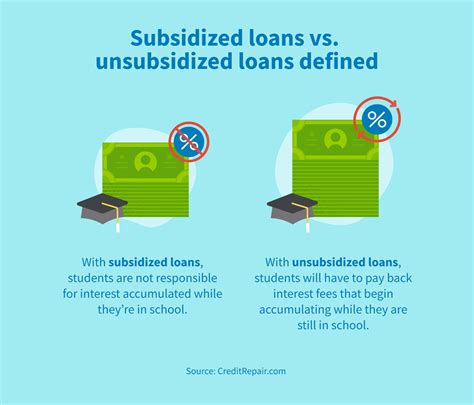

As a college student, financial aid is a crucial lifeline that helps cover tuition, fees, and living expenses. Among the various forms of financial assistance available, subsidized loans stand out for their enticing feature: the government pays the interest on these loans while you’re in school and during certain deferment and forbearance periods. Missing out on such a generous opportunity can be a costly mistake. Unfortunately, that’s exactly what happened to me.

The Painful Mistake

In a moment of carelessness, I accidentally declined my subsidized loan while completing my financial aid application. It was a simple checkbox that I overlooked, and that oversight has haunted me ever since. I realized my mistake only after the loans had been disbursed, and it was too late to rectify it.

The Financial Consequences

The financial consequences of declining my subsidized loan were substantial. I missed out on thousands of dollars in interest savings over the life of the loan. According to the College Board, the average student loan debt for the class of 2022 was $31,800. Assuming a 4% interest rate, declining a subsidized loan on that amount would result in paying an additional $1,400 in interest over ten years. For larger loan amounts, the interest savings would be even more significant.

The Emotional Rollercoaster

Beyond the financial implications, declining my subsidized loan took a toll on my emotional well-being. I felt a sense of guilt and anxiety knowing that I had made a costly mistake. The thought of having to pay thousands of dollars more in interest weighed heavily on my mind.

Strategies for Avoiding Such a Mistake

To prevent other students from experiencing the same pain I did, here are some strategies to consider:

- Carefully Review Your Financial Aid Application: Pay meticulous attention to every detail of your financial aid application, especially when it comes to loan options. Make sure to read and understand the terms of each loan type before making any decisions.

- Seek Professional Advice: If you’re not sure about anything on your financial aid application, don’t hesitate to reach out to a financial aid counselor or advisor. They can provide expert guidance and help you make informed decisions.

- Meet Deadlines: Financial aid applications often have strict deadlines. Make sure you submit your application well before the deadline to avoid any last-minute errors.

How to Correct Your Mistake

If you’ve accidentally declined your subsidized loan, there may still be options to correct your mistake.

- Contact Your Lender: Reach out to your loan servicer and explain your situation. They may be able to help you reinstate your subsidized loan or provide other options to minimize the impact of your mistake.

- File an Appeal: You may be able to file an appeal with the financial aid office of your school. Explain your circumstances and provide any supporting documentation to show that you accidentally declined your subsidized loan.

- Consider Refinancing: Refinancing your student loans may be an option to lower your interest rate and save money. However, refinancing a federal loan into a private loan may mean losing certain benefits, such as income-driven repayment plans.

Conclusion

Declining your subsidized loan can be a costly mistake. By carefully reviewing your financial aid application, seeking professional advice, and meeting deadlines, you can avoid this unfortunate situation. If you do make such a mistake, remember that there may still be options to correct it. Don’t hesitate to reach out for help to minimize the financial and emotional impact of this error.