Hillsdale College, renowned for its classical liberal arts education, offers students a transformative experience. However, understanding the financial implications of attending Hillsdale is crucial for prospective students. This guide provides a detailed overview of Hillsdale College tuition, fees, financial aid, and strategies for minimizing costs.

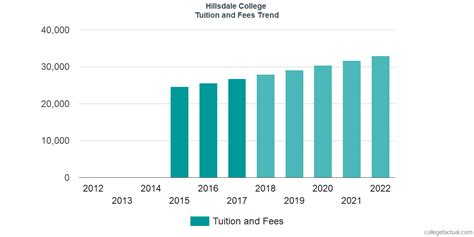

Tuition and Fees

Hillsdale College adheres to a traditional fee structure, ensuring that all students have access to its exceptional academic programs and extracurricular opportunities.

| Year | Tuition | Fees |

|---|---|---|

| 2023-2024 | $35,020 | $1,090 |

| 2024-2025 | $37,180 | $1,140 |

| 2025-2026 | $39,450 | $1,190 |

Financial Aid

Hillsdale College is committed to making higher education accessible to all qualified students, regardless of their financial circumstances. The college offers a wide range of financial aid programs, including:

- Scholarships: Based on academic merit, leadership, or other factors

- Grants: Free funds awarded based on financial need

- Loans: Funds that must be repaid after graduation

- Work-Study: Employment opportunities on campus to earn money towards tuition

Common Mistakes to Avoid

- Assuming You Won’t Qualify for Financial Aid: Even students from affluent families may be eligible for need-based aid.

- Not Filing the FAFSA on Time: The Free Application for Federal Student Aid (FAFSA) is essential for determining financial aid eligibility.

- Ignoring Scholarships: Explore various scholarship opportunities outside of Hillsdale College.

- Taking on Excessive Debt: Consider part-time work or other strategies to reduce loan obligations.

- Neglecting Federal Student Loans: Federal loans offer lower interest rates and more flexible repayment options than private loans.

How to Apply for Financial Aid

- Create an FSA ID: Visit fafsa.gov to create a username and password.

- Complete the FAFSA: Provide information about your income, assets, and financial situation.

- Submit the FAFSA: Deadline: April 15 for fall semester enrollment.

- Receive Award Letter: Hillsdale College will send you an award letter outlining the types and amounts of financial aid you qualify for.

- Review and Accept: Carefully review the award letter and indicate your acceptance of the financial aid offered.

FAQs

- Is Hillsdale College expensive? Hillsdale College has a traditional fee structure, but it offers generous financial aid packages to make education affordable.

- How much financial aid can I receive? The amount of financial aid you receive depends on your financial need and academic profile.

- Can I work part-time while attending Hillsdale? Yes, Hillsdale College offers work-study programs to help students earn money towards tuition.

- Are there payment plans available? Yes, Hillsdale College offers installment payment plans to help students manage the cost of tuition.

- Can I transfer scholarships from another college? Yes, some scholarships can be transferred to Hillsdale College with approval.

- What is the average student loan debt at Hillsdale? The average student loan debt at Hillsdale College is lower than the national average.

- How can I reduce the cost of attending Hillsdale? Explore scholarships, grants, work-study programs, and part-time employment options.

- What is Hillsdale College’s endowment? Hillsdale College has a strong endowment of over $1 billion, which supports student scholarships and academic programs.

Budget Breakdown

For students paying the full cost of tuition and fees without financial aid, the annual estimated expenses for 2023-2024 are as follows:

| Category | Amount |

|---|---|

| Tuition and Fees | $36,110 |

| Room and Board | $12,500 |

| Books and Supplies | $600 |

| Transportation | $2,400 |

| Personal Expenses | $1,000 |

| Total Estimated Annual Cost | $52,610 |

Conclusion

Hillsdale College offers an exceptional education that empowers students to excel in their careers and lives. Understanding the financial implications of attending Hillsdale is essential for prospective students. By exploring financial aid options and minimizing costs, students can invest in a transformative experience without the burden of excessive debt.