

How to Find W-2 Box 14 SDI

Your W-2 form, issued by your employer, contains the information you need to determine your SDI withholdings. Look for the section labeled “Federal Income Tax Withheld” or “Social Security and Medicare Tax Withheld.” Below these sections, you will find a row labeled “State Disability Insurance” with the corresponding amount withheld listed in box 14.

Implications for Taxable Income

The amount withheld for SDI is considered a pre-tax expense, meaning it is deducted from your gross income before calculating your federal and state income taxes. This reduces your taxable income, resulting in potential tax savings.

State-by-State SDI Contributions

| State | 2023 SDI Contribution Rate | Maximum Annual Contribution |

|---|---|---|

| California | 1.1% | $1,500 |

| Hawaii | 0.5% | $1,000 |

| New Jersey | 0.35% | $1,330 |

| New York | 0.9% | $2,273 |

| Rhode Island | 1.0% | $1,200 |

Creative Innovations for SDI Applications

Emerging technologies and innovative ideas are transforming the way SDI is administered and utilized. Here’s a novel application:

AI-Driven Disability Detection: Artificial intelligence (AI) algorithms can analyze medical records and data to identify individuals at risk of developing a disability. This allows for proactive SDI coverage and early intervention, maximizing benefits for those in need.

Frequently Asked Questions

1. Is SDI coverage mandatory?

Yes, SDI coverage is mandatory in all states that offer the program.

2. How do I know if I am eligible for SDI benefits?

Eligibility criteria vary by state, but generally include having a disability that prevents you from working and having paid into the program through payroll deductions.

3. Can I opt out of SDI?

In most states, you cannot opt out of SDI. However, some states allow for exemptions based on religious or philosophical objections.

4. How long do SDI benefits last?

The duration of SDI benefits depends on the state and the severity of the disability. Typically, benefits are available for up to 26 weeks, with extensions possible in certain circumstances.

5. How do I file for SDI benefits?

Contact your state’s disability insurance agency to initiate the claims process.

6. Can I still receive SDI benefits if I am receiving other income sources?

Yes, in most cases, you can receive SDI benefits regardless of other income sources.

Conclusion

W-2 box 14 SDI is an essential aspect of your tax form, providing insights into your disability insurance contributions and the financial implications thereof. Understanding its significance empowers you to make informed decisions about your financial well-being and secure your future against the potential impact of disability.