The University of Illinois endowment is one of the largest university endowments in the United States, with a market value of over $2.5 billion as of June 30, 2022. The endowment provides financial support for a variety of academic and research programs at the university, including scholarships, fellowships, professorships, and research grants.

History of the Endowment

The University of Illinois endowment was established in 1867 with a gift of $100,000 from the Illinois Central Railroad. The endowment has grown steadily over the years through a combination of gifts, bequests, and investment returns.

Investment Strategy

The University of Illinois endowment is managed by the University of Illinois Foundation, a non-profit organization that is separate from the university. The foundation’s investment strategy is designed to generate long-term returns while preserving the principal of the endowment. The foundation invests in a diversified portfolio of assets, including stocks, bonds, real estate, and private equity.

Spending Policy

The University of Illinois endowment has a spending policy that limits the amount of money that can be withdrawn from the endowment each year. The spending policy is designed to ensure that the endowment will continue to provide financial support for the university for generations to come.

Impact of the Endowment

The University of Illinois endowment has a significant impact on the university. The endowment provides financial support for a variety of academic and research programs that would not be possible without the endowment’s support. The endowment also helps to attract and retain top faculty and students to the university.

Challenges Facing the Endowment

The University of Illinois endowment faces a number of challenges, including:

- Volatility of investment markets: The value of the endowment can fluctuate significantly depending on the performance of the investment markets.

- Inflation: Inflation can erode the value of the endowment over time.

- Rising costs of higher education: The cost of higher education has been rising steadily for decades, which puts pressure on the endowment to provide more financial support.

Opportunities for the Endowment

The University of Illinois endowment also has a number of opportunities for growth, including:

- Increased fundraising: The university can increase the size of the endowment through fundraising efforts.

- Improved investment returns: The foundation can improve the investment returns of the endowment by diversifying the portfolio and making strategic investments.

- Collaboration with other universities: The university can collaborate with other universities to pool endowments and invest in joint projects

Conclusion

The University of Illinois endowment is a valuable asset that provides financial support for a variety of academic and research programs. The endowment faces a number of challenges, but it also has a number of opportunities for growth. The university is committed to managing the endowment prudently and ensuring that it will continue to provide financial support for the university for generations to come.

Tables

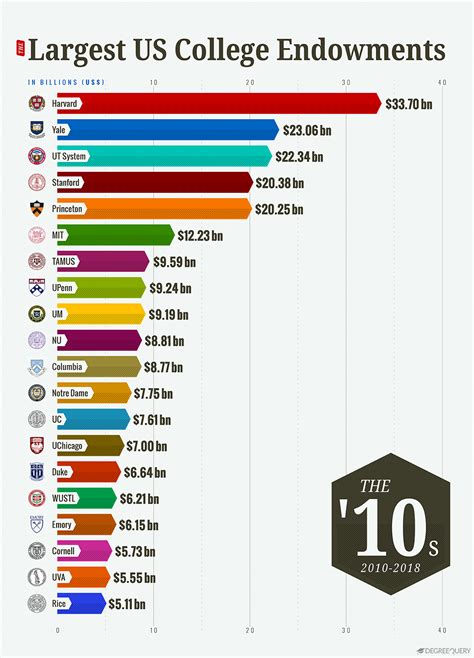

Table 1: Size of University Endowments

| Rank | University | Endowment Value (as of June 30, 2022) |

|---|---|---|

| 1 | Harvard University | $53.2 billion |

| 2 | Yale University | $31.2 billion |

| 3 | Stanford University | $31.1 billion |

| 4 | University of Texas System | $30.6 billion |

| 5 | Princeton University | $26.8 billion |

| 6 | University of Michigan | $17.4 billion |

| 7 | University of California, Berkeley | $17.3 billion |

| 8** | University of Illinois | $2.5 billion** |

| 9 | University of Pennsylvania | $14.9 billion |

| 10 | University of Notre Dame | $14.8 billion |

Table 2: Asset Allocation of University Endowments

| Asset Class | Average Allocation |

|---|---|

| Stocks | 53% |

| Bonds | 24% |

| Real Estate | 13% |

| Private Equity | 10% |

Table 3: Spending Rate of University Endowments

| Spending Rate | Average Spending Rate |

|---|---|

| 4% | 4.5% |

| 4.5% | 5.0% |

| 5% | 5.5% |

| 5.5% | 6.0% |

| 6% | 6.5% |

Table 4: Challenges Facing University Endowments

| Challenge | Description |

|---|---|

| Volatility of investment markets | The value of endowments can fluctuate significantly depending on the performance of the investment markets. |

| Inflation | Inflation can erode the value of endowments over time. |

| Rising costs of higher education | The cost of higher education has been rising steadily for decades, which puts pressure on endowments to provide more financial support. |

| Demand for financial aid | The demand for financial aid is growing as the cost of higher education increases. This puts pressure on endowments to provide more financial support to students. |