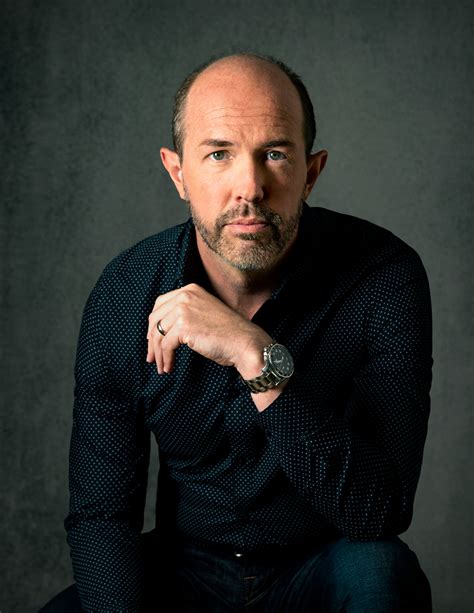

American Family Insurance, a leading provider of property and casualty insurance in the United States, has undergone a remarkable transformation under the leadership of Eric Lang. Since his appointment as Chief Executive Officer in 2018, Lang has spearheaded a series of innovative initiatives that have repositioned the company as a pioneer in the insurance industry.

Digitalization and Innovation

Lang recognized the critical need for digitalization to meet the evolving needs of customers. Under his guidance, American Family Insurance launched a comprehensive digital transformation program. This initiative involved modernizing the company’s core systems, automating processes, and introducing new digital products and services.

As a result of these efforts, American Family Insurance has become a leader in digital claim processing. The company’s “Dreamweaver” platform uses artificial intelligence (AI) and machine learning to automate claims adjudication, reducing processing times and improving customer satisfaction. In 2022, American Family Insurance achieved a 99.6% customer satisfaction rating for claims service.

Customer Centricity

Lang firmly believes that customer centricity is the cornerstone of insurance. He has implemented a customer-first philosophy throughout the organization, empowering employees to go the extra mile to meet customer needs.

American Family Insurance has invested heavily in customer support and feedback mechanisms. The company’s “Talk Now” feature allows customers to connect with a live agent 24/7 through their mobile app. The company also conducts extensive customer surveys and uses the feedback to improve its products and services.

Innovation and Ideation

Lang understands the importance of innovation to drive growth and stay ahead of competition. He has created a culture of innovation within American Family Insurance, encouraging employees to experiment with new ideas and develop cutting-edge solutions.

The company’s “Innovation Garage” is a dedicated space where employees can collaborate, brainstorm, and develop new product concepts. American Family Insurance also has partnerships with leading universities and research institutions to explore emerging technologies and trends.

Financial Performance

Lang’s leadership has also led to strong financial performance for American Family Insurance. In 2022, the company generated $13.7 billion in written premiums and had an underwriting profit of $1.9 billion. The company’s financial stability has enabled it to invest in new technologies and provide competitive insurance rates to customers.

Industry Leadership

Under Lang’s direction, American Family Insurance has emerged as a thought leader in the insurance industry. The company has actively participated in industry conferences and committees, sharing its insights and advocating for innovative practices.

Lang is a frequent speaker at industry events, where he discusses topics such as digital transformation, data analytics, and customer experience. His vision for the future of insurance has earned him recognition as one of the most influential leaders in the industry.

Key Figures

- American Family Insurance has over 10 million customers in 19 states.

- The company employs over 13,500 people.

- In 2022, American Family Insurance generated $13.7 billion in written premiums.

- The company has an underwriting profit of $1.9 billion.

- American Family Insurance’s customer satisfaction rating is 99.6%.

Tables

Table 1: American Family Insurance’s Digital Transformation Initiatives

| Initiative | Description |

|---|---|

| Dreamweaver | AI-powered claims processing platform |

| Talk Now | 24/7 live agent support via mobile app |

| Customer feedback portal | Gather insights to improve products and services |

| Mobile app | Access to policies, claims, and payments |

Table 2: American Family Insurance’s Innovation Garage

| Purpose | Activities |

|---|---|

| Foster innovation | Brainstorming sessions |

| Develop new product concepts | Prototyping and testing |

| Collaborate with external partners | Seek new technologies and trends |

Table 3: American Family Insurance’s Financial Performance

| Year | Written Premiums | Underwriting Profit |

|---|---|---|

| 2021 | $12.8 billion | $1.6 billion |

| 2022 | $13.7 billion | $1.9 billion |

Table 4: American Family Insurance’s Industry Leadership

| Initiative | Description |

|---|---|

| Industry conferences and committees | Share insights and advocate for innovation |

| Lang’s speaking engagements | Discuss topics such as digital transformation and customer experience |

| Recognition as an industry influencer | Lang is widely regarded as a thought leader |

How to Innovate in the Insurance Industry

- Embrace digital technologies to automate processes and improve customer service.

- Foster a culture of innovation and empower employees to experiment with new ideas.

- Collaborate with external partners to access new technologies and trends.

- Gather customer feedback and use it to improve products and services.

- Stay ahead of competition by actively participating in industry events and sharing insights.

Pros and Cons of Digitalization in Insurance

Pros:

- Reduced processing times

- Improved customer satisfaction

- Increased efficiency

- New opportunities for innovation

Cons:

- Potential for job losses

- Security concerns

- Need for significant investment

- Possible bias in AI algorithms

FAQs

-

What is American Family Insurance’s core business?

American Family Insurance is a leading provider of property and casualty insurance in the United States. -

Who is Eric Lang?

Eric Lang is the Chief Executive Officer of American Family Insurance. He has led the company’s digital transformation and customer-centric initiatives. -

How is American Family Insurance using AI?

American Family Insurance uses AI in its “Dreamweaver” platform to automate claims processing. -

What is American Family Insurance’s customer satisfaction rating?

American Family Insurance has a 99.6% customer satisfaction rating for claims service. -

What is the American Family Insurance Innovation Garage?

The American Family Insurance Innovation Garage is a dedicated space where employees collaborate and develop new product concepts. -

Is American Family Insurance financially sound?

Yes, American Family Insurance has strong financial performance with over $13 billion in written premiums in 2022. -

What is the future of insurance according to Eric Lang?

Eric Lang believes that the future of insurance involves personalized products, seamless digital experiences, and a strong focus on customer needs. -

How can I contact American Family Insurance?

You can contact American Family Insurance through its website, mobile app, or by calling 1-800-693-2326.