Higher education is an investment in your future. By understanding the cost of attendance and the financial resources available, you can make informed decisions during your college search.

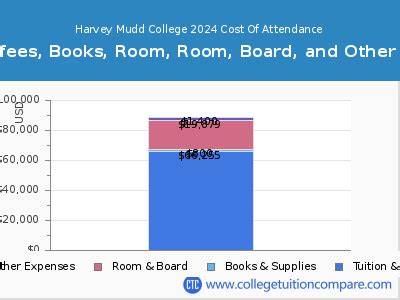

Understanding the Cost of Attendance at Harvey Mudd College

The cost of attendance includes all the expenses a student can expect to incur while attending college. It consists of both direct and indirect costs.

Direct Costs

- Tuition and fees: These costs cover the basic cost of instruction, academic support services, and other university-related expenses. At Harvey Mudd College, tuition for the 2023-2024 academic year is $60,990.

- On-campus room and board: This includes the cost of housing and meals provided by the college. For the 2023-2024 academic year, the estimated cost of on-campus room and board is $16,676.

Indirect Costs

- Books and supplies: Textbooks, course materials, and other supplies necessary for your classes. The estimated cost of books and supplies is $1,200 per year.

- Transportation: Costs associated with commuting to and from college, including gas, public transportation, or parking. The estimated cost of transportation is $1,500 per year.

- Personal expenses: These include expenses such as laundry, haircuts, entertainment, and other personal needs. The estimated cost of personal expenses is $2,000 per year.

Total Cost of Attendance

The total cost of attendance at Harvey Mudd College for the 2023-2024 academic year is estimated to be $82,366 for students living on campus.

| Cost Component | Cost |

|---|---|

| Tuition and fees | $60,990 |

| Room and board (on-campus) | $16,676 |

| Books and supplies | $1,200 |

| Transportation | $1,500 |

| Personal expenses | $2,000 |

| Total | $82,366 |

Financial Aid: Options and Resources

Harvey Mudd College offers a comprehensive financial aid program to help students and families cover the cost of attendance. Financial aid can take the form of scholarships, grants, loans, and work-study programs.

- Scholarships: Scholarships are awarded based on academic merit, financial need, or other criteria.

- Grants: Grants are awarded based on financial need and do not need to be repaid.

- Loans: Loans must be repaid after completing college and can be subsidized (interest paid by the government) or unsubsidized (interest paid by the borrower).

- Work-study programs: These programs allow students to earn money to help pay for college expenses by working on or off campus.

Tips for Managing College Expenses

- Apply for financial aid: Every student should fill out the Free Application for Federal Student Aid (FAFSA) to determine their eligibility for financial aid.

- Explore scholarship opportunities: Research and apply for scholarships from a variety of sources, including schools, organizations, and employers.

- Consider a part-time job: Working part-time during college can help you earn extra money and reduce the amount of debt you need to take on.

- Be mindful of expenses: Track your spending and identify areas where you can cut back to save money.

- Negotiate with the college: If you have financial concerns, contact the financial aid office at Harvey Mudd College. They may be able to help you negotiate payment plans or find additional financial aid resources.

Step-by-Step Approach to Managing College Expenses

- Determine your total cost of attendance.

- Research and apply for financial aid, including scholarships, grants, and loans.

- Explore work-study programs and part-time job opportunities.

- Track your spending and find ways to save money.

- Negotiate with the college if necessary.

- Monitor your financial aid and expenses throughout your college career.

Common Mistakes to Avoid

- Assuming you won’t qualify for financial aid: Don’t let your assumptions prevent you from applying for financial aid. Fill out the FAFSA regardless of your family’s income or assets.

- Waiting to apply for financial aid: Apply for financial aid as soon as possible after October 1st of your senior year of high school. The earlier you apply, the more options you’ll have.

- Not exploring all your scholarship options: Don’t just rely on scholarships from your school. Look for scholarships from outside organizations and employers.

- Taking on too much debt: Only borrow as much money as you need and can afford to repay. Be aware of the interest rates and repayment terms before signing any loan agreements.

- Not managing your expenses: It’s important to track your spending and find ways to save money throughout your college career. Avoid unnecessary expenses and look for ways to earn extra money.

Conclusion

Understanding the cost of attendance at Harvey Mudd College and the financial aid resources available will help you make informed decisions about your education. By applying for financial aid, exploring scholarships, and managing your expenses wisely, you can make college affordable and invest in your future.