Introduction

University Mary Hardin-Baylor (UMHB) is a private Christian university located in Belton, Texas. Founded in 1845, UMHB offers a wide range of undergraduate and graduate programs to its students.

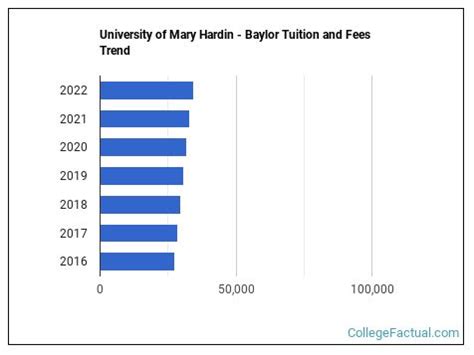

Tuition and Fees

The cost of attendance at UMHB varies depending on a student’s residency status, course load, and other factors. According to the university’s website, the following tuition and fees apply for the 2023-2024 academic year:

| Category | In-State Tuition | Out-of-State Tuition |

|---|---|---|

| Undergraduate | $34,600 | $38,400 |

| Graduate | $18,000 | $24,000 |

Additional Expenses

In addition to tuition and fees, students should also budget for the following additional expenses:

- Housing and dining: $11,000-$13,000 per year

- Books and supplies: $1,000-$2,000 per year

- Transportation: $1,000-$2,000 per year

- Personal expenses: $1,000-$2,000 per year

Financial Aid

UMHB offers a variety of financial aid programs to help students pay for college, including scholarships, grants, loans, and work-study. According to the College Board, the average financial aid package at UMHB for the 2021-2022 academic year was $22,000.

Merit Scholarships

UMHB offers a number of merit scholarships based on academic achievement and other criteria. The following are some of the most popular merit scholarships:

- Presidential Scholarship: $25,000 per year

- Dean’s Scholarship: $18,000 per year

- Provost’s Scholarship: $12,000 per year

Need-Based Aid

UMHB also offers a variety of need-based aid programs to help students from low-income families. The following are some of the most popular need-based aid programs:

- Pell Grant: Up to $6,895 per year

- Federal Supplemental Educational Opportunity Grant (FSEOG): Up to $4,000 per year

- Texas Public Education Grant (TPEG): Up to $2,500 per year

Payment Plans

UMHB offers a variety of payment plans to help students manage their college expenses. The following are some of the most popular payment plans:

- Monthly payment plan: Students can make monthly payments over the course of the academic year.

- Semester payment plan: Students can make two payments, one at the beginning of each semester.

- Third-party payment plan: Students can use a third-party lender to finance their college expenses.

Conclusion

The cost of attendance at UMHB can be significant, but there are a variety of financial aid programs available to help students pay for college. By carefully planning and budgeting, students can make a UMHB education affordable.

Additional Resources