Embark on an Empowered Financial Journey with UTC Financial Aid Office

Navigating the intricate world of financial aid can be daunting, but with the UTC Financial Aid Office, you have a trusted guide to illuminate your path to academic success. Our dedicated team is committed to providing you with the resources and guidance you need to make informed financial decisions and overcome any challenges that may arise during your educational journey.

Comprehensive Financial Aid Support:

- Scholarships: Discover a wide range of merit-based and need-based scholarships tailored to your unique achievements and financial circumstances.

- Grants: Explore various grant programs, including federal, state, and university-funded grants, to cover your tuition and living expenses.

- Loans: Access both federal and private student loans to supplement your financial aid package and bridge any remaining funding gaps.

- Work-Study Programs: Engage in part-time on-campus or off-campus employment opportunities to earn money while gaining valuable work experience.

Financial Literacy and Counseling:

- Financial Counseling: Schedule personalized appointments with our experienced financial counselors to discuss your financial situation, explore funding options, and develop strategies to manage your budget effectively.

- Financial Literacy Workshops: Attend informative workshops covering topics such as budgeting, credit management, and student loan repayment to empower you with the knowledge you need to make sound financial decisions.

Pain Points and Motivations for Financial Aid:

- Rising Tuition Costs: The escalating cost of higher education can make it challenging for students to afford their desired educational pursuits.

- Lack of Financial Resources: Many students and families struggle to cover the substantial expenses associated with college, including tuition, housing, and living expenses.

- Fear of Debt: The prospect of accumulating student loan debt can be daunting, leading students to hesitate pursuing higher education or to limit their enrollment to part-time status.

- Desire for a Brighter Future: Despite the financial obstacles, the pursuit of higher education remains a powerful motivator for students seeking to enhance their earning potential, career opportunities, and overall quality of life.

Tips and Tricks for Navigating Financial Aid:

- Apply Early: Submit your Free Application for Federal Student Aid (FAFSA) as soon as possible after October 1st each year to maximize your eligibility for financial assistance.

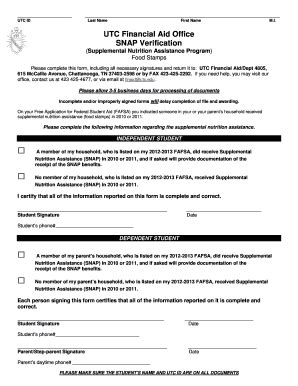

- Gather Required Documents: Ensure you provide all necessary documentation, including tax returns, income statements, and additional financial information, to support your application.

- Research and Compare: Explore different scholarship and grant programs to find the ones that best align with your qualifications and financial circumstances.

- Negotiate with Lenders: If you are considering taking out student loans, contact different lenders to compare interest rates and repayment terms to secure the most favorable loan options.

- Manage Your Finances Responsibly: Create a realistic budget, track your expenses, and seek financial counseling if you encounter difficulties managing your finances while in school.

How to Apply for Financial Aid at UTC:

- Complete the FAFSA: Visit the FAFSA website (https://studentaid.gov/h/apply-for-aid/fafsa) to create an account and complete the free application.

- Provide Supporting Documents: Gather and submit any required documentation to support your application, such as tax returns or income statements.

- Receive Notification: Once your FAFSA is processed, you will receive a Student Aid Report (SAR) detailing your eligibility for federal financial aid.

- Complete UTC Application: Submit the UTC Financial Aid Application (https://www.utc.edu/financial-aid/forms/online-financial-aid-application) to be considered for institutional scholarships and grants.

- Review Award Letter: After reviewing your application, the UTC Financial Aid Office will send you an award letter outlining the types and amounts of financial aid you have been awarded.

Additional Resources:

- UTC Financial Aid Office Website: https://www.utc.edu/financial-aid/

- FAFSA Website: https://studentaid.gov/h/apply-for-aid/fafsa

- National Student Loan Data System (NSLDS): https://nslds.ed.gov/

- Consumer Financial Protection Bureau (CFPB): https://www.consumerfinance.gov/

Table 1: Estimated Cost of Attendance (2022-2023 Academic Year)

| Category | In-State | Out-of-State |

|:—|:—|:—|

| Tuition and Fees | $12,590 | $24,960 |

| Room and Board | $11,800 | $11,800 |

| Books and Supplies | $1,800 | $1,800 |

| Personal Expenses | $2,000 | $2,000 |

Table 2: Federal Student Loan Limits (2022-2023 Academic Year)

| Loan Type | Graduate or Professional Students | Undergraduate Students (Dependent) |

|:—|:—|:—|

| Direct Unsubsidized Loans | $20,500 | $12,500 |

| Direct Subsidized Loans | $20,500 | $6,500 |

Table 3: Average Scholarship and Grant Awards at UTC (2022)

| Award Type | Average Amount |

|:—|:—|

| UTC Scholarships | $5,000 |

| Federal Pell Grants | $4,692 |

| Tennessee Student Assistance Award (TSAA) | $2,000 |

Table 4: Financial Literacy Resources

| Resource | Description |

|:—|:—|

| Financial Literacy Workshops | On-campus workshops covering various financial topics |

| Financial Counseling | Personalized appointments with financial counselors |

| Online Resources | Articles, videos, and online tools on financial management |

Conclusion:

The UTC Financial Aid Office stands as your trusted partner in navigating the complexities of financial aid. With our comprehensive support, tailored resources, and experienced counselors, we are dedicated to empowering you to make informed financial decisions that enable you to pursue your educational dreams without barriers. Embrace our guidance, follow our tips, and let us be your financial aid success story. Together, we will unlock your potential and pave the way for a brighter future.