Introduction

In a market economy, the interplay between supply and demand determines the equilibrium quantity of a particular good or service. However, this equilibrium quantity may not always be desirable from a societal perspective. When negative externalities exist, the market-determined quantity leads to a suboptimal outcome for society as a whole.

Socially Efficient Quantity

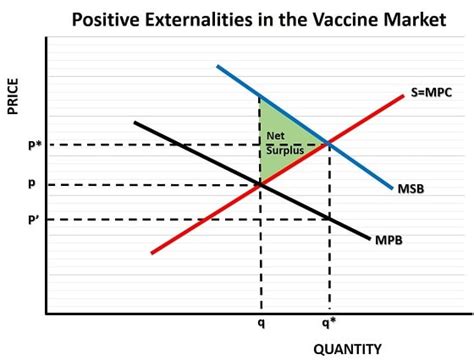

The socially efficient quantity is the output level at which the marginal social benefit (MSB) equals the marginal social cost (MSC). MSB represents the additional benefit that accrues to society from producing one more unit of a good, while MSC quantifies the additional cost that society incurs as a result of this extra production.

Negative Externalities

Negative externalities arise when the production or consumption of a good or service imposes costs on third parties who are not directly involved in the transaction. For example, pollution from a factory can harm the health of nearby residents. In such cases, the market equilibrium quantity will be higher than the socially efficient quantity because the market price does not reflect the external costs.

Calculating the Socially Efficient Quantity

The socially efficient quantity can be calculated using the following formula:

MSB = MSC

MSB is typically measured using the willingness-to-pay of consumers for the marginal unit of the good, while MSC includes both private production costs and external costs.

Examples of Negative Externalities

Numerous examples of negative externalities exist in the real world, including:

- Pollution: Air pollution, water pollution, and solid waste can harm human health and ecosystems.

- Congestion: Traffic jams and overcrowded public transportation impose time and stress costs on travelers.

- Tobacco smoke: Secondhand smoke can cause health problems for nonsmokers.

Government Intervention

When negative externalities are present, the market fails to produce the socially efficient quantity. To address this issue, government intervention is often necessary. Governments can use various policy tools to correct for negative externalities, including:

- Pigouvian taxes: Taxes imposed on goods that generate negative externalities to internalize the external costs.

- Subsidies: Payments provided to producers or consumers to encourage activities that generate positive externalities.

- Regulations: Mandates or restrictions on certain activities to reduce negative externalities.

Benefits of Socially Efficient Quantity

Achieving the socially efficient quantity offers numerous benefits:

- Reduced negative externalities: Negative externalities are minimized, improving the well-being of society as a whole.

- Increased economic efficiency: The allocation of resources is optimized, leading to higher overall economic output.

- Improved environmental sustainability: Negative externalities related to pollution and other environmental impacts are reduced, preserving natural resources for future generations.

Challenges in Achieving Socially Efficient Quantity

Implementing policies to achieve the socially efficient quantity can face several challenges:

- Measurement difficulties: Accurately quantifying negative externalities can be difficult, making it challenging to determine the appropriate level of government intervention.

- Political constraints: Politicians may be reluctant to implement policies that impose costs on certain industries or consumers, even if they would generate net social benefits.

- Compliance and enforcement: Enforcing regulations and collecting taxes on negative externalities can be costly and difficult, especially in cases where there is widespread noncompliance.

Tips and Tricks for Achieving Socially Efficient Quantity

Consider the following tips and tricks to effectively achieve the socially efficient quantity:

- Use market-based instruments: Pigouvian taxes and subsidies can be effective in internalizing external costs and encouraging desired behaviors.

- Engage stakeholders: Involve affected parties in the policymaking process to ensure their concerns are addressed and compliance is maximized.

- Foster innovation: Encourage research and development to find cost-effective ways to reduce negative externalities.

- Educate the public: Raising awareness about the existence and impacts of negative externalities can help build public support for policy interventions.

Conclusion

Striving for the socially efficient quantity is crucial for maximizing societal well-being and economic efficiency. By understanding the concept of negative externalities and the role of government intervention, policymakers can design and implement effective measures to correct market failures and achieve optimal outcomes. Achieving the socially efficient quantity requires a combination of sound economic principles, political will, and collaborative efforts from all stakeholders.

Additional Information

- Table 1: Estimated External Costs of Pollution in the United States

| Pollutant | External Cost (USD billions/year) |

|---|---|

| Particulate matter (PM2.5) | 140-220 |

| Ozone (O3) | 30-60 |

| Nitrogen oxides (NOx) | 21-33 |

| Sulfur dioxide (SO2) | 14-21 |

- Table 2: Potential Economic Benefits of Reducing Air Pollution in the European Union

| Benefit Category | Economic Benefit (EUR billions/year) |

|---|---|

| Reduced healthcare costs | 10-20 |

| Increased labor productivity | 5-10 |

| Improved tourism revenue | 1-2 |

| Increased agricultural output | 1-2 |

- Table 3: Pigouvian Taxes and Subsidies in Practice

| Policy | Example |

|---|---|

| Carbon tax | Tax levied on carbon emissions to internalize the costs of climate change |

| Renewable energy subsidies | Payments provided to producers of renewable energy sources to encourage adoption |

| Traffic congestion pricing | Tolls or surcharges on vehicles entering congested areas |

- Table 4: Challenges in Achieving Socially Efficient Quantity

| Challenge | Example |

|---|---|

| Difficulty measuring negative externalities | Quantifying the health impacts of air pollution |

| Political resistance to taxes | Lobbying by industries against carbon taxes |

| Enforcement difficulties | Monitoring and penalizing noncompliance with pollution regulations |

Glossary of Terms

- Marginal social benefit: The additional benefit to society from producing one more unit of a good or service.

- Marginal social cost: The additional cost to society from producing one more unit of a good or service.

- Negative externality: A cost that is imposed on third parties who are not directly involved in the production or consumption of a good or service.

- Pigouvian tax: A tax imposed on goods that generate negative externalities to internalize the external costs.

- Subsidy: A payment provided to producers or consumers to encourage activities that generate positive externalities.