The University of Bowling Green (BGSU) is a public research university with a long and distinguished history. Founded in 1910, BGSU has grown into a thriving institution with over 20,000 students enrolled in its undergraduate, graduate, and doctoral programs.

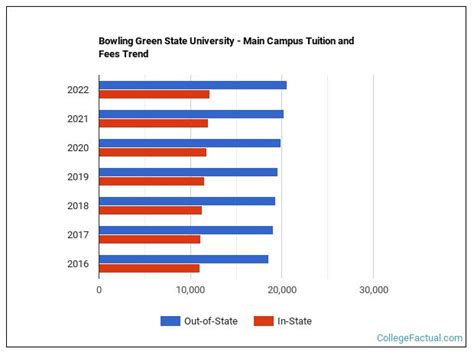

One of the most important factors for prospective students to consider is tuition costs. This guide provides a comprehensive overview of BGSU tuition, including a detailed breakdown of costs for in-state, out-of-state, and international students.

Tuition Costs for 2022-2023

The following table outlines the tuition costs for the 2022-2023 academic year:

| Student Type | Tuition (per semester) |

|---|---|

| In-state undergraduate | $6,058 |

| Out-of-state undergraduate | $11,924 |

| International undergraduate | $17,800 |

| In-state graduate | $6,960 |

| Out-of-state graduate | $13,900 |

| International graduate | $19,350 |

Please note that these costs are subject to change for future academic years.

Additional Fees

In addition to tuition, students should also budget for additional fees, such as:

- Student fees: These fees cover the cost of student services, such as the student union, health center, and recreation center. The student fee for the 2022-2023 academic year is $1,612.

- Technology fee: This fee covers the cost of technology resources, such as computer labs and Wi-Fi access. The technology fee for the 2022-2023 academic year is $148.

- Health insurance: All full-time students are required to have health insurance. The cost of health insurance through BGSU varies depending on the plan selected.

- Housing and dining: Students who live on campus must pay for room and board. The cost of housing and dining varies depending on the type of accommodation and meal plan selected.

Financial Aid

BGSU offers a variety of financial aid options to help students pay for college, including scholarships, grants, loans, and work-study programs. Over 90% of BGSU students receive some form of financial aid.

To apply for financial aid, students must complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is available online at www.fafsa.gov.

How to Save Money on Tuition

There are a number of ways to save money on tuition at BGSU, including:

- Apply for scholarships: BGSU offers a variety of scholarships to students based on academic merit, financial need, and other criteria.

- Get a part-time job: Working a part-time job can help you offset the cost of tuition.

- Take advantage of discounts: BGSU offers a number of discounts on tuition for students who take courses online, enroll in a summer program, or take advantage of other special promotions.

- Consider a tuition payment plan: BGSU offers a tuition payment plan that allows students to spread the cost of tuition over a period of time.

Conclusion

The cost of attending BGSU can be significant, but there are a number of ways to save money on tuition. By taking advantage of financial aid, scholarships, and other discounts, students can make college more affordable.

Here are some additional tips for saving money on college:

- Start saving early: The sooner you start saving for college, the more time your money will have to grow.

- Set a budget: Create a budget to track your spending and make sure you’re not overspending.

- Avoid unnecessary expenses: Cut back on unnecessary expenses, such as eating out or going to the movies.

- Make extra money: Get a part-time job or start a side hustle to earn extra money.

- Ask for help: If you’re struggling to pay for college, don’t be afraid to ask for help from your family, friends, or financial aid office.

Common Mistakes to Avoid

When it comes to paying for college, there are a few common mistakes that students should avoid:

- Don’t borrow more than you can afford to repay: Student loans can be a helpful way to pay for college, but it’s important to borrow only what you can afford to repay.

- Don’t put off saving for college: The sooner you start saving for college, the more time your money will have to grow.

- Don’t be afraid to ask for help: If you’re struggling to pay for college, don’t be afraid to ask for help from your family, friends, or financial aid office.

Pros and Cons of Taking Out Student Loans

Taking out student loans can be a helpful way to pay for college, but it’s important to weigh the pros and cons before making a decision.

Pros:

- Student loans can help you pay for college without having to work a part-time job or take on other debt.

- Student loans can help you build credit.

- Student loans can be tax-deductible.

Cons:

- Student loans can be expensive, and you will have to pay them back with interest.

- Student loans can damage your credit if you don’t make your payments on time.

- Student loans can limit your financial flexibility after college.

Conclusion

The cost of college can be a significant burden, but there are a number of ways to save money on tuition and avoid taking on unnecessary debt. By following the tips in this guide, you can make college more affordable and achieve your educational goals.