Are you tired of being bombarded with loan offers? Do you feel like you’re drowning in debt? If so, you’re not alone. Millions of Americans are struggling with debt, and it can be difficult to know how to get out of it.

One of the best ways to reduce your debt is to reject loans. But how do you do that? Here are a few tips:

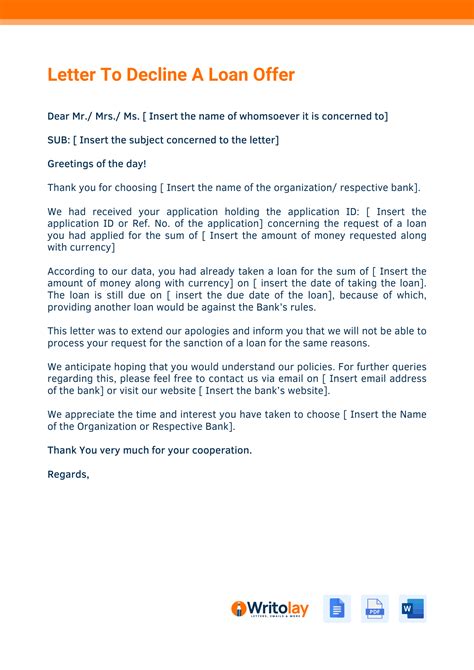

- Be assertive. When a lender offers you a loan, don’t be afraid to say no. Thank them for the offer, but let them know that you’re not interested.

- Explain your reasons. If you’re comfortable, you can explain to the lender why you’re rejecting the loan. This will help them understand your situation and make it less likely that they’ll offer you a loan in the future.

- Don’t be pressured. Lenders may try to pressure you into taking out a loan. They may tell you that you need the money, or that you’ll miss out on a great opportunity if you don’t take the loan. Don’t let them pressure you. Remember, you’re the one who’s in control of your finances.

Rejecting loans can be difficult, but it’s important to remember that you have the right to say no. If you’re struggling with debt, rejecting loans is a good way to start getting your finances back on track.

Common Reasons To Reject Loans

There are many reasons why you might want to reject a loan. Some of the most common reasons include:

- You don’t need the money.

- You can’t afford the monthly payments.

- You have a bad credit score.

- You’re worried about getting into more debt.

- You’re not sure if you can trust the lender.

- The loan terms are not favorable.

If you’re considering rejecting a loan, it’s important to weigh the pros and cons carefully. Consider your financial situation and your goals. If you’re not sure whether or not you should reject a loan, talk to a financial advisor.

Benefits Of Rejecting Loans

There are many benefits to rejecting loans. Some of the most common benefits include:

- Reducing your debt.

- Improving your credit score.

- Saving money on interest payments.

- Gaining peace of mind.

If you’re struggling with debt, rejecting loans can be a good way to get your finances back on track. It can also help you improve your credit score and save money on interest payments.

Alternatives To Loans

If you need money, there are several alternatives to loans that you can consider. Some of the most common alternatives include:

- Savings.

- Investments.

- Credit cards.

- Family and friends.

- Government assistance.

If you’re considering taking out a loan, it’s important to explore all of your options. There may be a better way to get the money you need without taking on more debt.

Conclusion

Rejecting loans can be difficult, but it’s important to remember that you have the right to say no. If you’re struggling with debt, rejecting loans is a good way to start getting your finances back on track.