Navigating the labyrinthine world of university tuition fees can be a daunting task, especially in the esteemed institutions of the Southern United States. This all-encompassing guide will illuminate the intricate tapestry of tuition fees prevalent at Southern universities, providing invaluable insights to prospective students and their families.

Tuition Fees Landscape

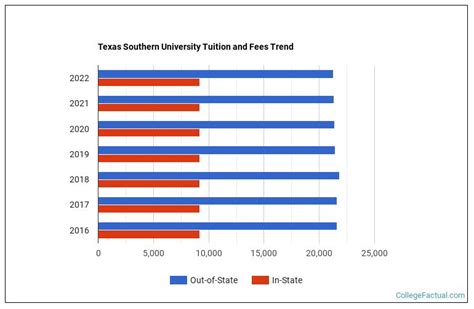

According to the College Board’s Trends in College Pricing Report, the average published tuition and fees for a four-year public college in the South escalated to $10,822 for in-state students and an eye-watering $28,586 for out-of-state students in the academic year 2022-2023.

For those pursuing the halls of private Southern universities, the financial burden weighs even heavier. The report reveals that the average tuition and fees for a four-year private nonprofit college in the region soared to a staggering $38,930.

Factors Influencing Tuition Fees

A myriad of factors coalesce to shape the tuition fees imposed by Southern universities. These include:

- Operating Costs: The day-to-day operations of a university, such as faculty salaries, research expenses, and facility upkeep, are major drivers of tuition fees.

- State Funding and Support: Public universities heavily rely on state funding to offset their operational costs. However, fluctuations in state appropriations can lead to tuition fee adjustments.

- Institutional Prestige: Universities with a long-standing reputation for academic excellence and research prowess often command higher tuition fees.

- Student Demand: Universities that attract a high number of students can leverage that demand to set higher tuition fees.

- Financial Aid and Scholarships: The availability of financial aid and scholarships can mitigate the financial burden of tuition fees for some students.

State-by-State Breakdown of Tuition Fees

The following table provides a state-by-state breakdown of average in-state and out-of-state tuition fees for public four-year colleges in the South:

| State | In-State Tuition and Fees | Out-of-State Tuition and Fees |

|---|---|---|

| Alabama | $10,406 | $21,066 |

| Arkansas | $8,948 | $18,448 |

| Florida | $6,570 | $22,832 |

| Georgia | $10,978 | $23,330 |

| Kentucky | $11,314 | $24,860 |

| Louisiana | $9,040 | $20,280 |

| Mississippi | $8,814 | $18,462 |

| North Carolina | $10,005 | $29,182 |

| Oklahoma | $9,280 | $21,218 |

| South Carolina | $12,704 | $29,524 |

| Tennessee | $11,280 | $25,530 |

| Texas | $10,619 | $25,651 |

| Virginia | $14,435 | $34,443 |

Effective Strategies for Navigating Tuition Fees

Navigating the financial intricacies of Southern university tuition fees requires a proactive and strategic approach. Here are some effective strategies:

- Apply for Financial Aid and Scholarships: Explore all available financial aid options, including grants, scholarships, and student loans.

- Negotiate with the University: Engage in discussions with the admissions or financial aid office to explore potential fee reductions or payment plans.

- Consider In-State Residency: Establishing in-state residency can significantly reduce tuition fees at public universities.

- Attend Part-Time: Enrolling as a part-time student can spread the financial burden over a longer period.

- Seek Employer Tuition Assistance: Inquire if your employer offers tuition assistance programs for employees pursuing higher education.

Tips and Tricks for Keeping Costs Down

- Take Advantage of Early Payment Discounts: Some universities offer discounts for students who pay their tuition fees in full before a specific deadline.

- Buy Used Textbooks: Explore the resale market for used textbooks, which can save hundreds of dollars compared to purchasing new ones.

- Use Public Transportation: Take advantage of public transportation systems to commute to campus and save on parking fees.

- Live Frugally: Adopt a budget-friendly lifestyle to minimize living expenses while attending university.

Common Mistakes to Avoid

- Failing to Research Fees: Neglecting to thoroughly research tuition fees and associated costs can lead to unexpected financial surprises.

- Overestimating Financial Aid: Being overly optimistic about the amount of financial aid you will receive can create a significant financial burden.

- Ignoring Payment Deadlines: Missing payment deadlines can result in late fees and other penalties.

- Not Considering All Costs: Failing to account for indirect costs such as housing, food, and transportation can lead to financial strain.

- Exceeding the Cost of Attendance: Spending more than the allowable cost of attendance as determined by the university can impact financial aid eligibility.

Conclusion

Southern university tuition fees present a significant financial hurdle for many students and families. By understanding the factors that influence these fees, exploring effective strategies, and heeding the common pitfalls, prospective students can navigate this complex landscape and make informed decisions about their educational investments. Remember, higher education is a transformative journey, and with the right planning and resourcefulness, the financial obstacles can be overcome.