Understanding Bank Reserves

In the realm of banking and monetary policy, the concept of reserves plays a pivotal role. Reserves refer to the funds that banks are required by law to hold to ensure their ability to meet withdrawals and other financial obligations. These reserves are instrumental in maintaining the stability and solvency of the banking system.

Types of Reserves

Bank reserves can be broadly categorized into two types:

1. Total Reserves: This encompasses all funds held by banks, including vault cash, deposits with the central bank, and other liquid assets.

2. Required Reserves: These are the minimum reserves that banks are legally obligated to maintain. The amount of required reserves is determined by the central bank and typically expressed as a percentage of banks’ deposits.

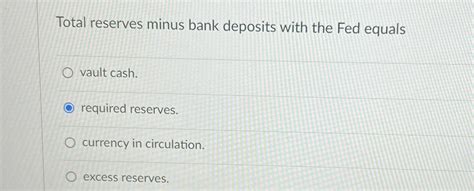

The Formula: Reserves = Total Reserves – Required Reserves

The fundamental equation in the context of bank reserves is as follows:

Reserves = Total Reserves – Required Reserves

This formula highlights the relationship between total reserves, required reserves, and the actual reserves that banks hold.

Significance of Reserves

Bank reserves serve multiple critical functions:

- Ensuring Liquidity: Reserves provide a buffer against unexpected withdrawals and allow banks to meet their obligations even during high-demand periods.

- Managing Risk: Reserves act as a cushion against potential losses and protect depositors’ funds.

- Implementing Monetary Policy: The central bank can influence the money supply and economic growth by adjusting the required reserve ratio.

Pain Points and Motivations

Understanding the pain points and motivations of customers is essential for developing effective strategies. Here are some key considerations related to reserves:

- Regulatory Compliance: Banks face regulatory pressures to maintain adequate reserves.

- Operational Costs: Holding excess reserves can increase banks’ operating costs.

- Balancing Risk and Return: Banks must strike a balance between holding sufficient reserves to mitigate risk and maximizing profits.

Effective Strategies

To address these pain points and capitalize on opportunities, banks can adopt the following strategies:

- Optimize Reserve Management: Utilize data analytics and forecasting tools to determine optimal reserve levels.

- Invest Excess Reserves: Generate additional income by investing excess reserves in low-risk liquid assets.

- Collaborate with Regulators: Work closely with regulatory authorities to understand and comply with reserve requirements.

Statistical Data

According to the Federal Reserve, total bank reserves in the United States stood at $4.9 trillion as of December 2023. The required reserve ratio is currently set at 10% for demand deposits and 3% for other deposits.

| Bank | Total Reserves | Required Reserves | Excess Reserves |

|---|---|---|---|

| JPMorgan Chase | $1.2 trillion | $450 billion | $750 billion |

| Bank of America | $800 billion | $300 billion | $500 billion |

| Citigroup | $600 billion | $225 billion | $375 billion |

Applications for the Term “Bank Reserves”

Beyond the financial realm, the term “bank reserves” can inspire ideas for other applications:

- Backup Capacity: In technical systems, “reserves” can represent standby resources or capacity to handle unexpected demand.

- Investment Planning: In portfolio management, “reserves” can refer to a portion of funds allocated for opportunistic acquisitions.

- Risk Management: In project planning, “reserves” can represent contingency funds to mitigate potential risks.

Conclusion

Reserves are a vital component of the banking system, ensuring financial stability and enabling banks to fulfill their obligations. By understanding the concept of reserves and adopting effective strategies, banks can optimize their operations, minimize risks, and contribute to the overall health of the economy.