Calculating payroll accurately and efficiently is crucial for any business. Rhode Island’s unique payroll laws and tax regulations make it essential to have a reliable and up-to-date payroll calculator at your disposal. Our comprehensive RI Payroll Calculator offers a user-friendly interface that streamlines your payroll preparation process, ensuring compliance and accuracy.

Key Features of Our RI Payroll Calculator

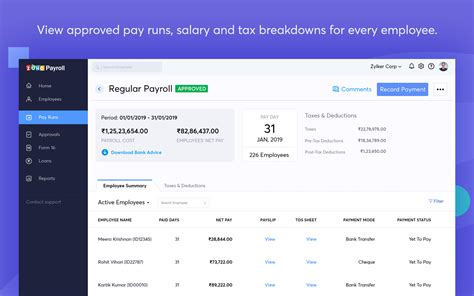

- Precise Tax Calculations: Our calculator incorporates all relevant RI withholding tax rates, including state income tax, unemployment insurance tax, and disability insurance tax.

- Time-Saving Automation: Automate complex time-tracking and payroll processing tasks, freeing up valuable time for other business operations.

- Comprehensive Reporting: Generate detailed payroll reports, including pay stubs, tax filings, and reconciliation summaries.

- Integration with Your Systems: Seamlessly integrate with popular accounting and HR software to streamline payroll management.

- Mobile Accessibility: Access your payroll data and process payments remotely with our mobile app.

Benefits of Using Our RI Payroll Calculator

- Increased Efficiency: Save significant time and effort by automating repetitive payroll tasks.

- Improved Accuracy: Eliminate human errors and ensure compliance with RI payroll regulations.

- Reduced Costs: Eliminate the need for expensive payroll services or in-house payroll staff.

- Enhanced Compliance: Stay up-to-date with changing payroll laws and avoid costly penalties.

- Improved Employee Satisfaction: Ensure accurate and timely paychecks for your employees, fostering a positive work environment.

How Our RI Payroll Calculator Can Help Your Business

- Accurate Payroll Calculations: Our calculator accurately processes payroll for any number of employees, ensuring compliance with state and federal laws.

- Time Savings: Automate payroll calculations, freeing up valuable time for more strategic business initiatives.

- Cost Savings: Eliminate the need for expensive payroll outsourcing or in-house payroll departments.

- Improved Employee Relations: Promote employee satisfaction by ensuring timely and accurate paychecks.

- Compliance Assurance: Stay up-to-date with RI payroll regulations and avoid penalties for non-compliance.

- Enter your company’s information, including name, address, and EIN.

- Create employee profiles, including personal data, timekeeping information, and tax withholding preferences.

- Input payroll hours and earnings, including overtime, bonuses, and commissions.

- Select the correct payroll period and frequency.

- Review and finalize payroll calculations, including deductions and net pay.

- Generate paychecks and relevant payroll reports.

Frequently Asked Questions

- How often should I update my payroll calculator?

-

It is recommended to update your calculator regularly to reflect any changes in RI payroll regulations or tax rates.

-

Can I use the calculator for multiple businesses?

-

Yes, our calculator supports multiple company profiles, allowing you to manage payroll for multiple businesses.

-

What file formats does the calculator support?

-

Our calculator supports common file formats such as CSV, PDF, and Excel for easy data import and export.

-

Do you offer support with the calculator?

-

Yes, our dedicated support team is available to assist you with any questions or issues related to using the calculator.

-

How secure is my payroll data with the calculator?

-

We use industry-leading security measures to encrypt and protect your sensitive payroll data.

-

Can I integrate the calculator with third-party software?

- Yes, our calculator offers seamless integration with popular accounting and HR systems.

Conclusion

Accurate and efficient payroll processing is essential for any Rhode Island-based business. Our comprehensive RI Payroll Calculator simplifies this process, empowering you to calculate payroll with confidence and ease. By automating complex tasks, ensuring compliance, and providing valuable insights, our calculator helps you reduce costs, improve efficiency, and enhance employee satisfaction. Embrace the future of payroll management with our innovative RI Payroll Calculator.