Introduction:

The Free Application for Federal Student Aid (FAFSA) is an essential tool for students pursuing higher education. It determines eligibility for financial aid, including grants, scholarships, work-study programs, and low-interest loans. Neglecting to complete the FAFSA can have significant consequences, limiting access to vital financial assistance and potentially derailing academic dreams.

Understanding the FAFSA: A Key to Funding Higher Education

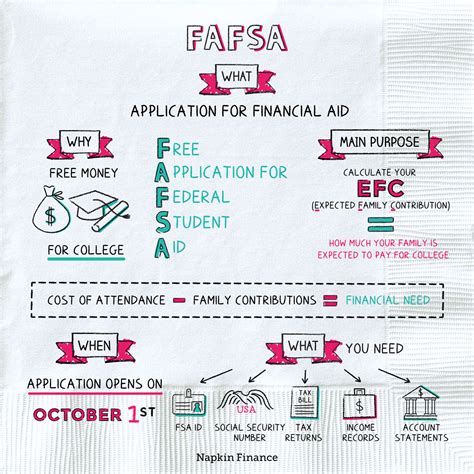

The FAFSA collects financial information to assess a student’s and their family’s ability to pay for college. It is used to determine the expected family contribution (EFC), which is then used to calculate the types and amounts of financial aid for which the student is eligible.

Why is the FAFSA Important?

1. Access to Financial Aid

According to the National College Attainment Network, over $122 billion in federal grants and scholarships are awarded annually based on FAFSA information. Completing the FAFSA is the gateway to unlocking this vital financial support, enabling students to pursue higher education regardless of their financial circumstances.

2. Scholarship and Grant Eligibility

The FAFSA not only determines eligibility for federal aid but also for state and institutional scholarships and grants. Many scholarships and grants require students to demonstrate financial need through the FAFSA, making it essential for students seeking to minimize their out-of-pocket expenses.

3. Student Employment Opportunities

The FAFSA also assesses eligibility for work-study programs, which allow students to earn money while pursuing their studies. These programs provide valuable work experience and reduce the overall cost of education.

4. Loan Repayment Assistance

Completing the FAFSA can also impact loan repayment options. Students who demonstrate financial need may be eligible for loan forgiveness programs and reduced interest rates.

Consequences of Not Completing the FAFSA:

1. Missed Aid Opportunities

Students who fail to submit the FAFSA may miss out on thousands of dollars in financial aid, increasing the burden of paying for college.

2. Reduced Eligibility for Loans

Students who do not complete the FAFSA may have limited eligibility for federal loans, which are essential for many students to cover the full cost of their education.

3. Delay of Enrollment

Students who do not submit the FAFSA on time may face delays in enrollment or even loss of their place in their desired program.

Tips for Completing the FAFSA:

1. Gather Necessary Documents

Collect financial documents such as tax returns, bank statements, and investment records before starting the FAFSA.

2. Create an FSA ID

Create an FSA ID on the Federal Student Aid website to electronically sign and submit the FAFSA.

3. Answer Honestly and Accurately

Provide complete and accurate information to ensure accurate EFC calculation and optimal aid eligibility.

4. Submit Early

The FAFSA opens on October 1 each year, and it’s advisable to submit early to maximize aid opportunities.

5. Seek Help if Needed

If you encounter difficulties completing the FAFSA, don’t hesitate to reach out to your high school counselor, college financial aid office, or community organizations for assistance.

Innovative Applications of FAFSA Data:

The FAFSA can serve as an innovative tool beyond financial aid distribution:

1. College Readiness Metrics

FAFSA data can provide insights into college readiness and identify students at risk of dropping out, enabling targeted interventions and support programs.

2. Higher Education Research

Researchers can analyze FAFSA data to study trends in college enrollment, affordability, and student outcomes, informing policy and decision-making.

3. College Completion Initiatives

FAFSA data can be used to track college completion rates and identify disparities between demographics, identifying opportunities for equity and access.

4. Early Intervention Programs

By identifying students with high financial need early on, schools and community organizations can provide support services and mentorship programs to improve their chances of academic success.

Conclusion:

The FAFSA is a powerful tool that unlocks access to financial aid, scholarships, and other support programs, making higher education more accessible for all. Completing the FAFSA is crucial for students seeking to reduce their financial burden, pursue their academic goals, and build a brighter future. By embracing the opportunities presented by the FAFSA, students can empower themselves to achieve their full potential.

Tables:

Table 1: Federal Financial Aid Awarded by Type (2021-2022)

| Aid Type | Amount Awarded |

|---|---|

| Pell Grants | $6.8 billion |

| Federal Supplemental Educational Opportunity Grants | $1.1 billion |

| Federal Work-Study | $1.4 billion |

| Perkins Loans | $238 million |

| Direct Subsidized Loans | $45.6 billion |

| Direct Unsubsidized Loans | $67.4 billion |

Table 2: Average FAFSA-Based Aid by Income Level (2021-2022)

| Income Range | Average Aid |

|---|---|

| Under $30,000 | $16,657 |

| $30,000-$75,000 | $11,184 |

| $75,000-$125,000 | $6,713 |

| Over $125,000 | $4,270 |

Table 3: Consequences of Not Completing the FAFSA

| Consequence | Impact |

|---|---|

| Missed Aid Opportunities | Loss of thousands of dollars in financial assistance |

| Reduced Eligibility for Loans | Difficulty covering college expenses |

| Delay of Enrollment | Loss of place in desired program |

Table 4: Innovative Applications of FAFSA Data

| Application | Outcome |

|---|---|

| College Readiness Metrics | Identification of students at risk of dropping out |

| Higher Education Research | Analysis of trends in college enrollment and affordability |

| College Completion Initiatives | Tracking of completion rates and identification of disparities |

| Early Intervention Programs | Support services for students with high financial need |

FAQs:

- When should I complete the FAFSA?

- Complete the FAFSA as early as possible after October 1 each year.

- What information do I need to complete the FAFSA?

- Financial documents such as tax returns, bank statements, and investment records.

- Who should complete the FAFSA?

- All students planning to attend college or career school.

- Is the FAFSA confidential?

- Yes, the FAFSA is confidential, and the information provided is protected by law.

- What if I have questions about completing the FAFSA?

- Contact your high school counselor, college financial aid office, or community organizations for assistance.

- What happens if I don’t complete the FAFSA?

- You may miss out on financial aid opportunities and have difficulty covering college expenses.