Are you struggling to manage your finances effectively? Tired of waiting for paper checks to arrive in the mail? The Randolph Brooks Federal Credit Union (RBFCU) has a solution for you: direct deposit.

What is Direct Deposit?

Direct deposit is a convenient and secure method of receiving your paycheck electronically. Instead of receiving a paper check, your employer sends your paycheck directly to your RBFCU account on the designated pay date.

Benefits of Direct Deposit

- Convenience: No need to worry about lost or stolen checks or waiting for them to arrive in the mail.

- Security: Direct deposit eliminates the risk of check fraud or theft.

- Timeliness: Your paycheck is deposited directly into your account on the pay date, giving you immediate access to your funds.

- Budgeting: Direct deposit makes it easier to track your income and expenses, as the money is automatically deposited into your account.

How to Set Up Direct Deposit with RBFCU

To set up direct deposit with RBFCU, simply follow these steps:

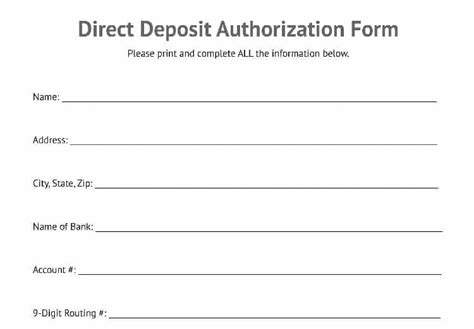

- Obtain a Direct Deposit Form from RBFCU: You can download the form from the RBFCU website or visit any RBFCU branch to obtain a hard copy.

- Complete the Form: Fill out the form accurately, providing your RBFCU account number, employer information, and the amount you want to deposit.

- Submit the Form to Your Employer: Once completed, submit the form to your employer’s payroll department.

Troubleshooting Direct Deposit with RBFCU

- Missing Deposit: If you do not receive a direct deposit on the expected pay date, contact RBFCU immediately and provide your employer’s name and the amount expected.

- Incorrect Amount Deposited: If an incorrect amount is deposited into your account, contact RBFCU and your employer to resolve the issue.

- Account Closed: If your RBFCU account is closed before the direct deposit date, the deposit may be rejected. Notify RBFCU in advance of any account closures.

Frequently Asked Questions (FAQs)

Q: Can I set up direct deposit for multiple accounts?

A: Yes, you can set up direct deposit for up to two accounts with RBFCU.

Q: Is there a fee for direct deposit with RBFCU?

A: No, direct deposit with RBFCU is free of charge.

Q: Can I cancel direct deposit at any time?

A: Yes, you can cancel direct deposit by contacting RBFCU or submitting a written request to your employer.

Additional Tips for Managing Your Finances

- Create a Budget: Track your income and expenses to identify areas where you can save or cut back.

- Consider Automatic Savings: Set up automatic transfers from your checking account to a savings account to build up your savings.

- Use Online Banking: Manage your finances conveniently from anywhere with RBFCU’s online banking platform.

- Take Advantage of Financial Education Resources: RBFCU offers a variety of financial education resources to help you improve your financial literacy.

By embracing direct deposit and following these additional tips, you can streamline your finances, save time, and gain greater control over your money.