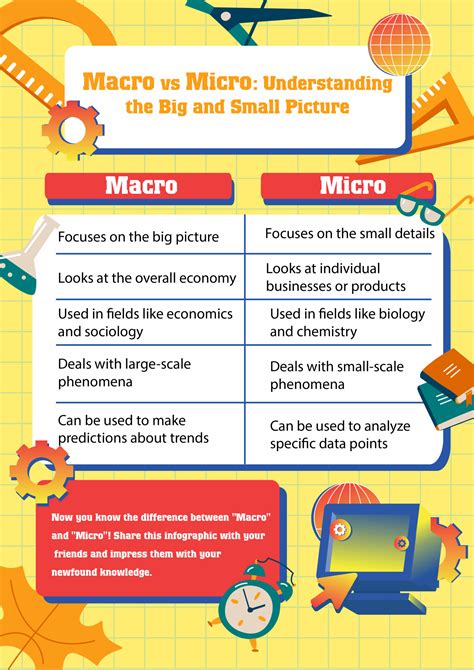

When it comes to managing finances, there are two main schools of thought: macro and micro. Macro focuses on the big picture, while micro focuses on the details. But which approach is easier?

There is no easy answer to this question, as the best approach for you will depend on your individual circumstances and preferences. However, there are some general advantages and disadvantages to each approach.

Macro

-

Advantages:

- Less time-consuming

- Easier to see the big picture

- Can be more effective for long-term planning

-

Disadvantages:

- Can be less effective for short-term goals

- Can be more difficult to adjust to changes in circumstances

Micro

-

Advantages:

- More precise

- Can be more effective for short-term goals

- Can be easier to adjust to changes in circumstances

-

Disadvantages:

- More time-consuming

- Can be more difficult to see the big picture

- Can be less effective for long-term planning

Ultimately, the best approach for you will depend on your individual circumstances and preferences. If you are looking for a simple and straightforward approach that requires less time, macro may be a good option. If you are looking for a more precise approach that gives you more control over your finances, micro may be a better choice.

The best way to determine which approach is right for you is to experiment with both. Try using macro for a few months, and then try using micro for a few months. See which approach works better for you and your needs.

If you are not sure which approach to use, you can consult with a financial advisor. A financial advisor can help you develop a personalized financial plan that meets your individual needs and goals.

No matter which approach you choose, there are certain strategies that you can use to improve your chances of success. These strategies include:

- Setting goals: The first step to managing your finances is to set goals. What do you want to achieve with your money? Do you want to retire early? Buy a house? Pay off debt? Once you know what you want to achieve, you can start to develop a plan to get there.

- Creating a budget: A budget is a plan for how you will spend your money. It will help you track your income and expenses, and ensure that you are spending your money wisely. There are many different budgeting methods available, so find one that works for you and stick to it.

- Tracking your progress: Once you have created a budget, it is important to track your progress. This will help you stay on track and make adjustments as needed. You can use a spreadsheet, a budgeting app, or simply a notebook to track your income and expenses.

- Getting help: If you are struggling to manage your finances, do not be afraid to get help. There are many resources available, such as financial advisors, credit counselors, and online budgeting tools.

There are a few common mistakes that people make when managing their finances. These mistakes include:

- Not setting goals: If you do not know what you want to achieve with your money, it will be difficult to develop a plan to get there.

- Not creating a budget: A budget is essential for tracking your income and expenses, and ensuring that you are spending your money wisely.

- Not tracking your progress: If you do not track your progress, it will be difficult to stay on track and make adjustments as needed.

- Spending more than you earn: This is one of the biggest mistakes that people make when managing their finances. If you spend more than you earn, you will end up in debt.

- Not saving for the future: It is important to save for the future, such as retirement or a down payment on a house. If you do not save for the future, you may end up struggling financially later in life.

Managing your finances is important for your overall financial health. By managing your finances wisely, you can achieve your financial goals, build a strong financial foundation, and live a financially secure life.

There are many benefits to managing your finances wisely, including:

- Reduced stress: Managing your finances wisely can help to reduce stress. When you know that you are in control of your finances, you will feel more confident about your financial future.

- Greater financial security: Managing your finances wisely can help you to build a strong financial foundation. This will give you peace of mind and allow you to weather unexpected financial storms.

- Increased wealth: Managing your finances wisely can help you to increase your wealth. By making smart investment decisions and saving for the future, you can grow your wealth over time.

- Improved quality of life: Managing your finances wisely can help you to live a better quality of life. When you are financially secure, you can spend more time on the things that you enjoy, such as family, friends, and hobbies.

Managing your finances is an important part of life. By understanding the difference between macro and micro approaches, you can choose the approach that is right for you and your needs. By following the strategies outlined in this article, you can avoid common mistakes and reap the benefits of managing your finances wisely.

Table 1: Macro vs. Micro Approaches to Financial Management

| Feature | Macro | Micro |

|---|---|---|

| Focus | Big picture | Details |

| Time | Less time-consuming | More time-consuming |

| Effectiveness | More effective for long-term planning | More effective for short-term goals |

| Precision | Less precise | More precise |

| Adjustability | More difficult | Easier |

Table 2: Strategies for Success

| Strategy | Description | Benefits |

|---|---|---|

| Set goals | Determine what you want to achieve with your money | Provides direction and motivation |

| Create a budget | Plan how you will spend your money | Helps you track income and expenses, and ensure that you are spending your money wisely |

| Track your progress | Monitor your income and expenses | Helps you stay on track and make adjustments as needed |

| Get help | Seek assistance from a financial advisor, credit counselor, or online budgeting tool | Can provide guidance and support |

Table 3: Common Mistakes to Avoid

| Mistake | Description | Consequences |

|---|---|---|

| Not setting goals | Not knowing what you want to achieve with your money | Difficulty developing a plan to get there |

| Not creating a budget | Not tracking your income and expenses | Difficulty ensuring that you are spending your money wisely |

| Not tracking your progress | Not monitoring your income and expenses | Difficulty staying on track and making adjustments as needed |

| Spending more than you earn | Spending more than you earn | Debt |

| Not saving for the future | Not preparing for the future | Financial insecurity in later life |

Table 4: Benefits of Managing Your Finances Wisely

| Benefit | Description |

|---|---|

| Reduced stress | Feeling more confident about your financial future |

| Greater financial security | Building a strong financial foundation |

| Increased wealth | Growing your wealth over time |

| Improved quality of life | Spending more time on the things you enjoy |