Introduction

The pursuit of higher education should not be hindered by financial constraints. Financial aid offers a lifeline for students of all backgrounds, providing access to tuition, fees, and living expenses that might otherwise be out of reach. However, navigating the complex world of financial aid can be daunting. This comprehensive guide will untangle the complexities of financial aid, empowering you with the knowledge and strategies you need to secure the support you deserve.

Types of Financial Aid

Financial aid comes in various forms, each with its own eligibility criteria and requirements:

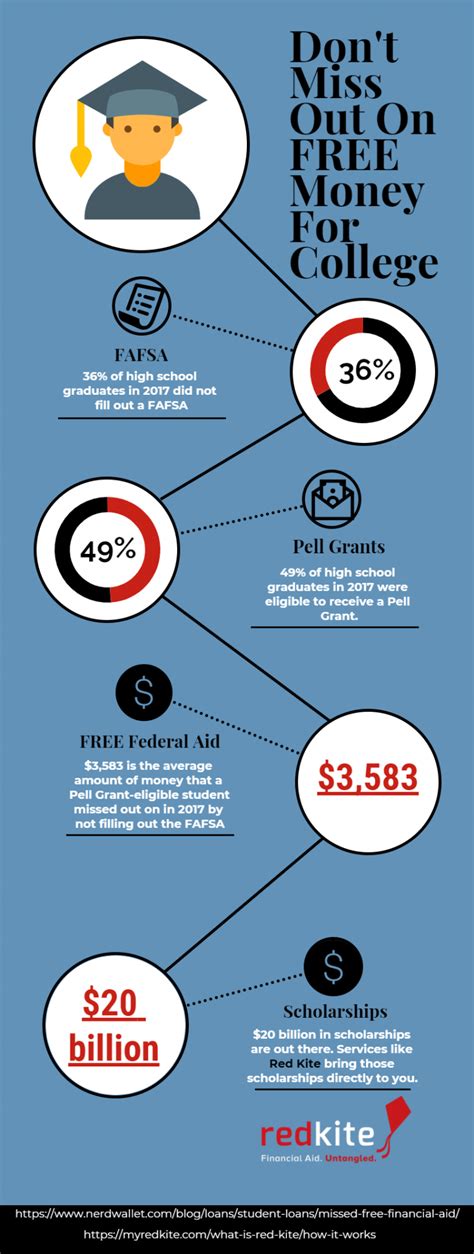

- Grants: Free money that does not need to be repaid, often awarded based on financial need or academic merit.

- Scholarships: Awards based on academic achievement, athletic ability, or other criteria, which do not need to be repaid.

- Work-Study Program: Part-time jobs on campus that allow students to earn money while pursuing their education.

-

Loans: Funds that must be repaid, typically with interest.

- Federal Loans: Government-backed loans with fixed or variable interest rates.

- Private Loans: Loans from banks or other private lenders, typically with higher interest rates than federal loans.

Eligibility for Financial Aid

Most forms of financial aid require you to complete the Free Application for Federal Student Aid (FAFSA). The FAFSA collects information about your family’s income, assets, and other financial details to determine your eligibility for need-based aid.

Steps to Apply for Financial Aid

- Complete the FAFSA: Submit the FAFSA as soon as possible after October 1st of your senior year of high school or after January 1st for continuing students.

- Check Your Award Letter: Review the financial aid package offered by the college or university you plan to attend.

- Accept or Decline Aid: Decide which financial aid awards you want to accept. Keep in mind that some forms of aid may require additional steps, such as accepting work-study positions.

- Monitor Your Financial Aid: Track your aid disbursement and make sure it covers your education expenses.

Understanding Your Financial Aid Package

Your financial aid package will likely include a combination of grants, scholarships, and loans. It’s important to understand the differences between these types of aid:

- Grants and Scholarships: Do not need to be repaid and are often based on need or merit.

- Loans: Must be repaid with interest, typically after you graduate or leave school.

Strategies to Increase Your Financial Aid

- Explore Scholarships and Grants: Seek out scholarships and grants that align with your interests, talents, and background.

- Negotiate Your Financial Aid: In some cases, colleges or universities may be willing to adjust your financial aid package if you demonstrate financial need.

- Consider Work-Study Programs: Work-study programs can help you earn money while pursuing your education.

- Apply for Private Loans Wisely: If you need to borrow private loans, compare interest rates and repayment terms from multiple lenders.

Why Financial Aid Matters

- Access to Education: Financial aid makes higher education accessible to students from all socioeconomic backgrounds.

- Reduced Financial Burden: Financial aid can reduce the financial strain on students and their families, allowing them to focus on their education.

- Increased Graduation Rates: Studies have shown that financial aid can improve graduation rates by helping students stay enrolled in college.

Benefits of Financial Aid

- Lower Cost of Attendance: Financial aid can reduce the overall cost of attending college.

- Improved Academic Performance: Financial aid allows students to focus on their studies without the added stress of financial concerns.

- Career Advancement: A college degree can lead to increased earning potential, making the investment in education worthwhile.

FAQs

- When should I apply for financial aid? Complete the FAFSA as soon as possible after October 1st of your senior year of high school or after January 1st for continuing students.

- What’s the difference between a grant and a scholarship? Grants are awarded based on financial need, while scholarships are awarded based on merit.

- Do I have to pay back financial aid? Grants and scholarships do not need to be repaid, but loans do.

- Can I get financial aid for online or part-time programs? Yes, many colleges and universities offer financial aid for students enrolled in online or part-time programs.

- How do I find scholarships and grants? Use scholarship search engines, ask your school counselor for guidance, and explore opportunities through organizations and businesses.

- What are the interest rates on federal student loans? Interest rates for federal student loans vary depending on the type of loan and the loan amount.

- What happens if I can’t pay back my student loans? If you are unable to repay your student loans, you may be eligible for loan forgiveness or repayment assistance programs.

Conclusion

Financial aid is an invaluable resource for students seeking higher education. By understanding the different types of aid, completing the FAFSA, and exploring various strategies, you can unlock the financial support you need to pursue your educational dreams. Remember, financial aid is a tool that can help you reduce the cost of college and set you up for a successful future. So, don’t let financial concerns hold you back from achieving your educational goals.