In the tapestry of life, every decision we make weaves a thread of opportunity into the intricate fabric. The concept of constant opportunity cost underscores this fundamental truth, demonstrating that each choice we embrace inevitably entails the sacrifice of alternatives. This seminal economic principle forms the foundation of rational decision-making, illuminating the interconnectedness of our choices and their consequences.

Understanding Constant Opportunity Cost

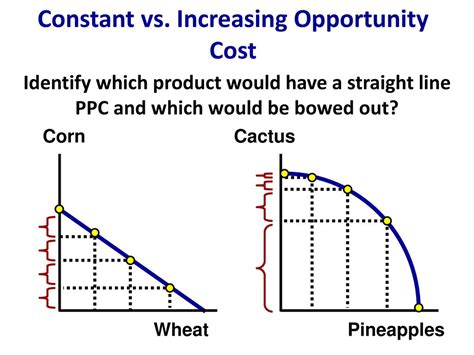

An opportunity cost is the value of the best alternative foregone when a decision is made. It represents the potential gain that could have been realized had a different choice been pursued. The constant opportunity cost graph depicts this relationship graphically, highlighting the trade-offs inherent in any decision.

The x-axis of the graph represents the quantity of goods or services produced on the vertical axis. The blue line ascending diagonally represents the production possibilities frontier (PPF), which defines the maximum level of output that can be achieved given the available resources and technology.

[Image of Constant Opportunity Cost Graph]

Each point on the PPF represents a different combination of goods or services that can be produced. For example, point A on the graph indicates that 10 units of good X can be produced, while 20 units of good Y can be produced.

Making Informed Decisions

The constant opportunity cost graph empowers us to make informed decisions by visualizing the trade-offs between different choices. By understanding the potential value of the alternative foregone, we can allocate our limited resources more efficiently.

Consider a producer who can choose between producing 100 units of product A or 200 units of product B. The constant opportunity cost graph shows that producing 100 units of product A entails the sacrifice of 200 units of product B. Therefore, the opportunity cost of producing 1 unit of product A is 2 units of product B.

Economic Implications

The constant opportunity cost principle has far-reaching implications for economic decision-making. Governments use it to allocate resources efficiently, businesses use it to optimize production, and individuals use it to make consumption and investment choices.

For instance, a government facing a budget deficit may prioritize funding education over infrastructure development. The constant opportunity cost graph reveals that this decision entails the sacrifice of infrastructure projects that could have improved economic growth.

Common Mistakes to Avoid

- Ignoring opportunity costs: Not considering the value of alternatives can lead to poor decision-making.

- Underestimating opportunity costs: Failing to fully appreciate the potential benefits of alternatives can result in missed opportunities.

- Comparing sunk costs to opportunity costs: Sunk costs are past expenditures that cannot be recovered, while opportunity costs are potential future gains. Mixing these concepts can distort decision-making.

Step-by-Step Approach to Decision-Making

- Identify alternatives: Determine the possible choices available to you.

- Evaluate consequences: Analyze the potential outcomes and opportunity costs of each alternative.

- Quantify opportunity costs: Estimate the value of the alternatives foregone.

- Compare and contrast: Weigh the potential benefits and sacrifices of each choice.

- Make a decision: Choose the alternative that maximizes your objectives while considering the opportunity cost.

Emerging Applications of Opportunity Cost Analysis

In an innovative twist, the concept of opportunity cost is being applied to novel areas, such as:

- Data analysis: Quantifying the cost of data storage, processing, and analytics to inform decision-making.

- Social media marketing: Determining the opportunity cost of time spent on social media platforms to optimize engagement and ROI.

- Environmental sustainability: Assessing the opportunity cost of environmental degradation to guide policy and resource management.

Useful Tables

Table 1: Opportunity Cost Examples

| Decision | Alternative Foregone | Opportunity Cost |

|—|—|—|

| Attend college | Work full-time | Potential earnings |

| Purchase a car | Invest in a business | Potential return on investment |

| Exercise daily | Watch TV | Health benefits, increased productivity |

Table 2: Common Applications of Opportunity Cost

| Sector | Application |

|—|—|

| Economics | Resource allocation, investment decisions |

| Business | Production planning, marketing strategies |

| Finance | Investment analysis, risk management |

| Public policy | Budgeting, infrastructure development |

Table 3: Limitations of Opportunity Cost Analysis

| Limitation | Description |

|—|—|

| Difficulty in quantifying | Opportunity costs may be intangible or difficult to measure. |

| Assumption of perfect information | Decision-makers may not have complete knowledge of alternatives and outcomes. |

| Neglect of external costs | Opportunity cost analysis often ignores costs imposed on others. |

Table 4: Tips for Effective Decision-Making

| Tip | Description |

|—|—|

| Consider opportunity costs | Evaluate the value of alternatives foregone. |

| Quantify opportunity costs | Estimate the potential benefits of alternatives. |

| Avoid sunk cost bias | Focus on future gains rather than past expenditures. |

| Use sensitivity analysis | Test how changes in assumptions affect the decision. |