Nicholls State University, located in Thibodaux, Louisiana, offers a wide range of undergraduate and graduate programs to students from all walks of life. As with any higher education institution, tuition and fees are a significant consideration for prospective students and their families. In this article, we will delve into the intricacies of Nicholls State University tuition, providing you with a comprehensive guide to costs, financial aid options, and strategies for minimizing your education expenses.

Understanding Nicholls State University Tuition Structure

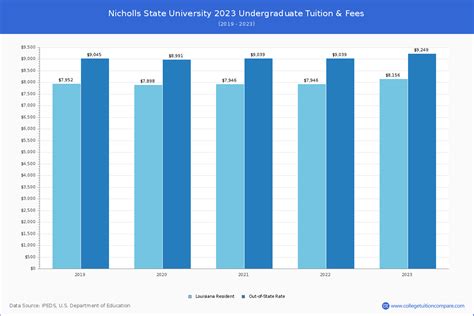

Nicholls State University employs a tiered tuition structure based on residency status and academic level. Here’s a breakdown of the tuition rates for the 2023-2024 academic year:

| Category | Undergraduate Tuition | Graduate Tuition |

|---|---|---|

| Louisiana Resident | $5,642 | $5,636 |

| Non-Louisiana Resident | $11,284 | $11,272 |

It’s important to note that these tuition rates are subject to change each academic year. For the most up-to-date information, refer to the Nicholls State University website.

Additional Fees and Expenses

In addition to tuition, students can expect to incur various fees and expenses during their time at Nicholls State University. These include:

- Application fee: $35

- Technology fee: $200 per semester

- Student activity fee: $120 per semester

- Health fee: $145 per semester

- Parking permit: $240 per year

Housing and meal plans also represent a significant expense for students. The average cost of on-campus housing is approximately $4,500 per semester, while meal plans range from $1,500 to $2,500 per semester.

Financial Aid Options

Nicholls State University is committed to making higher education accessible to all qualified students. The university offers a range of financial aid programs to help students offset the cost of attendance, including:

- Scholarships: Nicholls State University awards over $10 million in scholarships each year. Students are automatically considered for all university-based scholarships upon admission.

- Grants: Grants are need-based financial aid that do not have to be repaid. Nicholls State University awards approximately $40 million in grants each year.

- Student loans: Student loans are borrowed money that must be repaid with interest. Nicholls State University works with a variety of lenders to offer student loans at competitive interest rates.

How to Minimize Tuition Costs

While the cost of attending Nicholls State University can be significant, there are several strategies students can employ to minimize their tuition expenses:

- Apply for scholarships: Scholarships are the most effective way to reduce tuition costs. Research available scholarships and apply for as many as possible.

- Seek financial aid: File the Free Application for Federal Student Aid (FAFSA) to determine your eligibility for grants and student loans.

- Explore work-study programs: Work-study programs allow students to earn money while attending school. Nicholls State University offers a variety of work-study programs to help students offset the cost of attendance.

- Consider a part-time program: If you’re unable to attend school full-time, consider enrolling in a part-time program. This will reduce your tuition costs and allow you to work while earning your degree.

- Transfer credits: If you’ve taken college courses at another institution, you may be able to transfer those credits to Nicholls State University. This can reduce the amount of time it takes to complete your degree and save you money on tuition.

Common Mistakes to Avoid

When it comes to paying for college, it’s important to avoid common mistakes that can lead to unnecessary expenses. Here are a few things to keep in mind:

- Don’t wait to apply for financial aid: The earlier you apply for financial aid, the more options you’ll have. Deadlines for financial aid vary, so be sure to apply well in advance.

- Don’t borrow more than you need: Student loans can be a helpful way to finance your education, but it’s important to borrow only what you need. Remember, you’ll have to repay these loans with interest.

- Don’t forget about fees and expenses: In addition to tuition, you’ll also need to budget for fees, housing, meal plans, and other expenses. Be sure to factor these costs into your financial planning.

- Don’t ignore repayment options: Once you graduate, you’ll need to start repaying your student loans. Make sure you understand your repayment options and choose a plan that works for you.

Conclusion

Nicholls State University provides students with a high-quality education at an affordable cost. By understanding Nicholls State University tuition structure, financial aid options, and strategies for minimizing costs, students can make informed decisions about their education expenses. Remember to apply for financial aid early, borrow only what you need, and avoid common mistakes to make the most of your college experience.