The University of Monterey Bay (UMB) is a public university located in Monterey, California. The university offers a variety of undergraduate and graduate degree programs, as well as several certificate programs. UMB is known for its strong focus on sustainability and environmental science, and it is consistently ranked among the top universities in the nation for its commitment to sustainability.

Tuition and Fees

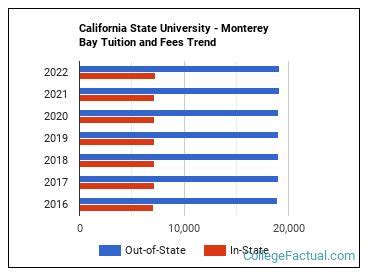

The cost of tuition at UMB varies depending on the student’s residency status and the type of program they are enrolled in. For the 2023-2024 academic year, the following are the tuition and fees for full-time undergraduate students:

In-State Tuition and Fees

- Tuition: $6,802

- Student Services Fee: $1,282

- Health Services Fee: $106

- Environmental Protection Fee: $70

- Campus Technology Fee: $126

- Total Tuition and Fees: $8,422

Out-of-State Tuition and Fees

- Tuition: $18,190

- Student Services Fee: $1,282

- Health Services Fee: $106

- Environmental Protection Fee: $70

- Campus Technology Fee: $126

- Non-Resident Tuition: $10,600

- Total Tuition and Fees: $30,374

Graduate Tuition and Fees

The cost of tuition for graduate students at UMB varies depending on the program they are enrolled in. For the 2023-2024 academic year, the following are the tuition and fees for full-time graduate students:

In-State Tuition and Fees

- Tuition: $8,410

- Student Services Fee: $1,282

- Health Services Fee: $106

- Environmental Protection Fee: $70

- Campus Technology Fee: $126

- Total Tuition and Fees: $9,994

Out-of-State Tuition and Fees

- Tuition: $19,798

- Student Services Fee: $1,282

- Health Services Fee: $106

- Environmental Protection Fee: $70

- Campus Technology Fee: $126

- Non-Resident Tuition: $11,388

- Total Tuition and Fees: $32,770

Additional Costs

In addition to tuition and fees, students should also budget for the following additional costs:

- Housing: On-campus housing is available for students, and the cost varies depending on the type of room and meal plan selected. Students can also choose to live off-campus, and the cost of rent will vary depending on the location and size of the apartment or house.

- Books and supplies: Students should budget for the cost of books and supplies, which can vary depending on the program of study.

- Transportation: Students should budget for the cost of transportation, which can include the cost of gas, public transportation, or parking.

- Food: Students should budget for the cost of food, which can include the cost of groceries, dining out, or meal plans.

- Personal expenses: Students should also budget for personal expenses, which can include the cost of clothing, entertainment, and other miscellaneous expenses.

Financial Aid

UMB offers a variety of financial aid options to help students pay for the cost of tuition and fees. These options include scholarships, grants, and loans. Students who are interested in financial aid should complete the Free Application for Federal Student Aid (FAFSA).

How to Apply

To apply to UMB, students must submit an application online. The application fee is $50. Students must also submit official transcripts from all previous colleges or universities attended. Students who are applying for financial aid must also submit a FAFSA.

Conclusion

The University of Monterey Bay is a great option for students who are interested in sustainability and environmental science. The university offers a variety of undergraduate and graduate programs, and it has a strong commitment to sustainability. The cost of tuition at UMB is comparable to other public universities in California, and the university offers a variety of financial aid options to help students pay for the cost of tuition and fees.

Strategies for Reducing the Cost of College

There are a number of strategies that students can use to reduce the cost of college. These strategies include:

- Applying for scholarships and grants. Scholarships and grants are free money that does not have to be repaid. There are a variety of scholarships and grants available, and students should research all of their options.

- Taking advantage of financial aid. Financial aid can help students pay for the cost of tuition and fees, and it can also help with the cost of housing, food, and other expenses. Students who are interested in financial aid should complete the FAFSA.

- Working part-time. Working part-time can help students earn money to pay for the cost of college. Students should research part-time jobs that fit their schedule and interests.

- Living off-campus. Living off-campus can be cheaper than living on-campus. Students should research off-campus housing options and compare costs.

- Buying used textbooks. Textbooks can be expensive, but students can save money by buying used textbooks. Students can also rent textbooks or purchase digital textbooks.

Common Mistakes to Avoid

There are a number of common mistakes that students make when paying for college. These mistakes include:

- Not applying for financial aid. Many students do not apply for financial aid because they think they will not qualify. However, there are a variety of financial aid programs available, and students should research all of their options.

- Borrowing too much money. Students should only borrow as much money as they need to pay for college. Students who borrow too much money may have difficulty repaying their loans after they graduate.

- Not budgeting. Students should create a budget and track their expenses. This will help them stay on track and avoid overspending.

- Not planning for the future. Students should start saving for college as early as possible. This will help them avoid having to borrow a lot of money to pay for college.

How to Pay for College Step-by-Step

The following are the steps that students should take to pay for college:

- Apply for scholarships and grants.

- Complete the FAFSA.

- Research part-time job opportunities.

- Research off-campus housing options.

- Purchase used textbooks.

- Create a budget.

- Start saving for college.

By following these steps, students can reduce the cost of college and make it more affordable.