For married couples seeking to pursue higher education, understanding the complexities of the Free Application for Federal Student Aid (FAFSA) is crucial. When filing jointly, couples must carefully consider the nuances and potential implications of combining their financial information. This comprehensive guide provides a detailed overview of the FAFSA process for married couples, addressing common questions and offering strategies to maximize financial aid eligibility.

Importance of Joint Filing

According to the National Center for Education Statistics, in 2020, over 20% of undergraduates were married. Filing a joint FAFSA allows couples to combine their incomes and assets, potentially increasing their eligibility for need-based financial aid. However, it’s important to note that joint filing also involves sharing tax information, which may affect their overall tax liability.

Determining Dependency Status

The initial step in completing the FAFSA is determining dependency status. For married couples, the general rule is that the spouse who is the primary source of support is considered the financial head of household and will file the FAFSA as an independent student. However, there are exceptions to this rule, such as if one spouse is a full-time student with no income.

Income and Asset Reporting

When filing jointly, couples must report their combined income and assets from the previous tax year. This includes wages, salaries, investments, and any other forms of income. The FAFSA uses a formula called the Expected Family Contribution (EFC) to calculate a couple’s eligibility for financial aid. Generally, couples with higher incomes and assets will have a higher EFC, which may reduce their financial aid eligibility.

Tax Consequences

Filing a joint FAFSA can have tax implications for married couples. By combining tax information, the couple’s tax liability may change. It’s advisable to consult with a tax professional to assess the potential impact of joint filing on their overall financial situation.

Effective Strategies

To maximize financial aid eligibility when filing jointly, consider the following strategies:

- Increase Income Earning: Explore options to supplement income through part-time work, entrepreneurship, or investments.

- Reduce Expenses: Identify areas where expenses can be cut, such as housing costs, transportation, or entertainment.

- Maximize Deductions and Credits: Take advantage of all available tax deductions and credits to reduce taxable income.

- Consider Alternative Aid: Explore scholarships, grants, and student loans that do not require joint income reporting, especially if one spouse has significant income or assets.

Step-by-Step Approach

- Determine Dependency Status: Assess the financial circumstances of each spouse to determine dependency status.

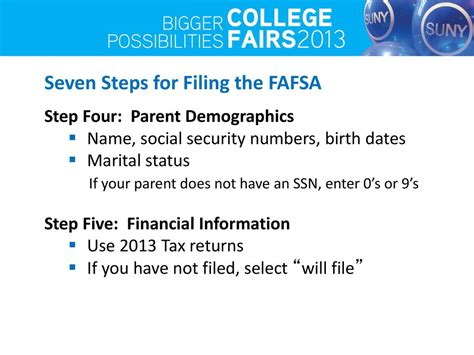

- Gather Financial Documents: Collect W-2s, tax returns, and bank statements for both spouses.

- Create a FSA ID: Establish a Federal Student Aid (FSA) ID for each spouse.

- Complete the FAFSA: Fill out the FAFSA form online at fafsa.ed.gov.

- File a Joint Tax Return: File a joint tax return using the same Social Security number as the spouse who is the primary source of support.

- Submit Tax Information: Transfer the tax information from the joint tax return to the FAFSA using the IRS Data Retrieval Tool.

FAQs

- Does filing jointly always result in reduced financial aid eligibility? Not necessarily. While combining incomes can increase the EFC, other factors such as expenses, deductions, and alternative aid sources can still impact eligibility.

- What if my spouse has significant debt? Debt is not directly reported on the FAFSA. However, if debt payments reduce the household’s disposable income, it may indirectly affect financial aid eligibility.

- Can I file a FAFSA separately from my spouse? Yes, but it may reduce the amount of financial aid you receive since your spouse’s income and assets will not be considered.

- How can I appeal my financial aid decision? If you believe your financial aid award is incorrect, you can contact your school’s financial aid office to request a review.

- What if I’m married but not filing taxes jointly? You may still be able to file the FAFSA using estimated income and asset information. However, you should consult with a tax professional to determine the impact on your tax liability.

- How can I prepare for future financial aid applications? Keep accurate financial records, explore alternative aid sources, and consult with a financial planner to optimize your financial situation for the long term.