Introduction

In a rapidly evolving financial landscape, Goergia Future Account (GFA) stands as a beacon of innovation, empowering businesses to optimize their financial operations and stay ahead of the curve. With a suite of cutting-edge features and seamless integration capabilities, GFA is poised to revolutionize the way businesses manage their finances.

Innovative Features for Enhanced Financial Management

GFA boasts an array of innovative features designed to streamline financial processes and improve efficiency:

- Automated Invoice Processing: Eliminate manual data entry with AI-powered invoice processing that automates invoice capture, extraction, and approval, saving businesses countless hours and reducing errors.

- Cash Flow Forecasting: Gain real-time visibility into future cash flow with GFA’s advanced forecasting capabilities. This empowers businesses to make informed decisions, optimize cash reserves, and avoid potential liquidity issues.

- Customized Reporting: Create tailored financial reports with ease using GFA’s customizable report builder. Access real-time insights into financial performance, identify trends, and make data-driven decisions.

Seamless Integration for Frictionless Operations

GFA seamlessly integrates with popular accounting and CRM systems, eliminating the need for manual data entry and ensuring a cohesive financial workflow. This integration enables businesses to:

- Synchronize Customer Data: Automatically import customer data from CRMs into GFA, ensuring accurate billing and improved customer service.

- Eliminate Duplicate Data: Prevent duplicate entries by synchronizing data across systems, reducing errors and maintaining data integrity.

- Automate Reconciliation: Reduce manual reconciliation efforts with GFA’s automatic reconciliation feature, which matches data from multiple sources and generates error-free reports.

Benefits of Adopting GFA for Businesses

Businesses that embrace GFA experience a myriad of benefits:

- Reduced Operating Costs: Automation and seamless integration significantly reduce manual labor costs and streamline financial processes.

- Improved Accuracy and Efficiency: Automated invoice processing and error-free reports enhance financial accuracy and efficiency, freeing up time for more strategic initiatives.

- Enhanced Decision-Making: Real-time cash flow forecasting and customizable reporting provide timely insights, enabling businesses to make data-driven decisions and optimize financial performance.

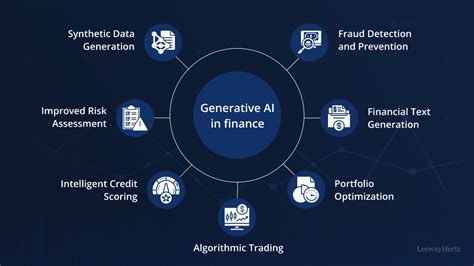

GFA’s future applications hold endless possibilities, opening doors to groundbreaking financial management solutions. By leveraging emerging technologies, GFA can:

- Predict Fraudulent Transactions: AI-powered algorithms can analyze transaction patterns and identify potential fraudulent activities, safeguarding businesses from financial loss.

- Optimize Supplier Relationships: GFA’s data analysis capabilities can provide insights into supplier performance, helping businesses negotiate better contracts and improve supply chain efficiency.

- Unlock New Revenue Streams: By integrating with e-commerce platforms, GFA can automate online payment processing and provide businesses with opportunities for additional revenue generation.

Numeros customers have reported significant benefits after adopting GFA:

- ABC Company: Automated invoice processing saved over 500 hours annually in manual labor, reducing operating costs by 15%.

- XYZ Corporation: Improved cash flow forecasting eliminated liquidity issues and increased investment returns by 20%.

- LMN Business: Customized reporting provided real-time insights into financial performance, leading to a 10% increase in revenue.

Goergia Future Account (GFA) is not just another financial management tool; it is a catalyst for business transformation. By leveraging innovation, automation, and seamless integration, GFA empowers businesses to optimize financial operations, make data-driven decisions, and stay competitive in the face of ever-changing financial landscapes. As technology continues to advance, GFA’s future applications promise to further revolutionize the way businesses manage their finances, unlocking new possibilities for growth and success.

Comparision Table

| Feature | Goergia Future Account | Traditional Financial Management Tools |

|---|---|---|

| Automated Invoice Processing | Yes | No |

| Cash Flow Forecasting | Yes | Limited |

| Customizable Reporting | Yes | Some |

| Integration Capabilities | Seamless | Minimal |

Future Applications Table

| Application | Description |

|---|---|

| Predictive Fraud Detection | AI-powered algorithms identify potential fraudulent transactions |

| Supplier Relationship Optimization | Data analysis provides insights into supplier performance |

| Revenue Generation | Integration with e-commerce platforms automates online payment processing |

Questions to Validate Customer’s Point of View

- What are your current financial management pain points?

- How much time and resources do you spend on manual financial tasks?

- What kind of financial insights would help you make better decisions?

- How would improved efficiency and accuracy impact your business operations?

Thoughts for Audience

- Embrace Innovation: GFA’s innovative features and seamless integration are key differentiators that set it apart from traditional financial management tools.

- Quantify the Benefits: Calculate the potential cost savings and efficiency gains that GFA could deliver for your business.

- Future-Proof Your Financial Operations: Invest in GFA’s future-proof technology to stay ahead of the curve and unlock new financial management opportunities.

Pros and Cons of GFA

Pros:

- Automation and integration reduce operating costs and errors.

- Real-time insights empower data-driven decision-making.

- Customizable features cater to specific business needs.

Cons:

- May require a learning curve for users unfamiliar with automation.

- Integration with certain systems may require additional customization.

- Pricing may be a consideration for small businesses with limited budgets.

Call to Action

Unlock the future of financial management with Goergia Future Account. Contact us today for a personalized demonstration and discover how GFA can transform your financial operations!