Navigating the financial complexities of college life can be daunting, especially when it comes to managing your monthly allowance. Whether you’re a freshman just starting out or a seasoned senior preparing for graduation, this comprehensive guide will provide you with the essential tools and knowledge you need to establish a solid financial foundation and make informed decisions about your spending.

Understanding Your Needs and Expenses

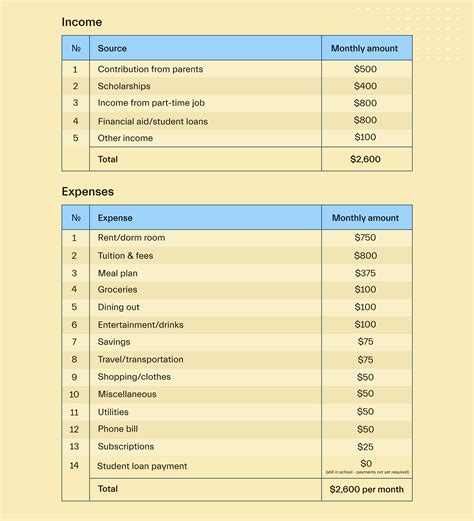

Before you can create a realistic budget, it’s crucial to understand your financial needs and expenses. Here’s a breakdown of the essential categories to consider:

- Tuition and Fees: This is the largest expense for most college students. Determine the total cost of tuition, fees, and other academic expenses for the academic year and divide it by the number of months you’re in school.

- Housing: Whether you live on or off campus, housing costs can be significant. Factor in rent, utilities, internet, and parking expenses.

- Food: Groceries, dining out, and meal plans can vary depending on your lifestyle and dietary preferences. Estimate a realistic amount for food expenses based on your eating habits.

- Transportation: If you need a car, factor in gas, insurance, maintenance, and parking. Consider public transportation costs or ride-sharing services if applicable.

- Books and Supplies: Textbooks, stationery, and other academic materials can add up. Research the cost of books and materials for your courses and allocate a budget accordingly.

- Personal Expenses: This category includes clothing, entertainment, personal care items, and other miscellaneous expenses. Determine a reasonable amount based on your lifestyle and needs.

- Savings: Setting aside money for emergencies or future goals is essential. Aim to save a portion of your allowance each month, even if it’s a small amount.

Creating a Budget

Once you have a clear understanding of your expenses, it’s time to create a budget. Here’s a step-by-step approach:

- Calculate Your Total Income: Determine the total amount of money you receive from your parents, scholarships, loans, or any other sources.

- Allocate Essential Expenses First: Start by allocating funds to your essential expenses, such as tuition, housing, and food. These are non-negotiable expenses that must be paid on time.

- Set Spending Limits for Discretionary Expenses: For discretionary expenses like entertainment, shopping, and dining out, set spending limits that align with your financial goals and priorities.

- Plan for Emergencies: Designate a portion of your budget for unexpected expenses, such as medical bills or car repairs.

- Track Your Expenses: Use a budgeting app or spreadsheet to track your expenses throughout the month. This will help you stay on track and identify areas where you can cut back.

Increasing Your Monthly Allowance

If your monthly allowance is insufficient to cover your expenses, consider these options to supplement your income:

- Apply for Scholarships and Grants: Research and apply for scholarships and grants that align with your academic achievements, extracurricular activities, or financial need.

- Get a Part-Time Job: Balance your studies with a part-time job that fits your schedule and interests.

- Become a Tutor or Teaching Assistant: Utilize your academic skills by tutoring other students or assisting professors with teaching duties.

- Freelance Your Skills: If you have specialized skills in writing, graphic design, or website development, offer your services as a freelancer.

- Start a Side Hustle: Explore creative ways to generate additional income, such as selling handmade items, providing pet care services, or running a small online business.

The Psychology of Budgeting

Understanding the psychological aspects of budgeting can help you make better financial decisions. Here are some key insights:

- Framing: How you frame your financial goals can influence your behavior. Instead of thinking about saving money as a sacrifice, reframe it as a way to achieve your future dreams.

- Cognitive Biases: Be aware of cognitive biases that can lead to poor financial decisions, such as the tendency to overestimate future income or underestimate future expenses.

- Mindful Spending: Pay attention to your spending habits and identify areas where you can reduce unnecessary purchases.

- Reward Yourself: Reward yourself for sticking to your budget and meeting your financial goals. This positive reinforcement will help you stay motivated.

Strategies for Managing a Monthly Allowance

Effective strategies can help you manage your monthly allowance wisely:

- Negotiate with Your Parents: If your monthly allowance is insufficient, communicate your needs and expenses clearly to your parents.

- Set Financial Goals: Establish specific financial goals for the semester or year. This will provide a sense of direction and motivation.

- Use Technology to Your Advantage: Utilize budgeting apps, spreadsheets, and online resources to track expenses and stay organized.

- Avoid Impulse Purchases: Give yourself time to consider major purchases and avoid impulse spending.

- Seek Professional Advice: If you’re struggling to manage your monthly allowance or feel overwhelmed by financial stress, consider seeking professional advice from a financial counselor or therapist.

Conclusion

Managing your college monthly allowance effectively is a crucial aspect of financial literacy and independence. By understanding your expenses, creating a realistic budget, and implementing effective strategies, you can establish a solid financial foundation that will empower you to achieve your academic and financial goals.

Frequently Asked Questions

Q: How much is the average college monthly allowance?

A: According to a recent study by the College Board, the average monthly allowance for college students in the United States is $400.

Q: How can I save money on housing costs?

A: Consider sharing an apartment or house with roommates, exploring off-campus housing options that are more affordable, or negotiating a lower rent with your landlord.

Q: What are some common budgeting mistakes to avoid?

A: Common budgeting mistakes include overestimating income, underestimating expenses, impulse spending, and failing to track expenses regularly.

Q: How can I increase my financial literacy?

A: Seek financial education resources from your college, attend workshops or seminars, read personal finance books and articles, and consult with financial professionals.

## Tables

Table 1: College Expenses by Category

| Category | Average Monthly Cost |

|---|---|

| Tuition and Fees | $1,500 |

| Housing | $750 |

| Food | $350 |

| Transportation | $250 |

| Books and Supplies | $100 |

| Personal Expenses | $150 |

| Savings | $50 |

Table 2: Strategies for Increasing Monthly Income

| Strategy | Potential Income |

|---|---|

| Scholarships and Grants | $1,000-$5,000 |

| Part-Time Job | $500-$1,000 |

| Tutoring or Teaching Assistant | $200-$500 |

| Freelancing | $100-$500 |

| Side Hustle | $100-$500 |

Table 3: Psychological Insights for Budgeting

| Insight | Description |

|---|---|

| Framing | How you frame your financial goals can influence your behavior. |

| Cognitive Biases | Be aware of cognitive biases that can lead to poor financial decisions. |

| Mindful Spending | Pay attention to your spending habits and identify areas where you can reduce unnecessary purchases. |

| Reward Yourself | Reward yourself for sticking to your budget and meeting your financial goals. |

Table 4: Effective Budgeting Strategies

| Strategy | Description |

|---|---|

| Negotiate with Your Parents | Communicate your needs and expenses clearly to your parents. |

| Set Financial Goals | Establish specific financial goals for the semester or year. |

| Use Technology to Your Advantage | Utilize budgeting apps, spreadsheets, and online resources to track expenses and stay organized. |

| Avoid Impulse Purchases | Give yourself time to consider major purchases and avoid impulse spending. |

| Seek Professional Advice | Consider seeking professional advice from a financial counselor or therapist if needed. |