Kenyon University, a prestigious liberal arts college nestled in Gambier, Ohio, offers an exceptional academic experience with a rich history and dedicated faculty. However, prospective students and their families must carefully consider the institution’s tuition costs and explore financial aid options to make an informed decision.

Tuition and Fees Breakdown

The 2023-2024 academic year tuition at Kenyon University is $61,734. This comprehensive fee includes instruction, academic resources, and various student services.

In addition to tuition, students should anticipate additional expenses, such as:

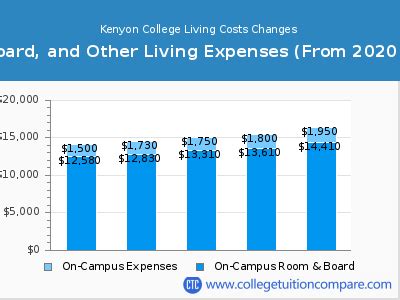

- Room and board: $16,148

- Orientation fee: $550 (one-time fee)

- Technology fee: $750 per year

- Health insurance fee: $1,854

- Wellness Center fee: $260

Finding Financial Aid

Kenyon University is committed to providing financial assistance to students and families with demonstrated financial need. The institution offers a range of financial aid programs, including:

- Grants: Need-based awards that do not require repayment.

- Scholarships: Merit-based awards based on academic achievement or other criteria.

- Work-study: Part-time employment opportunities on campus.

- Loans: Government or private loans that must be repaid after graduation.

Applying for Financial Aid

To apply for financial aid at Kenyon University, students must complete the Free Application for Federal Student Aid (FAFSA). The FAFSA collects information about the student’s and family’s financial situation to determine eligibility for federal and institutional aid.

The FAFSA application opens on October 1st each year. Kenyon University’s priority deadline for financial aid consideration is January 15th.

Tips for Reducing Costs

Students can explore various strategies to reduce their overall tuition and college expenses at Kenyon University:

- Explore scholarship opportunities: Research and apply for merit-based scholarships offered by Kenyon University and external organizations.

- Consider work-study: Apply for on-campus work-study positions to offset costs.

- Negotiate tuition: Inquire about tuition payment plans or negotiate a reduced rate based on financial hardship.

- Utilize external resources: Seek financial assistance from state or local programs, community organizations, or family members.

- Maximize tax deductions: Take advantage of tax deductions and credits available for education expenses.

Conclusion

Kenyon University offers a transformative educational experience with a significant tuition investment. By understanding the institution’s costs and exploring financial aid opportunities, prospective students and families can make an informed decision about financing their education. Through careful planning and exploring various cost-saving strategies, students can pursue their academic goals without overwhelming financial burdens.

相关推荐

- 2024 Kenyon College Tuition Unveiled: Breaking Down the Costs

- 2024 Kenyon College Tuition Unveiled: Breaking Down the Costs

- Kenyon College Financial Aid for International Students: A Comprehensive Guide

- Hampton University Out-of-State Tuition: An Investment in Excellence

- How to Apply for College Scholarships: A Comprehensive Guide to Maximizing Your Financial Aid