As parents, we all want to provide the best possible future for our children. That includes giving them the opportunity to get a good education. But saving for college can be a daunting task.

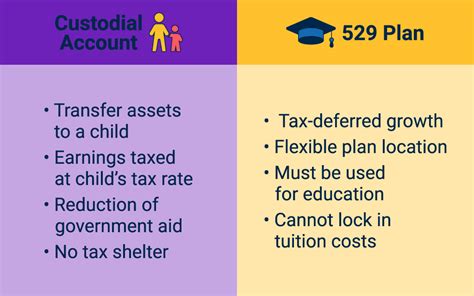

There are a lot of different ways to save for college, and two of the most popular options are custodial accounts and 529 plans. Both options have their own advantages and disadvantages, so it’s important to understand the differences between them before you decide which one is right for you.

Custodial Accounts

Custodial accounts are simple, non-retirement investment accounts that parents can set up for their children. The child is the legal owner of the account, but the parent or guardian manages the money until the child reaches the age of majority.

There are no income limits for custodial accounts, so anyone can open one. And there are no contribution limits, so you can save as much or as little as you want.

The money in a custodial account can be used for any purpose, including college. However, if the money is used for non-educational expenses, the child will have to pay taxes on the earnings.

529 Plans

529 plans are tax-advantaged savings plans that are specifically designed for college savings. There are two main types of 529 plans: state-sponsored plans and private plans.

State-sponsored plans offer tax breaks to residents of the state. The amount of the tax break varies from state to state, but it can be significant.

Private plans do not offer state tax breaks, but they may offer other benefits, such as lower investment fees.

The money in a 529 plan can only be used for qualified education expenses, such as tuition, fees, books, and supplies. If the money is used for non-educational expenses, the child will have to pay taxes on the earnings, plus a 10% penalty.

Which Is Right for You?

So, which type of savings plan is right for you? It depends on your individual circumstances and financial goals.

If you want a simple, flexible savings plan that you can use for any purpose, a custodial account may be a good option. However, if you are looking for a tax-advantaged savings plan that can only be used for college, a 529 plan may be a better choice.

Here is a table that summarizes the key differences between custodial accounts and 529 plans:

| Feature | Custodial Account | 529 Plan |

|---|---|---|

| Account owner | Child | Child |

| Account manager | Parent or guardian | Parent or guardian |

| Age limit | None | None |

| Contribution limits | None | Varies by state |

| Investment options | Varies | Varies |

| Tax benefits | None | State tax break (for state-sponsored plans) |

| Usage restrictions | None | Must be used for qualified education expenses |

| Penalty for non-qualified withdrawals | Taxes on earnings | Taxes on earnings plus 10% penalty |

Common Mistakes to Avoid

Here are some common mistakes to avoid when saving for college:

- Starting too late. The sooner you start saving, the more time your money will have to grow.

- Saving too little. College costs are rising every year, so it’s important to save as much as you can.

- Choosing the wrong savings plan. There are a lot of different savings plans available, so it’s important to choose one that is right for your needs.

- Taking money out of your savings plan. It’s tempting to take money out of your savings plan to cover unexpected expenses, but it’s important to resist the temptation. The money you save now will be worth much more in the future.

Creative New Word

CollegeSaver

Definition: A person who is saving for college.

Usage:

- “I’m a CollegeSaver, and I’m committed to saving as much money as I can for my child’s education.”

- “CollegeSavers should start saving early and take advantage of tax-advantaged savings plans.”

Conclusion

Saving for college is a smart way to invest in your child’s future. By understanding the differences between custodial accounts and 529 plans, you can choose the right savings plan for your needs.