A Comprehensive Guide to HCC Cost per Credit Hour

In today’s competitive job market, higher education is essential for success. However, the cost of college can be a major barrier for many students. Houston Community College (HCC) offers affordable tuition rates and a variety of financial aid options to make college more accessible.

HCC Cost per Credit Hour

The cost per credit hour at HCC varies depending on your residency status and the type of课程you are taking. For the 2022-2023 academic year, the cost per credit hour is as follows:

- In-district: $131

- Out-of-district: $206

- Out-of-state: $281

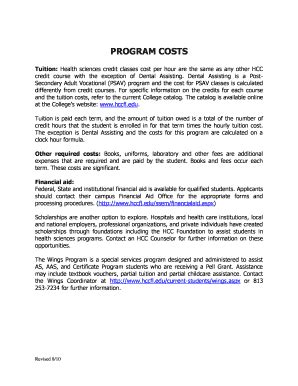

Tuition and Fees

In addition to the cost per credit hour, students also pay tuition and fees. Tuition covers the cost of instruction, while fees cover the cost of other services, such as the library, student activities, and technology.

For the 2022-2023 academic year, the tuition and fees for full-time students are as follows:

- In-district: $2,454

- Out-of-district: $3,859

- Out-of-state: $5,274

Financial Aid

HCC offers a variety of financial aid options to help students pay for college. These options include grants, scholarships, loans, and work-study programs.

To be eligible for financial aid, students must complete the Free Application for Federal Student Aid (FAFSA). The FAFSA is used to determine your financial need and eligibility for aid.

How to Save Money on College

There are a number of ways to save money on college. Here are a few tips:

- Take advantage of financial aid. Financial aid can help you pay for college without going into debt.

- Attend community college. Community college tuition rates are typically lower than four-year college tuition rates.

- Take online courses. Online courses can be more affordable than traditional face-to-face courses.

- Buy used textbooks. Used textbooks can save you a lot of money.

- Live at home. Living at home can help you save on housing costs.

Paying for College

If you don’t have enough money to pay for college, you can finance your education with loans. Student loans are available from both the federal government and private lenders.

Federal student loans typically have lower interest rates than private student loans. However, to qualify for federal student loans, you must meet certain eligibility requirements.

Private student loans are available to students who do not qualify for federal student loans. However, private student loans typically have higher interest rates than federal student loans.

Repaying Student Loans

Student loans must be repaid once you graduate or leave school. The amount of your monthly payments will be based on the amount of money you borrowed, the interest rate on your loan, and the length of your repayment period.

You can repay your student loans through a variety of methods, including:

- Standard repayment plan. This is the most common repayment plan. Under this plan, you will make fixed monthly payments for a period of 10 years.

- Graduated repayment plan. Under this plan, your monthly payments will start out low and gradually increase over time.

- Extended repayment plan. This plan is available to borrowers who have a high amount of student loan debt. Under this plan, you will make monthly payments for a period of 20 or 25 years.

If you have difficulty repaying your student loans, you may be able to qualify for loan forgiveness. Loan forgiveness is available to borrowers who work in certain public service professions, such as teaching, nursing, and social work.

Conclusion

The cost of college can be a major barrier for many students. However, HCC offers affordable tuition rates and a variety of financial aid options to make college more accessible. With careful planning, you can afford to get the education you need to achieve your career goals.

## Frequently Asked Questions

Q: What is the cost per credit hour at HCC?

A: The cost per credit hour at HCC varies depending on your residency status and the type of course you are taking. For the 2022-2023 academic year, the cost per credit hour is as follows:

- In-district: $131

- Out-of-district: $206

- Out-of-state: $281

Q: What are the tuition and fees at HCC?

A: For the 2022-2023 academic year, the tuition and fees for full-time students are as follows:

- In-district: $2,454

- Out-of-district: $3,859

- Out-of-state: $5,274

Q: What financial aid options are available at HCC?

A: HCC offers a variety of financial aid options to help students pay for college. These options include grants, scholarships, loans, and work-study programs.

Q: How can I save money on college?

A: There are a number of ways to save money on college. Here are a few tips:

- Take advantage of financial aid. Financial aid can help you pay for college without going into debt.

- Attend community college. Community college tuition rates are typically lower than four-year college tuition rates.

- Take online courses. Online courses can be more affordable than traditional face-to-face courses.

- Buy used textbooks. Used textbooks can save you a lot of money.

- Live at home. Living at home can help you save on housing costs.

Q: How do I repay student loans?

A: You can repay your student loans through a variety of methods, including:

- Standard repayment plan. This is the most common repayment plan. Under this plan, you will make fixed monthly payments for a period of 10 years.

- Graduated repayment plan. Under this plan, your monthly payments will start out low and gradually increase over time.

- Extended repayment plan. This plan is available to borrowers who have a high amount of student loan debt. Under this plan, you will make monthly payments for a period of 20 or 25 years.