Understanding Horizontal Integration: A Key Concept in Business Strategy

In today’s competitive business landscape, companies strive to gain an edge by leveraging various strategies. One such strategy is horizontal integration, a fundamental concept that has shaped the structure and dynamics of industries across the globe. This article provides a comprehensive definition and analysis of horizontal integration, its impact on businesses, and its relevance in the modern market environment.

Defining Horizontal Integration

Horizontal integration, also known as lateral integration, is a business strategy whereby a company expands its operations by acquiring or merging with other companies that operate at the same stage of the production or distribution process. The primary goal of horizontal integration is to increase market share, reduce competition, and achieve economies of scale.

Types of Horizontal Integration

Horizontal integration can be classified into two main types:

- Backward integration: This involves acquiring or merging with suppliers or vendors to gain control over the supply chain.

- Forward integration: This involves acquiring or merging with distributors or retailers to gain control over the distribution channels.

Benefits of Horizontal Integration

Horizontal integration offers several potential benefits, including:

- Increased market share: By consolidating operations with competitors, companies can increase their market share and dominate a larger portion of the industry.

- Reduced competition: Acquiring or merging with competitors eliminates competition and allows the integrated company to set prices and influence market dynamics.

- Economies of scale: Expanding operations through horizontal integration can lead to cost savings through increased production capacity and reduced overhead.

- Enhanced bargaining power: A larger, integrated company has greater bargaining power with suppliers and customers, enabling it to negotiate favorable terms.

Drawbacks of Horizontal Integration

While horizontal integration can provide significant benefits, there are also potential drawbacks to consider:

- Antitrust concerns: Regulatory authorities may scrutinize horizontal integration transactions to prevent the creation of monopolies and protect competition.

- Increased complexity: Merging multiple companies can lead to increased organizational complexity and management challenges.

- Cultural conflicts: Integrating companies with different cultures and operating practices can create conflicts and resistance to change.

- Reduced flexibility: Large, integrated companies may become less agile and responsive to market changes.

Examples of Horizontal Integration

Throughout history, numerous companies have successfully implemented horizontal integration strategies. Notable examples include:

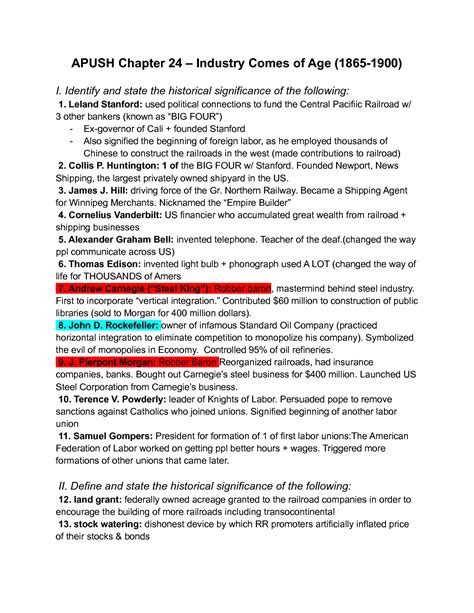

- Standard Oil Company: In the late 19th century, John D. Rockefeller used horizontal integration to consolidate the oil industry and create a virtual monopoly.

- Ford Motor Company: Henry Ford’s acquisition of suppliers and distribution channels allowed Ford to control the entire automotive production process and drive down costs.

- Amazon: Amazon’s acquisition of Whole Foods Market in 2017 was a major example of forward integration, enabling Amazon to expand its reach into the grocery sector.

Horizontal Integration in the Modern Market

In the contemporary market environment, horizontal integration remains a relevant and frequently employed strategy. Companies are increasingly leveraging horizontal integration to:

- Gain access to new markets: By acquiring or merging with companies in different geographic regions or product categories, companies can expand their customer base and revenue streams.

- Enhance customer experience: Integrated companies can provide customers with a seamless, end-to-end experience by controlling all aspects of the supply chain and distribution channels.

- Respond to technological advancements: Horizontal integration can enable companies to acquire the expertise and resources necessary to keep pace with rapid technological advancements.

Tips and Tricks for Successful Horizontal Integration

For businesses considering horizontal integration, careful planning and execution are crucial. Here are some tips and tricks to increase the likelihood of success:

- Conduct thorough due diligence: Perform extensive research on potential acquisition targets to assess their financial health, market position, and cultural fit.

- Develop a clear integration plan: Outline the specific steps and timelines for integrating the acquired company, including leadership transitions, process alignment, and cultural integration.

- Communicate effectively: Keep employees, customers, and stakeholders informed throughout the integration process to reduce uncertainty and foster a sense of collaboration.

- Monitor and adjust: Regularly assess the progress and outcomes of the integration and make adjustments as needed to ensure alignment with strategic objectives.

Conclusion

Horizontal integration is a fundamental business strategy that has played a significant role in shaping the global economy. By consolidating operations, reducing competition, and achieving economies of scale, companies can leverage horizontal integration to enhance their market position, improve customer experience, and respond to evolving market dynamics. While antitrust concerns and other challenges must be considered, careful planning and execution can increase the likelihood of successful horizontal integration and drive long-term business growth.