Whether you’re a prospective student, a current student, or a parent, understanding the cost of attending Michigan State University (MSU) is crucial for planning your educational journey. This article will provide a detailed overview of MSU’s tuition, fees, and other expenses, empowering you to make informed decisions about your higher education investment.

Tuition and Fees

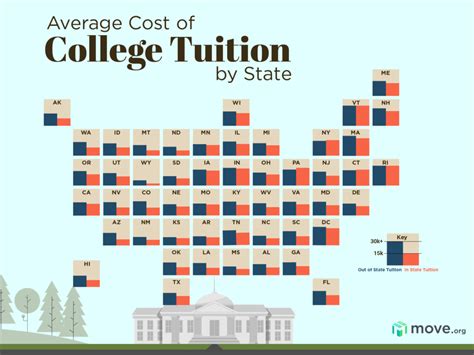

The cost of tuition and fees at MSU varies depending on your residency status, academic program, and year of study. Here’s a breakdown of the current rates for undergraduates and graduates for the 2023-2024 academic year:

Undergraduates

| Residency Status | Tuition | Fees | Total |

|---|---|---|---|

| Michigan Residents | $15,326 | $1,268 | $16,594 |

| Non-Michigan Residents | $30,928 | $1,268 | $32,196 |

Graduates

| Residency Status | Tuition | Fees | Total |

|---|---|---|---|

| Michigan Residents | $12,772 | $1,190 | $13,962 |

| Non-Michigan Residents | $26,016 | $1,190 | $27,206 |

Other Expenses

Beyond tuition and fees, there are additional expenses associated with attending MSU that students should consider:

- Housing: On-campus housing costs range from $7,000 to $12,000 per academic year. Off-campus housing options vary widely in price depending on location and amenities.

- Meal Plan: MSU offers various meal plans ranging from $1,700 to $3,000 per semester.

- Transportation: Students who bring a vehicle to campus must purchase a parking pass, which costs around $300 per year.

- Books and Supplies: Textbooks and course materials can cost around $1,000 per year.

- Health Insurance: Students who do not have adequate health coverage through their parents or other sources must purchase the MSU student health insurance plan, which costs around $1,000 per year.

Financial Aid Opportunities

MSU recognizes that higher education can be financially challenging, and it offers various financial aid programs to help students cover the costs of attendance. These include:

- Scholarships: MSU awards merit-based and need-based scholarships to students with exceptional academic records or financial need.

- Grants: Grants are need-based, free money that does not have to be repaid. MSU participates in federal and state grant programs.

- Loans: Loans must be repaid, but they offer students the opportunity to spread out the cost of attendance over time. MSU provides access to both federal and private loans.

Common Mistakes to Avoid

To minimize the financial burden of attending MSU, students should avoid the following common mistakes:

- Underestimating the total cost of attendance: It’s important to consider all expenses associated with college, not just tuition and fees.

- Borrowing too much: Students should only borrow as much as they need to cover their essential expenses.

- Not applying for financial aid: Many students qualify for financial aid but fail to apply.

- Spending excessively: College students should manage their money carefully to avoid overspending.

Conclusion

Understanding the cost of attending Michigan State University is essential for planning your educational investment. By carefully considering tuition, fees, and other expenses, and exploring financial aid opportunities, students can make informed decisions about their higher education journey and minimize their financial burden.

Additional Resources:

- MSU Office of Student Financial Aid

- MSU Student Accounts Office

- MSU Housing and Residential Services

Tables:

- Table 1: Michigan State University Tuition and Fees

- Table 2: Michigan State University Estimated Other Expenses

- Table 3: Michigan State University Financial Aid Programs

- Table 4: Common Financial Aid Mistakes to Avoid