James Madison University’s financial aid office is committed to helping students and their families with the financial challenges of paying for college. It offers a wide range of financial aid programs, including scholarships, grants, loans, and work-study programs.

Types of Financial Aid Available

The James Madison financial aid office offers a variety of financial aid programs to help students pay for college, including:

- Scholarships are awarded to students based on academic merit, athletic ability, or other criteria. They do not have to be repaid.

- Grants are awarded to students based on financial need. They do not have to be repaid.

- Loans are borrowed money that must be repaid with interest.

- Work-study programs allow students to work part-time to earn money to help pay for college.

How to Apply for Financial Aid

To apply for financial aid, students must complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is used to determine a student’s financial need and eligibility for federal and state financial aid programs.

Deadlines

The priority deadline for submitting the FAFSA is March 1st. However, students are encouraged to submit the FAFSA as early as possible after October 1st.

Contact Information

The James Madison financial aid office is located in the Student Success Center. Students can contact the financial aid office by phone at (540) 568-6431 or by email at [email protected].

Additional Resources

In addition to the financial aid office, James Madison University also offers a number of other resources to help students pay for college, including:

- The Office of Student Financial Planning provides counseling and guidance to students and their families on how to finance college.

- The Student Employment Office helps students find part-time jobs on and off campus.

- The University Bursar’s Office provides information on tuition and fees, as well as payment plans.

Pain Points of Students Seeking Financial Aid

- The FAFSA is a complex and time-consuming process. Students may be frustrated by the amount of information they are required to provide, and they may be concerned about making mistakes that could delay or even jeopardize their financial aid eligibility.

- The financial aid process can be confusing and overwhelming. Students may not understand the different types of financial aid available to them, and they may not know how to choose the best option for their needs.

- Students may feel pressure to borrow more money than they need. They may be tempted to take out student loans to cover not only their tuition and fees, but also their living expenses. However, this can lead to a significant amount of debt that can be difficult to repay after graduation.

- Students may not know how to budget their money effectively. They may spend their financial aid funds too quickly, and they may end up struggling to make ends meet.

Motivations of Students Seeking Financial Aid

- Students want to pursue their education without worrying about the cost. They believe that a college degree is essential for success in today’s job market, and they are willing to work hard to achieve their academic goals.

- Students want to avoid taking on excessive debt. They understand that student loans can be a burden, and they want to minimize the amount of debt they have to repay after graduation.

- Students want to learn how to manage their money effectively. They want to develop the skills they need to make sound financial decisions and to avoid financial problems in the future.

Comparisons of Pros and Cons of Different Types of Financial Aid

| Type of Financial Aid | Pros | Cons |

|---|---|---|

| Scholarships | Do not have to be repaid | Can be competitive to obtain |

| Grants | Do not have to be repaid | Based on financial need |

| Loans | Can be used to cover all college costs | Must be repaid with interest |

| Work-study programs | Provide students with work experience | Can be limited in number and availability |

Summary

The James Madison financial aid office offers a wide range of financial aid programs to help students pay for college. Students are encouraged to apply for financial aid as early as possible after October 1st. The FAFSA is a complex and time-consuming process, but it can be completed in a few hours. By understanding the different types of financial aid available and by applying for aid early, students can increase their chances of receiving the financial assistance they need.

Appendices

Appendix A: Glossary of Financial Aid Terms

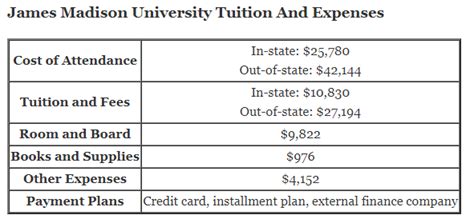

- Cost of attendance (COA): The total cost of attending college, including tuition and fees, room and board, and other expenses.

- Expected family contribution (EFC): The amount of money that a student’s family is expected to contribute to the cost of college.

- Financial aid award: The amount of money that a student is offered to help pay for college.

- Financial need: The difference between a student’s COA and their EFC.

- Free Application for Federal Student Aid (FAFSA): The application that students must complete to be considered for federal and state financial aid.

- Grant: A financial aid award that does not have to be repaid.

- Loan: A financial aid award that must be repaid with interest.

- Scholarship: A financial aid award that is based on academic merit, athletic ability, or other criteria