Rising University Tuition: A Growing Concern

The surge in tuition fees has become a pressing concern for students and their families. As per the College Board, the average tuition and fees at four-year public colleges have risen by more than 250% since 1985, far outpacing the rate of inflation. This skyrocketing cost of higher education has made it increasingly challenging for students to pursue their academic aspirations.

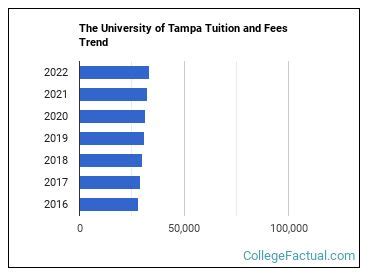

University of Tampa: Tuition and Fees in State

The University of Tampa (UT), a private institution in Florida, offers a wide range of undergraduate and graduate programs. For the 2023-2024 academic year, the university’s tuition and fees for in-state students are as follows:

| Category | Amount |

|---|---|

| Tuition and Fees | $44,250 |

| Room and Board (on campus) | $15,150 |

| Books and Supplies | $1,200 |

| Transportation | $1,500 |

| Personal Expenses | $2,500 |

| Total Estimated Cost | $64,600 |

Financial Aid Opportunities

Recognizing the financial burden faced by students, UT offers a range of financial aid options to help make education more affordable. In the 2022-2023 academic year, the university awarded over $110 million in financial aid to its students.

The types of financial aid available include:

- Scholarships: Merit-based awards that recognize academic excellence or other achievements.

- Grants: Need-based awards that do not have to be repaid.

- Loans: Funds that students borrow to cover educational expenses, which must be repaid with interest.

- Work-Study: Programs that allow students to earn money to help pay for college.

Impact of Tuition on Student Debt

The high cost of tuition has a significant impact on student debt levels. The Institute for College Access & Success reports that the average student loan debt for the class of 2022 was $28,950. This debt can have long-term financial implications for graduates, affecting their ability to purchase homes, save for retirement, or pursue further education.

Strategies to Reduce College Expenses

To mitigate the financial burden of college, students can consider the following strategies:

- Explore financial aid options: Research and apply for all available scholarships, grants, and loans to reduce the cost of tuition.

- Apply for in-state tuition: If possible, attend a public college or university in your state of residency to qualify for lower tuition rates.

- Consider a community college: Start your education at a community college, which typically has lower tuition costs, and then transfer to a four-year institution for your junior and senior years.

- Negotiate with the university: In some cases, students may be able to negotiate a lower tuition rate with the university’s financial aid office based on their financial circumstances.

- Live frugally: Reduce living expenses by sharing housing, cooking meals at home, and using public transportation.

Conclusion

The high cost of tuition at the University of Tampa can be a significant barrier for students pursuing higher education. However, by exploring financial aid options, considering cost-saving strategies, and being proactive in managing expenses, students can make college more affordable and achieve their academic goals.