As a new student embarking on your academic expedition at Northeastern University (NEU), navigating the financial landscape is crucial for a smooth and worry-free journey. Enter NEU Student Financial Services, your beacon of support in navigating the complexities of financing your education. This comprehensive guide will illuminate your path, equipping you with the knowledge and resources to make informed financial decisions throughout your time at NEU.

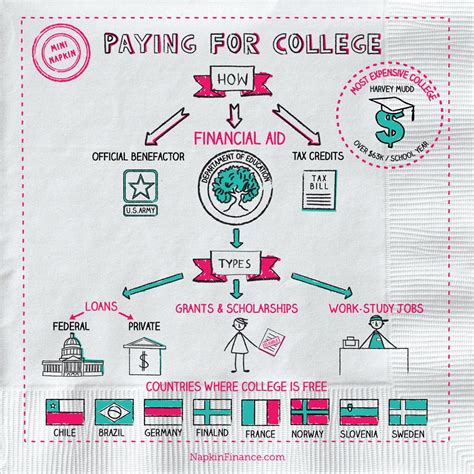

Understanding Financial Aid at NEU

NEU offers a diverse array of financial aid options tailored to your unique circumstances. Understanding these options is paramount for maximizing your financial support.

Types of Financial Aid

- Scholarships: Merit-based awards granted to students based on academic excellence, athletic ability, or other special talents.

- Grants: Need-based awards that do not require repayment.

- Loans: Funds borrowed from the federal government or private lenders that must be repaid with interest.

- Work-Study: On-campus or off-campus employment opportunities that provide financial assistance while gaining valuable work experience.

Applying for Financial Aid

- Complete the FAFSA (Free Application for Federal Student Aid): The FAFSA is a federal form that determines your eligibility for need-based aid. You must file the FAFSA annually to maintain your aid.

- Check with NEU’s Financial Aid Office: Contact the office to discuss your eligibility and explore additional financial aid opportunities.

Managing Your Student Loans

Student loans are an integral part of financing your education, but managing them wisely is essential. Here are some tips to help you navigate this aspect:

- Understand Your Loan Terms: Carefully review your loan documents to understand the loan amount, interest rate, repayment period, and any fees associated with it.

- Choose a Repayment Plan: Select a repayment plan that fits your budget and financial goals.

- Consolidate or Refinance: Explore options for consolidating or refinancing your loans to secure lower interest rates or extended repayment terms.

- Seek Loan Forgiveness: Consider loan forgiveness programs, such as Public Service Loan Forgiveness, if you qualify.

Budgeting and Saving for College

Financial planning is a key aspect of your financial well-being as a student. Here’s how you can create a budget and save effectively:

- Track Your Expenses: Use budgeting apps or spreadsheets to keep track of your income and expenses.

- Set Financial Goals: Identify your short-term and long-term financial goals, such as paying off student loans or saving for a down payment on a home.

- Explore Savings Opportunities: Research on-campus or off-campus employment opportunities to supplement your income. Consider opening a high-yield savings account to earn interest on your savings.

NEU Student Financial Services in Action

Here are real-world examples of how NEU Student Financial Services empowers students:

- Sarah, a first-generation college student, received a full-tuition scholarship based on her academic achievements. This support allowed her to focus on her studies without the burden of financial worry.

- John, a veteran pursuing a master’s degree, qualified for the Yellow Ribbon Program, which covered all of his tuition expenses. This program enabled him to pursue his education without the pressure of student loan debt.

- Emily, a work-study student, balances her academic responsibilities with a part-time job on campus. The income she earns helps her cover living expenses and reduce her overall financial burden.

FAQs

- When is the deadline for submitting the FAFSA? The FAFSA deadline varies each year. Visit the NEU Financial Aid website for the most up-to-date information.

- Can I apply for financial aid after the deadline? Yes, but it is recommended to submit your FAFSA as early as possible to access the best financial aid packages.

- How do I know if I qualify for financial aid? You can estimate your financial aid eligibility using the FAFSA4caster tool on the Federal Student Aid website.

- What if I have questions about my financial aid award? Contact the NEU Financial Aid Office for personalized guidance and assistance.

- Is there additional financial aid I can apply for beyond the FAFSA? Yes, scholarships and grants are available from the university, private organizations, and local businesses.

- How do I create a budget as a student? Use budgeting tools, track your expenses, and set realistic financial goals.

- How can I save money while in college? Take advantage of student discounts, explore part-time work opportunities, and consider living in affordable student housing.

Conclusion

NEU Student Financial Services is your unwavering companion on your academic journey, providing a comprehensive suite of services and resources to empower your financial well-being. By embracing the information and strategies outlined in this guide, you can navigate the financial complexities of college with confidence and focus on achieving your academic aspirations. Remember, financial planning is an ongoing process, so stay informed, ask questions, and seek guidance from NEU’s financial aid professionals whenever needed. Your financial success is intertwined with your academic success, and NEU Student Financial Services is here to support you every step of the way.