The Free Application for Federal Student Aid (FAFSA) is an essential step for students who need financial assistance for college. One of the key pieces of information that the FAFSA collects is your Expected Family Contribution (EFC).

Your EFC is a measure of your family’s financial strength. It is used to determine your eligibility for federal grants, loans, and work-study programs. The higher your EFC, the less financial aid you will be eligible for.

How is Your EFC Calculated?

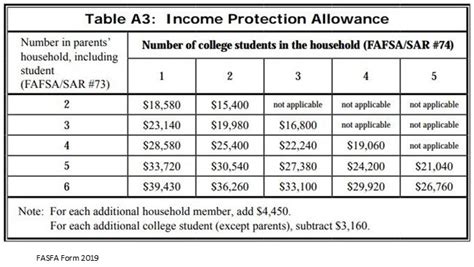

Your EFC is calculated using a formula that takes into account your family’s income, assets, and expenses. The formula is complex, but it generally considers the following factors:

- Your and your parents’ income

- Your and your parents’ assets

- Your and your parents’ expenses

- Your family size

- Your year in school

FAFSA EFC Table

The FAFSA EFC Table is a tool that can help you estimate your EFC. The table lists the EFC ranges for different family income levels.

| Family Income | EFC Range |

|---|---|

| Less than $30,000 | 0 to $4,000 |

| $30,000 to $48,000 | $4,001 to $8,000 |

| $48,001 to $75,000 | $8,001 to $12,000 |

| $75,001 to $110,000 | $12,001 to $16,000 |

| More than $110,000 | $16,001 and up |

Effective Strategies for Reducing Your EFC

There are a few things you can do to reduce your EFC and increase your eligibility for financial aid. These strategies include:

- Increasing your income. This can be done by getting a job, working more hours, or starting a business.

- Reducing your expenses. This can be done by cutting back on unnecessary spending, finding cheaper housing, or getting rid of debt.

- Transferring assets. This can be done by giving assets to your children or putting them in a trust.

- Filing your taxes early. This will give you more time to make adjustments to your return that could reduce your EFC.

Tips and Tricks

Here are a few tips and tricks for completing the FAFSA and calculating your EFC:

- Use the IRS Data Retrieval Tool. This tool allows you to import your tax information directly into the FAFSA, which can save you time and prevent errors.

- Estimate your income. If you don’t have your tax information handy, you can estimate your income using the FAFSA4caster tool.

- Round your numbers. When entering your financial information, round your numbers to the nearest dollar.

- Don’t forget to sign and date the FAFSA. This is a required step, and your FAFSA will not be processed if it is not signed and dated.

Common Mistakes to Avoid

Here are a few common mistakes to avoid when completing the FAFSA and calculating your EFC:

- Entering incorrect information. Make sure that you enter all of your financial information accurately. Even a small error can affect your EFC.

- Not reporting all of your income. Be sure to report all of your income, even if it is from part-time work or investments.

- Not reporting all of your assets. Be sure to report all of your assets, even if they are in a trust or other financial account.

- Not reporting all of your expenses. Be sure to report all of your expenses, even if they are not directly related to school.

Conclusion

The FAFSA EFC Table is a valuable tool that can help you estimate your eligibility for financial aid. By understanding how your EFC is calculated and using effective strategies to reduce it, you can increase your chances of getting the financial assistance you need to pay for college.