Introduction

The bustling metropolis of New York City is a renowned hub for business and finance, offering a myriad of opportunities for accountants. This comprehensive guide delves into the intricacies of accountant salaries in the Big Apple, providing invaluable insights for professionals seeking to navigate the competitive job market.

Median Salary

According to the U.S. Bureau of Labor Statistics (BLS), the median annual salary for accountants in New York City is $87,060 as of May 2021. This figure surpasses the national median of $77,250.

Factors Influencing Salary

Several factors can impact an accountant’s salary in NYC, including:

- Experience: Accountants with extensive experience command higher salaries than their less experienced counterparts.

- Education: A higher level of education, such as a Master’s degree in Accounting or a CPA certification, typically leads to better earnings.

- Industry: Some industries pay accountants more than others, such as finance, consulting, and healthcare.

- Company Size: Accountants working for larger firms tend to earn more than those in smaller companies.

- Location: Accountants in Manhattan typically earn higher salaries than those in other boroughs.

Salary Range

The salary range for accountants in New York City is broad, with the lowest 10% earning less than $54,430 and the highest 10% earning more than $144,850. This wide range reflects the diversity of experience, education, and industry within the profession.

Bonus Incentives

Many accountants in New York City receive bonuses in addition to their base salary. Bonuses can range from 10% to 25% of base pay or more, depending on factors such as performance, company profitability, and tenure.

Benefits

In addition to competitive salaries, accountants in NYC often enjoy a comprehensive benefits package, including:

- Health, dental, and vision insurance

- Paid time off

- Retirement contributions

- Professional development opportunities

Career Path

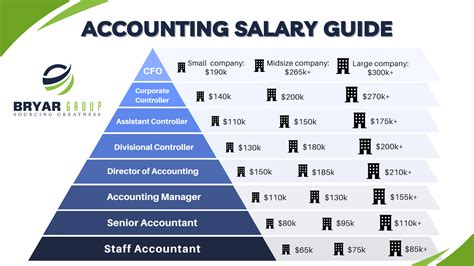

Accountants in New York City have the potential to advance their careers in various ways. Some choose to specialize in particular areas, such as auditing, tax, or forensic accounting. Others pursue leadership roles, such as becoming controllers, financial managers, or chief financial officers (CFOs).

Tips for Maximizing Your Salary

Consider these tips to enhance your earning potential as an accountant in NYC:

- Obtain a CPA certification: The CPA credential is highly valued in the accounting profession and can significantly increase your salary.

- Pursue a Master’s degree: An advanced degree in Accounting can open doors to higher-paying positions.

- Network within the industry: Attending industry events and joining professional organizations can connect you with potential employers and collaborators.

- Stay updated on accounting trends: Continuing education and professional development are essential for keeping your skills sharp and maximizing your earning potential.

Conclusion

Accountants in New York City enjoy competitive salaries and a comprehensive range of benefits. By understanding the factors that influence earnings and implementing strategies to maximize your salary, you can position yourself for success in the dynamic accounting landscape of the Big Apple. Whether you are a seasoned professional or a recent graduate, this guide provides valuable insights into the rewarding career path that awaits accountants in NYC.

Additional Tables

| Borough | Median Annual Salary |

|---|---|

| Manhattan | $95,000 |

| Brooklyn | $82,000 |

| Queens | $78,000 |

| Bronx | $75,000 |

| Staten Island | $72,000 |

| Industry | Median Annual Salary |

|---|---|

| Finance | $100,000 |

| Consulting | $90,000 |

| Healthcare | $85,000 |

| Manufacturing | $80,000 |

| Non-profit | $75,000 |

| Experience Level | Median Annual Salary |

|---|---|

| 0-5 years | $65,000 |

| 5-10 years | $80,000 |

| 10-15 years | $95,000 |

| 15+ years | $110,000 |

| Education Level | Median Annual Salary |

|---|---|

| Bachelor’s degree | $75,000 |

| Master’s degree | $90,000 |

| CPA certification | $105,000 |