Introduction

The Free Application for Federal Student Aid (FAFSA) is a critical step for all students seeking financial assistance for college. The FAFSA award letter is the official document that outlines the types and amounts of financial aid you have been awarded. Understanding your FAFSA award letter is crucial to making informed decisions about your education financing.

Understanding the FAFSA Award Letter

1. Types of Financial Aid

Your FAFSA award letter will list the different types of financial aid you have been offered, which may include:

- Grants: Free money that does not need to be repaid.

- Scholarships: Awards based on merit or specific criteria.

- Loans: Money that must be repaid with interest.

- Work-study programs: Opportunities to earn money while enrolled in college.

2. Award Amounts

The FAFSA award letter will indicate the specific amounts of each type of financial aid you have been awarded. These amounts are typically determined based on your financial need, as determined by the FAFSA application.

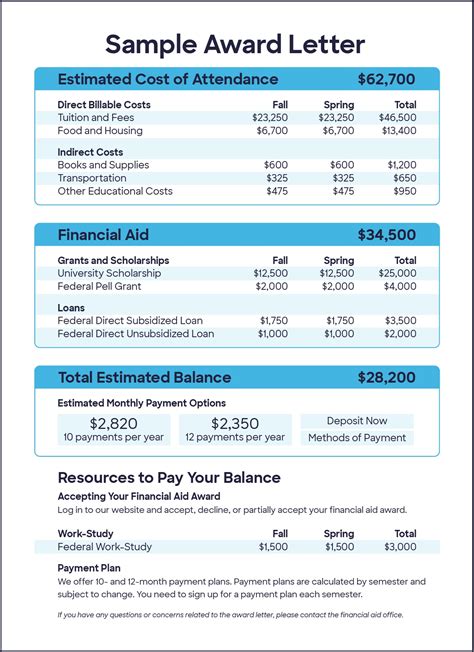

3. Cost of Attendance

Your FAFSA award letter will also include the estimated cost of attendance (COA) for your college or university. The COA includes tuition and fees, room and board, books and supplies, transportation, and other expenses.

4. Expected Family Contribution (EFC)

The EFC is the amount of money that your family is expected to contribute towards your education costs. The EFC is calculated based on the FAFSA information you provided.

5. Financial Need

Your financial need is determined by subtracting your EFC from the COA. The difference represents the amount of financial aid you may be eligible to receive.

6. Disbursement Dates

Your FAFSA award letter will provide the disbursement dates for your financial aid. This is the date when the funds will be credited to your student account.

Tips for Understanding Your FAFSA Award Letter

- Read carefully: Take your time to read and understand all of the information in your FAFSA award letter.

- Compare costs: Compare the amount of financial aid you have been awarded to the COA to determine if there is any unmet need.

- Review deadlines: Note the deadlines for accepting and returning your FAFSA award letter.

- Contact your financial aid office: If you have any questions or concerns about your FAFSA award letter, do not hesitate to contact your college or university’s financial aid office.

Maximizing Your Financial Aid

- Explore additional aid: Apply for scholarships and grants that are not administered through the FAFSA.

- Negotiate costs: Contact your college or university to inquire about payment plans or financial assistance programs.

- Consider loans wisely: If you must borrow money, carefully consider the terms and conditions of the loans before signing.

- Manage your expenses: Create a budget to track your expenses and avoid overspending.

- Seek professional advice: If you are struggling to understand or maximize your financial aid, seek the help of a financial aid advisor or counselor.

Tables for Reference

Table 1: Types of Financial Aid

| Type | Description |

|---|---|

| Grant | Free money that does not need to be repaid |

| Scholarship | Award based on merit or specific criteria |

| Loan | Money that must be repaid with interest |

| Work-study program | Opportunity to earn money while enrolled in college |

Table 2: Cost of Attendance

| Expense | Description |

|---|---|

| Tuition and fees | Cost of classes and mandatory charges |

| Room and board | Cost of housing and meal plans |

| Books and supplies | Cost of textbooks, notebooks, and other materials |

| Transportation | Cost of commuting or transportation to college |

| Other expenses | Personal expenses, such as laundry, entertainment, and healthcare |

Table 3: Expected Family Contribution (EFC)

| Income | EFC |

|---|---|

| $0 – $30,000 | 0 – 5% |

| $30,000 – $48,000 | 5 – 10% |

| $48,000 – $75,000 | 10 – 15% |

| $75,000 – $110,000 | 15 – 20% |

| Over $110,000 | 20 – 25% |

Table 4: Financial Need

| COA | EFC | Financial Need |

|---|---|---|

| $25,000 | $10,000 | $15,000 |

| $30,000 | $15,000 | $15,000 |

| $35,000 | $20,000 | $15,000 |

| $40,000 | $25,000 | $15,000 |

Conclusion

Your FAFSA award letter is a valuable tool that can help you plan and finance your college education. By understanding the information in your award letter, you can make informed decisions about your financial aid package and maximize your opportunities for success.