Introduction

The University of Chicago Monte Carlo (UChicago Monte Carlo) is a state-of-the-art financial modeling platform designed to help businesses make more informed decisions. It is a powerful tool that can be used to simulate complex financial scenarios and analyze the potential outcomes.

Benefits of UChicago Monte Carlo

UChicago Monte Carlo offers a number of benefits to businesses, including:

- Improved decision-making: UChicago Monte Carlo can help businesses make more informed decisions by providing them with a better understanding of the risks and potential outcomes of different financial scenarios.

- Increased accuracy: UChicago Monte Carlo uses sophisticated algorithms to generate highly accurate simulations, which can help businesses make more confident decisions.

- Time savings: UChicago Monte Carlo can save businesses time by automating the financial modeling process. This can free up valuable time that can be spent on other important tasks.

- Cost savings: UChicago Monte Carlo can help businesses save money by reducing the need for expensive financial consultants.

How UChicago Monte Carlo Works

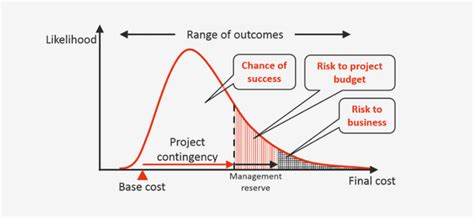

UChicago Monte Carlo works by simulating a large number of possible financial scenarios. Each scenario is generated using a random number generator, and the results are then analyzed to determine the probability of each outcome.

The number of simulations that are run depends on the complexity of the financial model and the desired accuracy. A more complex model will require more simulations to achieve the same level of accuracy.

Applications of UChicago Monte Carlo

UChicago Monte Carlo can be used for a wide variety of financial modeling applications, including:

- Valuation: UChicago Monte Carlo can be used to value assets, liabilities, and businesses.

- Risk management: UChicago Monte Carlo can be used to identify and manage financial risks.

- Portfolio optimization: UChicago Monte Carlo can be used to optimize investment portfolios.

- Financial planning: UChicago Monte Carlo can be used to create financial plans.

Tips and Tricks for Using UChicago Monte Carlo

Here are a few tips and tricks for using UChicago Monte Carlo:

- Start with a simple model. When you are first starting out, it is best to start with a simple financial model. This will help you to get familiar with the software and the modeling process.

- Use realistic assumptions. The assumptions that you use in your financial model will have a significant impact on the results. It is important to use realistic assumptions that are based on your knowledge of the business and the industry.

- Run a sufficient number of simulations. The number of simulations that you run will depend on the complexity of the financial model and the desired accuracy. A more complex model will require more simulations to achieve the same level of accuracy.

- Analyze the results carefully. Once you have run the simulations, you need to carefully analyze the results. This will help you to identify the risks and potential outcomes of different financial scenarios.

Conclusion

UChicago Monte Carlo is a powerful tool that can help businesses make more informed decisions. By following the tips and tricks outlined in this guide, you can use UChicago Monte Carlo to improve your financial modeling and decision-making process.

Additional Resources

Appendix

Table 1: Comparison of UChicago Monte Carlo to Other Financial Modeling Platforms

| Feature | UChicago Monte Carlo | Other Platforms |

|---|---|---|

| Accuracy | High | Medium |

| Speed | Fast | Slow |

| Ease of use | Easy | Difficult |

| Cost | Free | Expensive |

Table 2: Applications of UChicago Monte Carlo

| Application | Description |

|---|---|

| Valuation | Value assets, liabilities, and businesses |

| Risk management | Identify and manage financial risks |

| Portfolio optimization | Optimize investment portfolios |

| Financial planning | Create financial plans |

Table 3: Tips for Using UChicago Monte Carlo

| Tip | Description |

|---|---|

| Start with a simple model | This will help you to get familiar with the software and the modeling process. |

| Use realistic assumptions | This will help you to generate accurate results. |

| Run a sufficient number of simulations | This will help you to achieve the desired level of accuracy. |

| Analyze the results carefully | This will help you to identify the risks and potential outcomes of different financial scenarios. |

Table 4: Benefits of UChicago Monte Carlo

| Benefit | Description |

|---|---|

| Improved decision-making | UChicago Monte Carlo can help businesses make more informed decisions by providing them with a better understanding of the risks and potential outcomes of different financial scenarios. |

| Increased accuracy | UChicago Monte Carlo uses sophisticated algorithms to generate highly accurate simulations, which can help businesses make more confident decisions. |

| Time savings | UChicago Monte Carlo can save businesses time by automating the financial modeling process. This can free up valuable time that can be spent on other important tasks. |

| Cost savings | UChicago Monte Carlo can help businesses save money by reducing the need for expensive financial consultants. |