Knowing your FAFSA family size is crucial for accurately completing the Free Application for Federal Student Aid (FAFSA). It significantly impacts your Expected Family Contribution (EFC), the amount of financial aid you’re eligible for.

Definition of FAFSA Family Size

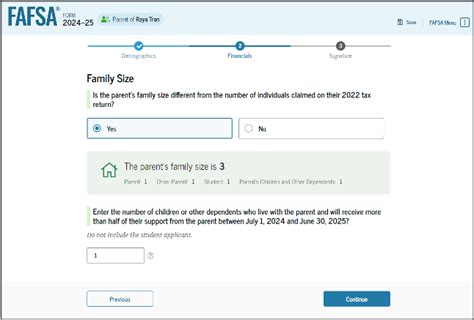

Your FAFSA family size refers to the number of individuals living in your household as of the day you file your FAFSA. This includes:

- You, the student

- Your parents or legal guardians

- Your siblings, half-siblings, step-siblings, and adopted siblings

- Your grandparents if you live with them

- Your dependent children

Example: If you live with both your parents and a full-time student brother, your FAFSA family size would be 4.

Determining Your Family’s Income

Once you’ve established your family size, you’ll need to determine your family’s income. This includes income from all sources, such as:

- Wages, salaries, and tips

- Commissions and bonuses

- Interest and dividends

- Unemployment benefits

- Alimony and child support

Using the Income Information to Calculate EFC

Your family’s income, in conjunction with your family size, is used to calculate your EFC. The EFC is a measure of your family’s financial strength and determines how much you and your family are expected to contribute towards your education.

The EFC calculation formula varies depending on the dependency status of the student. For dependent students, the formula includes:

- Adjusted gross income (AGI)

- Taxes paid

- Untaxed income (e.g., Social Security)

- Assets (e.g., savings, investments)

Impact of Family Size on EFC

The larger your FAFSA family size, the lower your EFC is likely to be. This is because the income of all family members is used to calculate your EFC. Therefore, a larger family size means more income is being considered, potentially resulting in a lower EFC.

Example: Let’s say two students have the same AGI, assets, and untaxed income. However, Student A has a FAFSA family size of 3, while Student B has a family size of 5. Student A’s EFC is likely to be higher than Student B’s because Student B’s income is divided among more family members.

Common Mistakes to Avoid

When determining your FAFSA family size, it’s important to avoid these common mistakes:

- Not including all family members: Ensure you include every individual living in your household, regardless of their relationship or age.

- Using the wrong dependency status: Your dependency status affects the EFC calculation. If you are unsure of your dependency status, refer to the FAFSA website or consult with a financial aid advisor.

- Misreporting income: Accurately report all income from all sources. Any discrepancies may result in delays or denial of financial aid.

Tips and Tricks

Here are some tips and tricks to help you accurately determine your FAFSA family size and EFC:

- File your FAFSA as early as possible: This gives you the best chance of meeting deadlines and receiving maximum aid.

- Gather all necessary financial documents: Have your tax returns, W-2s, and other financial records ready before starting your FAFSA application.

- Use the IRS Data Retrieval Tool: This tool allows you to import your tax information directly into your FAFSA, reducing the risk of errors.

- Contact your financial aid office: If you have any questions or concerns, don’t hesitate to reach out to your financial aid office for assistance.

Frequently Asked Questions (FAQs)

Q: What if my parents are divorced?

A: Include both parents’ income if they provide more than 50% of your support.

Q: What if I live with my grandparents?

A: Include your grandparents’ income if you live with them full-time and they provide more than 50% of your support.

Q: What if I have dependent children?

A: Include your dependent children in your FAFSA family size.

Q: What if I have a part-time job?

A: Report the income from your part-time job on your FAFSA application.

Q: What if I am a foster child?

A: You are considered a dependent of the state and should report the income of your foster parents.

Conclusion

Knowing your FAFSA family size is essential for accurately completing your FAFSA application. By understanding the impact of family size on EFC and avoiding common mistakes, you can increase your chances of receiving the maximum amount of financial aid for your education.