Introduction

Managing personal finances can be daunting, but with Suze Orman’s budget spreadsheet, it becomes a breeze. This revolutionary tool has helped millions of Americans take control of their money and achieve financial independence. In this comprehensive guide, we will delve into the intricacies of this spreadsheet, exploring its features, benefits, and how to use it effectively to transform your financial life.

What is the Suze Orman Budget Spreadsheet?

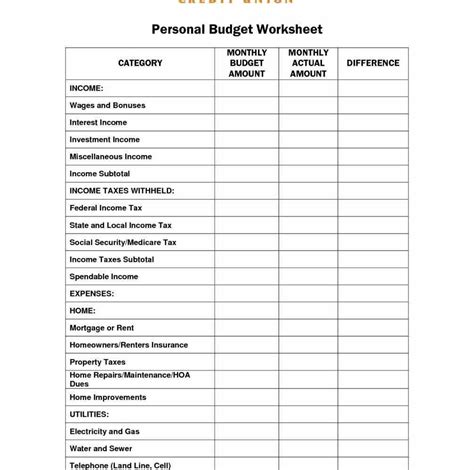

The Suze Orman budget spreadsheet is a free online tool designed to help individuals create a personalized budget that aligns with their financial goals. It is a comprehensive spreadsheet that includes various tabs for tracking income, expenses, savings, and investments. The spreadsheet is user-friendly, customizable, and compatible with Microsoft Excel, Google Sheets, and Numbers.

Benefits of Using the Suze Orman Budget Spreadsheet

1. Improved Financial Discipline:

The spreadsheet enforces financial discipline by tracking every dollar you earn and spend. This level of accountability helps you identify areas where you can save money and make more responsible financial choices.

2. Realistic Budgeting:

The spreadsheet allows you to create a realistic budget based on your actual income and expenses. By accurately tracking your financial inflows and outflows, you can avoid overspending and ensure that your budget aligns with your financial goals.

3. Comprehensive Tracking:

The spreadsheet provides a comprehensive overview of your financial situation. It includes tabs for tracking income, expenses, savings, investments, and net worth. This holistic view empowers you to make informed financial decisions based on a complete picture of your finances.

4. Personalization:

The spreadsheet is highly customizable, allowing you to tailor it to meet your specific financial needs and goals. You can add custom categories, adjust income and expense amounts, and set financial targets.

5. Educational Tool:

The spreadsheet also serves as an educational tool, providing valuable insights into personal finance. It includes helpful tips, explanations, and resources to help you make smarter financial decisions.

How to Use the Suze Orman Budget Spreadsheet

1. Download and Install:

Download the Suze Orman budget spreadsheet from her official website. Save it to a convenient location on your computer and open it using a spreadsheet software such as Microsoft Excel, Google Sheets, or Numbers.

2. Enter Your Information:

Start by entering your personal information, including your name, email address, and financial institution. This information will be used to customize the spreadsheet and provide you with tailored insights.

3. Track Income:

Create a list of all your sources of income, such as salary, investments, and side hustles. Enter the amount and frequency of each income source.

4. Track Expenses:

Categorize your expenses into different groups, such as housing, transportation, food, and entertainment. For each category, enter the amount and frequency of each expense.

5. Set Goals:

Establish specific financial goals, such as saving for a down payment on a house, paying off debt, or retiring early. Enter these goals into the spreadsheet to track your progress.

6. Review and Adjust:

Regularly review your budget and make adjustments as needed. Track your progress towards your goals and adjust income and expense amounts to align with your financial objectives.

Effective Strategies for Using the Suze Orman Budget Spreadsheet

1. Start Small:

Don’t try to track every single expense at once. Start with the major categories and gradually add more details as you become more comfortable with the spreadsheet.

2. Prioritize Needs vs. Wants:

Distinguish between essential expenses (needs) and non-essential expenses (wants). Focus on covering your needs first and then allocate remaining funds to your wants.

3. Use the “50/30/20 Rule”:

Allocate approximately 50% of your income to needs, 30% to wants, and 20% to savings and investments. This rule can help you maintain a healthy balance between spending and saving.

4. Automate Savings:

Set up automatic transfers from your checking to your savings account to ensure that you save regularly without having to rely on willpower.

Common Mistakes to Avoid

1. Overestimating Income:

Be cautious when estimating your income. Always use the lowest possible estimate to avoid overspending.

2. Underestimating Expenses:

Don’t forget to include small expenses, such as coffee or snacks. These expenses can add up over time and derail your budget.

3. Not Sticking to the Plan:

The key to success is consistency. Review your budget regularly and make adjustments as needed, but avoid abandoning it altogether.

4. Procrastination:

Don’t put off creating a budget. The sooner you start, the sooner you will see results.

FAQs

1. Is the Suze Orman budget spreadsheet free?

Yes, the Suze Orman budget spreadsheet is available for free download from her official website.

2. Is the spreadsheet compatible with all devices?

The spreadsheet is compatible with Microsoft Excel, Google Sheets, and Numbers, making it accessible on various devices.

3. How often should I update my budget?

Update your budget monthly or bi-weekly to ensure that it reflects your current financial situation and goals.

4. Can I use the spreadsheet to track my business finances?

While the Suze Orman budget spreadsheet is primarily designed for personal finances, it can be adapted to track business finances as well.

5. Is the spreadsheet secure?

The spreadsheet is hosted on a secure server and uses encryption to protect your financial information.

6. How can I get help with using the spreadsheet?

Suze Orman provides detailed instructions and support resources on her website and social media channels.

Conclusion

The Suze Orman budget spreadsheet is an invaluable tool for anyone looking to take control of their finances and achieve financial freedom. By following the steps outlined in this guide, you can harness the power of this spreadsheet to create a personalized budget that aligns with your financial goals. Remember, the key to success is consistency and discipline. Start today and pave the path towards a more secure and prosperous financial future.