Embarking on a higher education journey at the esteemed University of Richmond comes with a substantial financial commitment. To ensure financial preparedness, prospective students and their families must thoroughly understand the university’s cost of attendance. This comprehensive guide will dissect the various components that constitute the total cost and provide valuable insights into budgeting strategies.

Essential Cost Components

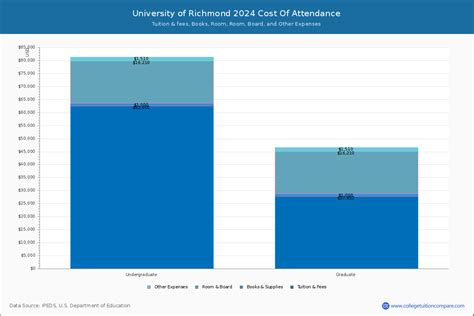

1. Tuition and Fees:

- Undergraduate tuition: $59,440

- Graduate tuition (varies by program): $35,700 – $48,900

- Student activity fee: $270

- Technology fee: $650

2. Room and Board:

- On-campus housing (double occupancy): $13,120

- Meal plan (19 meals per week): $6,500

3. Other Mandatory Expenses:

- Health insurance: $1,750

- Student health fee: $300

- Parking permit: $400

4. Estimated Personal Expenses:

- Books and supplies: $1,200

- Transportation: $1,500

- Laundry: $250

- Entertainment: $1,000

- Miscellaneous expenses: $500

Total Cost of Attendance

The total cost of attendance for the academic year 2023-2024 for undergraduate students residing on campus is estimated to be approximately $83,630. Graduate students’ costs will vary depending on their chosen program.

Budgeting Strategies

To manage the substantial costs associated with attending the University of Richmond, prospective students should consider the following budgeting strategies:

- Secure Financial Aid: Explore federal, state, and university-based financial aid programs, including scholarships, grants, and loans.

- Maximize Scholarships and Grants: Apply for both merit-based and need-based scholarships and grants to reduce the out-of-pocket expenses.

- Consider Work-Study: Apply for work-study programs that allow students to earn income while studying.

- Create a Detailed Budget: Track expenses meticulously to identify areas for potential savings.

- Seek On-Campus Employment: Explore part-time employment opportunities on campus to supplement income and reduce living expenses.

Tips and Tricks

- Negotiate Housing Costs: If possible, request a double or triple occupancy room to lower the housing expenses.

- Cook Meals at Home: Prepare meals in shared kitchens or use the university’s meal exchange program to save on dining costs.

- Take Advantage of Student Discounts: Utilize student discounts on entertainment, transportation, and other services.

- Use Public Transportation: Save on parking expenses by using Richmond’s public transportation system or carpooling with fellow students.

- Buy Used Textbooks: Purchase used or digital textbooks to reduce the cost of books and supplies.

Common Mistakes to Avoid

- Underestimating Transportation Costs: Factor in the cost of transportation, whether using public transit, driving, or flying to and from campus.

- Overlooking Hidden Expenses: Anticipate additional expenses such as laundry, healthcare, and entertainment.

- Borrowing Excessively: Avoid taking on excessive student loans. Only borrow what you need and consider the long-term repayment implications.

- Neglecting Financial Planning: Start planning for college expenses early and explore various financing options to minimize the financial burden.

Comparative Analysis

Compared to other private universities in the United States, the University of Richmond’s cost of attendance is relatively higher. However, the university’s financial aid packages are generous, with approximately 90% of undergraduates receiving some form of aid.

Pros and Cons

Pros:

- Access to a prestigious and highly respected university

- Generous financial aid packages

- Excellent academic programs and faculty

- Vibrant campus community and student life

Cons:

- High tuition and fees compared to some other private universities

- Limited on-campus housing availability

- Relatively high cost of living in the Richmond area

Conclusion

Attending the University of Richmond is an investment in your future, but it is essential to understand the true cost of this investment. By carefully planning your finances, exploring financial aid opportunities, and implementing budgeting strategies, you can minimize the financial burden and maximize the benefits of a world-class education at the University of Richmond.