Understanding Tuition and Fees

Navigating the financial aspects of higher education can be complex. As an in-state student planning to attend the University of North Carolina at Charlotte (UNC Charlotte), it’s crucial to understand the tuition and fee structure.

Undergraduate Tuition and Mandatory Fees:

| Year | Tuition | Fees | Total |

|---|---|---|---|

| 2023-2024 | $7,769 | $2,245 | $9,984 |

| 2024-2025 | $8,022 | $2,307 | $10,329 |

| 2025-2026 | $8,283 | $2,371 | $10,654 |

Graduate Tuition and Mandatory Fees:

| Degree | Tuition | Fees | Total |

|---|---|---|---|

| Master’s | $11,568 | $704 | $12,272 |

| Doctoral | $14,277 | $704 | $14,981 |

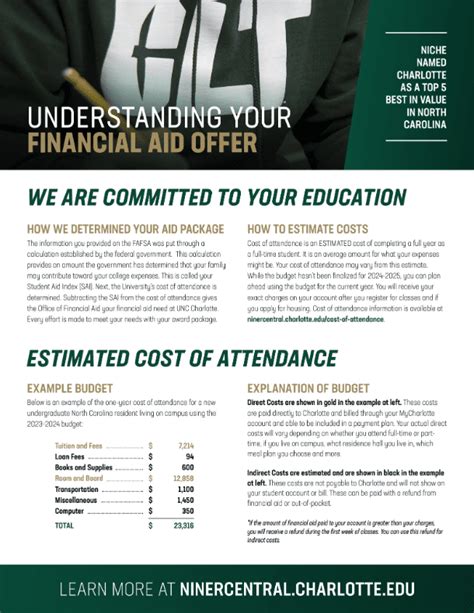

Additional Costs

Beyond tuition and mandatory fees, additional expenses should be considered:

Estimated Expenses for the 2023-2024 Academic Year:

| Category | Estimated Cost |

|---|---|

| Books and Supplies | $1,400-$1,600 |

| Housing | $4,500-$6,000 (on-campus) |

| Food | $2,200-$3,000 |

| Transportation | $1,500-$2,000 |

| Personal Expenses | $1,500-$2,000 |

Financial Aid

Numerous financial aid options are available to help offset the cost of education. Eligible students should explore the following:

Scholarships and Grants:

- Apply for scholarships through the university, government agencies, and private organizations.

- Explore need-based grants like the Pell Grant and Federal Supplemental Educational Opportunity Grant (FSEOG).

Student Loans:

- Federal student loans, such as Direct Subsidized and Unsubsidized Loans, offer flexible repayment options.

- Private student loans from banks and lending institutions may require higher interest rates.

Work-Study Programs:

- Federal Work-Study programs provide on-campus jobs to students with financial need. Earnings can supplement tuition and living expenses.

Managing Educational Costs

To effectively manage educational costs, consider the following strategies:

Choose a Degree Path Wisely: Consider the potential earning capacity and job market demand for your chosen field of study.

Explore Transfer Options: Taking courses at a community college or transferring after two years can save on tuition costs.

Budget Carefully: Track your expenses and create a realistic budget to avoid overspending.

Seek Financial Advising: The university’s financial aid office offers free counseling and guidance on financial matters.

Conclusion

Understanding UNC Charlotte’s tuition and fees is essential for in-state students. By exploring financial aid options, managing costs effectively, and planning wisely, students can pursue their higher education goals without incurring excessive debt. By embracing these strategies, you can enhance your chances of a successful and affordable educational journey.